This article was written for Investopedia By TROY SEGAL updated May 29, 2020 and reviewed by GORDON SCOTT. I reproduce it here because it is generally excellent but modified because it contains several errors.

¿Qué es un valor de transferencia?

A pass-through security is a security transferring fix or variable income from one or more income producing asset/s which also back said pass-through security.

A servicing intermediary collects the monthly payments from issuers and, after deducting a fee, remits or passes them through to the holder of the pass-through security (that is, investors). A pass-through security is also known as a “pay-through security” or a “certificado de transferencia“—though technically the certificate is the evidence of interest or participation in a pool of assets that signifies the transfer of payments to investors; it’s not the security itself.

Explicación de la seguridad de transferencia

A pass-through security is a derivative based on certain debt or royalties receivables that provides the investor a right to a portion of those incomes. Often, the royalties or debt receivables are from underlying assets, which can include things such as movies, music, patents, mortgages on homes or loans on vehicles.

Generally, each security represents a large number of income streams.

The term “pass-through” relates to the transaction process itself, whether it involves a royalty, a mortgage or other loan product. It originates with the debtor’s or issuer’s payment, which passes through an intermediario antes de ser entregado al inversionista.

Payments are made to investors on a periodic basis, corresponding with the standard payment schedules for royalties or debt repayment. The payments may include accrued interest on the unpaid principal or not, amortization on the principal itself or not, or simply royalties streams or not.

Riesgos de los valores de transmisión

El riesgo de impago de las deudas asociadas a los valores es un factor siempre presente, ya que la falta de pago por parte del deudor se traduce en una menor rentabilidad. Si suficientes deudores incumplen, los valores pueden perder esencialmente todo su valor.

Otro riesgo está ligado directamente a las tasas de interés actuales. Si las tasas de interés caen, existe una mayor probabilidad de que las deudas actuales puedan refinanciarse para aprovechar las tasas de interés bajas. Esto da como resultado pagos de intereses más pequeños, lo que significa rendimientos más bajos para los inversionistas de valores transferidos.

El pago anticipado por parte del deudor también puede afectar la devolución. Si un gran número de deudores paga más que los pagos mínimos, la cantidad de interés devengado sobre la deuda es menor y, por supuesto, se vuelve inexistente si el deudor paga la totalidad del préstamo antes de lo previsto. En última instancia, estos pagos anticipados dan como resultado menores rendimientos para los inversores en valores. En algunos casos, los préstamos tendrán multas por pago anticipado eso puede compensar algunas de las pérdidas basadas en intereses que causará un pago anticipado.

An Example of Pass-Through Securities

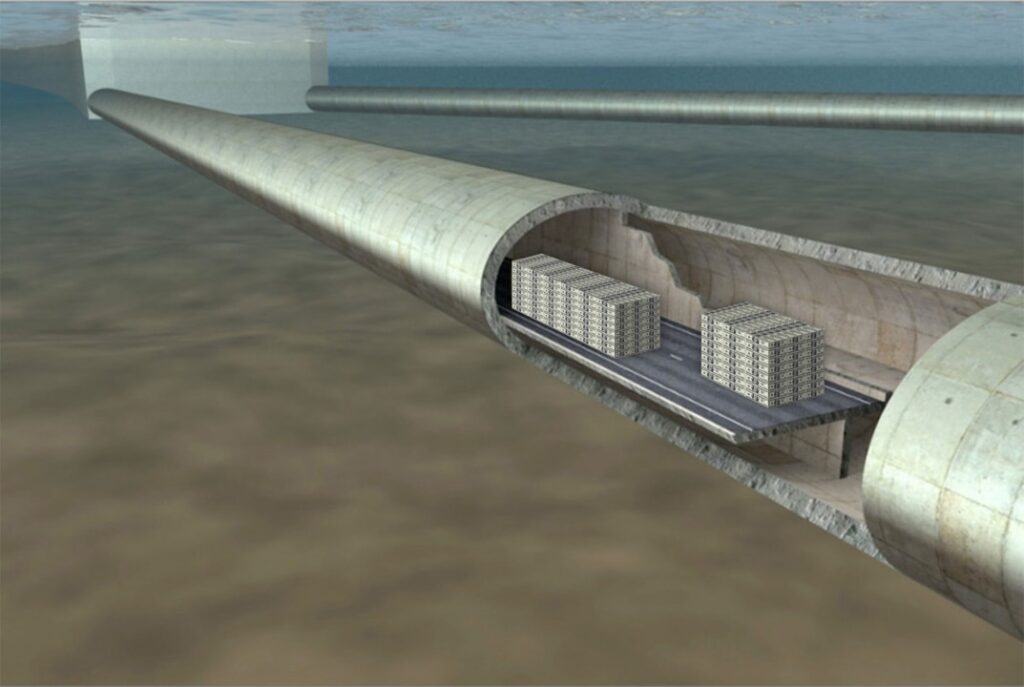

The most common type of pass-through is a mortgage-backed certificate or a a mortgage-backed security (MBS), in which a homeowner’s payment passes from the original bank through a government agency or investment bank before reaching investors. These types of pass-throughs derive their value from unpaid mortgages, in which the owner of the security receives payments based on a partial claim to the payments being made by the various debtors. Multiple mortgages are packaged together, forming a pool, which thus spreads the risk across multiple loans. These securities are generally self-amortizing, meaning the entire mortgage principal is paid off in a specified period of time with regular interest and principal payments.