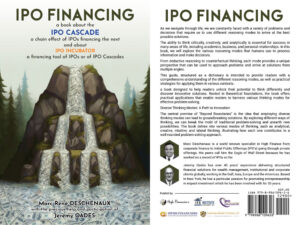

A practical guide to IPO a SPAC Wall St

A SPAC (Special Purpose Acquisition Company) is an empty or almost empty company, with no commercial operations that is formed strictly to raise capital through an 首次公开募股 (IPO) for the purpose of acquiring an existing company.