This article was written for Investopedia By TROY SEGAL updated May 29, 2020 and reviewed by GORDON SCOTT. I reproduce it here because it is generally excellent but modified because it contains several errors.

Was ist eine Pass-Through-Sicherheit?

A pass-through security is a security transferring fix or variable income from one or more income producing asset/s which also back said pass-through security.

A servicing intermediary collects the monthly payments from issuers and, after deducting a fee, remits or passes them through to the holder of the pass-through security (that is, investors). A pass-through security is also known as a “pay-through security” or a “Pass-Through-Zertifikat“—though technically the certificate is the evidence of interest or participation in a pool of assets that signifies the transfer of payments to investors; it’s not the security itself.

Pass-Through-Sicherheit erklärt

A pass-through security is a derivative based on certain debt or royalties receivables that provides the investor a right to a portion of those incomes. Often, the royalties or debt receivables are from underlying assets, which can include things such as movies, music, patents, mortgages on homes or loans on vehicles.

Generally, each security represents a large number of income streams.

The term “pass-through” relates to the transaction process itself, whether it involves a royalty, a mortgage or other loan product. It originates with the debtor’s or issuer’s payment, which passes through an Vermittler vor der Freigabe an den Investor.

Payments are made to investors on a periodic basis, corresponding with the standard payment schedules for royalties or debt repayment. The payments may include accrued interest on the unpaid principal or not, amortization on the Rektor itself or not, or simply royalties streams or not.

Risiken von Pass-Through-Wertpapieren

Das Risiko eines Ausfalls der mit den Wertpapieren verbundenen Schulden ist ein allgegenwärtiger Faktor, da die Nichtzahlung des Schuldners zu geringeren Renditen führt. Sollten genügend Schuldner ausfallen, können die Wertpapiere grundsätzlich an Wert verlieren.

Ein weiteres Risiko ist direkt mit dem aktuellen Zinsniveau verbunden. Wenn die Zinsen sinken, besteht eine höhere Wahrscheinlichkeit, dass aktuelle Schulden refinanziert werden, um von den niedrigen Zinsen zu profitieren. Dies führt zu geringeren Zinszahlungen, was für die Anleger von Pass-Through-Wertpapieren geringere Renditen bedeutet.

Auch eine Vorauszahlung des Schuldners kann Auswirkungen auf die Rendite haben. Zahlt eine große Zahl von Schuldnern mehr als die Mindestzahlungen, ist die Höhe der auf die Schulden aufgelaufenen Zinsen geringer – und entfällt natürlich, wenn der Schuldner den Kredit vorzeitig vollständig zurückzahlt. Letztendlich führen diese vorzeitigen Rückzahlungen zu geringeren Renditen für Wertpapierinvestoren. In einigen Fällen sind Kredite erforderlich Vorfälligkeitsentschädigung Dies kann einen Teil der zinsbedingten Verluste ausgleichen, die eine Vorauszahlung verursachen wird.

An Example of Pass-Through Securities

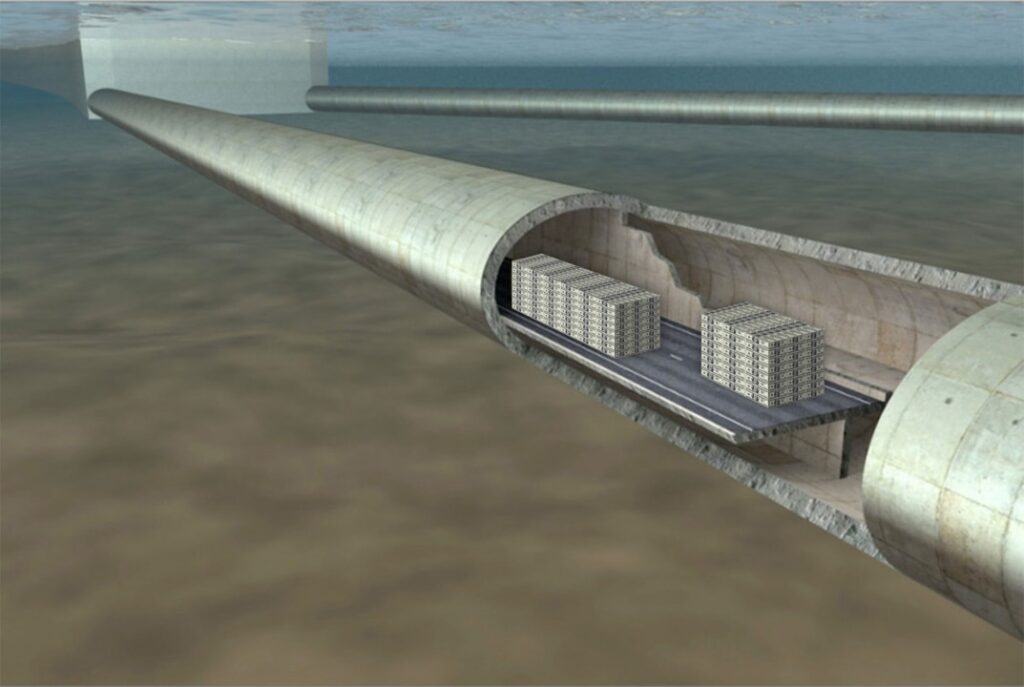

The most common type of pass-through is a mortgage-backed certificate or a a mortgage-backed security (MBS), in which a homeowner’s payment passes from the original bank through a government agency or investment bank before reaching investors. These types of pass-throughs derive their value from unpaid mortgages, in which the owner of the security receives payments based on a partial claim to the payments being made by the various debtors. Multiple mortgages are packaged together, forming a pool, which thus spreads the risk across multiple loans. These securities are generally self-amortizing, meaning the entire mortgage principal is paid off in a specified period of time with regular interest and principal payments.