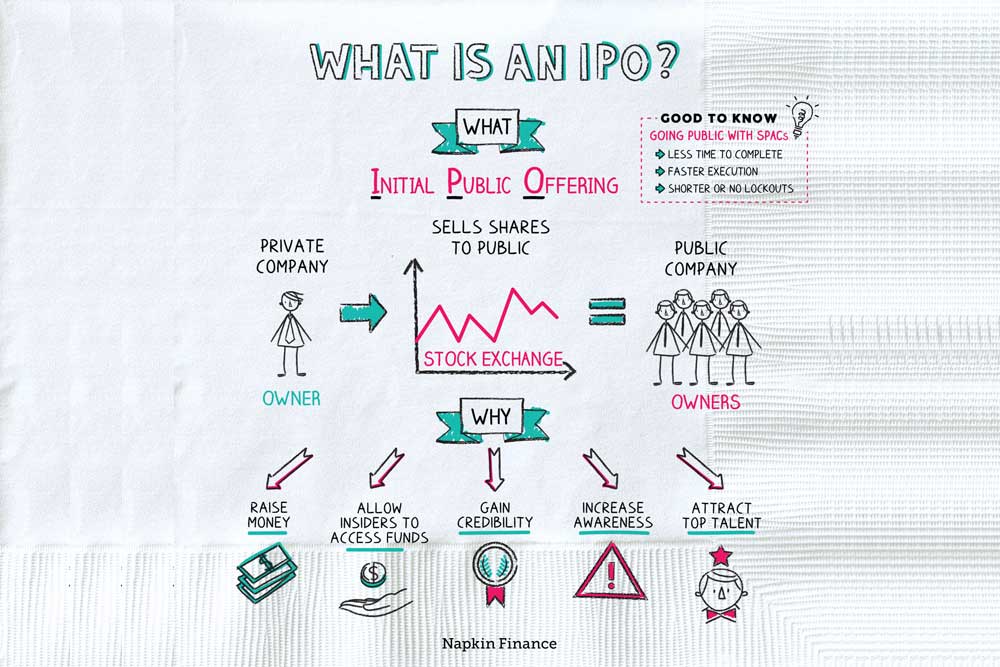

An IPO, or initial public offering, is a process by which a privately held company offers shares of its stock to the public for the first time. This allows the company to raise capital by selling ownership stakes to a large number of investors.

The IPO process typically involves a number of steps, including filing a registration statement with the relevant regulatory body (such as the Securities and Exchange Commission in the United States), conducting a roadshow to market the offering to potential investors, and setting an initial offering price for the shares. Once the shares are sold to the public, they can be bought and sold on a stock exchange like any other publicly traded company’s shares.

IPOs are often seen as a significant milestone for a company, as they provide an opportunity for the founders and early investors to cash out some of their holdings and realize a return on their investment. They also increase the visibility of the company and can help to attract new customers, partners, and employees. However, going public also comes with a number of regulatory and reporting requirements, as well as increased scrutiny from shareholders and the media.