什么是传递安全性?

A pass-through security is a security transferring fix or variable income from one or more income producing asset/s which also back said pass-through security.

A servicing intermediary collects the monthly payments from issuers and, after deducting a fee, remits or passes them through to the holder of the pass-through security (that is, investors). A pass-through security is also known as a “pay-through security” or a “传递证书“—though technically the certificate is the evidence of interest or participation in a pool of assets that signifies the transfer of payments to investors; it’s not the security itself.

传递安全性解释

A pass-through security is a derivative based on certain debt or royalties receivables that provides the investor a right to a portion of those incomes. Often, the royalties or debt receivables are from underlying assets, which can include things such as movies, music, patents, mortgages on homes or loans on vehicles.

Generally, each security represents a large number of income streams.

The term “pass-through” relates to the transaction process itself, whether it involves a royalty, a mortgage or other loan product. It originates with the debtor’s or issuer’s payment, which passes through an 中介 在发布给投资者之前。

Payments are made to investors on a periodic basis, corresponding with the standard payment schedules for royalties or debt repayment. The payments may include accrued interest on the unpaid principal or not, amortization on the 主要的 itself or not, or simply royalties streams or not.

转手证券的风险

与证券相关的债务违约风险是一个始终存在的因素,因为债务人未能支付会导致较低的回报。如果有足够多的债务人违约,证券基本上会失去所有价值。

另一个风险与当前利率直接相关。如果利率下降,则更有可能对当前债务进行再融资以利用低利率。这导致利息支付减少,这意味着转手证券投资者的回报较低。

债务人的提前还款也会影响回报。如果大量债务人支付的金额超过最低还款额,则债务应计利息金额会降低——当然,如果债务人提前全部偿还贷款,则利息将不复存在。最终,这些预付款会降低证券投资者的回报。在某些情况下,贷款将有 提前还款罚款 这可能会抵消提前还款将导致的一些基于利息的损失。

An Example of Pass-Through Securities

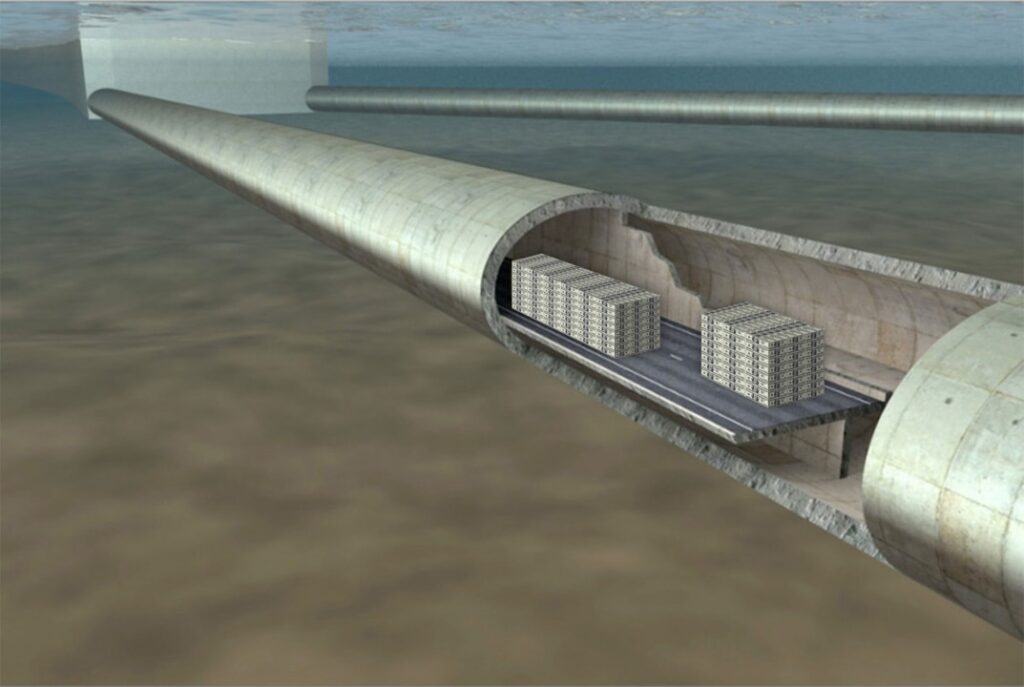

The most common type of pass-through is a mortgage-backed certificate or a a mortgage-backed security (MBS), in which a homeowner’s payment passes from the original bank through a government agency or investment bank before reaching investors. These types of pass-throughs derive their value from unpaid mortgages, in which the owner of the security receives payments based on a partial claim to the payments being made by the various debtors. Multiple mortgages are packaged together, forming a pool, which thus spreads the risk across multiple loans. These securities are generally self-amortizing, meaning the entire mortgage principal is paid off in a specified period of time with regular interest and principal payments.