A Special Purpose Acquisition Company

Is a public shell company created to acquire a private company and put it into the public markets. SPACs are also called “blank check” companies, they go public before their acquisition company is discovered. An alternative to a classic IPO for some startups and a new way to raise capital for investors. Richard Branson went public on Virgin Galactic in October 2019 using a SPAC.

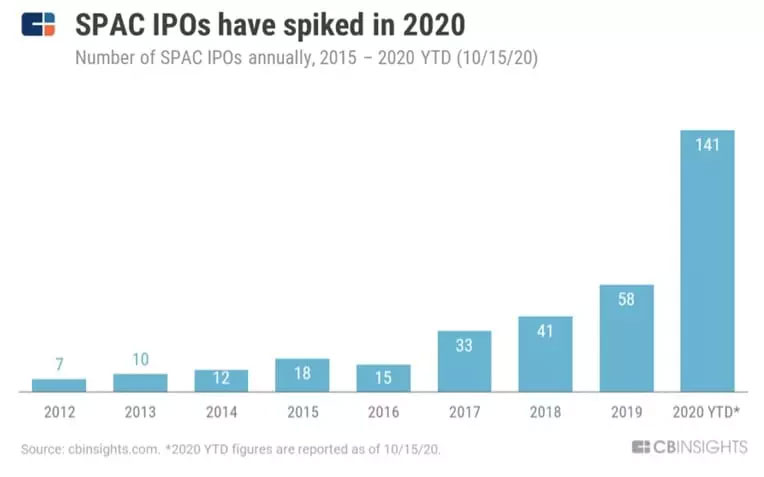

Although SPACs have existed since the 90s, they have gained popularity in recent times. The total funds raised by SPAC’s in 2o2o represented almost 45% of the the total IPO volume.

Today, SPACs are an attractive offering. The target company is able to go public easier avoiding much of the requirements of a traditional IPO. For investors it is a great opportunity to gain access to high-reward investments. For Sponsors that create the SPAC and find the target company, it is a way to list a company faster and more efficiently.

How a SPAC works

- The SPAC is headed by a sponsor , i.e a recognised market expert that undergoes an IPO procedure according to the rules established by the SEC. The filing process is easy and fast, because the company actually has no operational business.

- Then sponsors go on a roadshow in order to find interested investors. The difference is that they don’t sell a specific company, but themselves, their team and experience.

- Sponsors put the money raised from the IPO into a untouchable blind trust, until the acquisition transaction is finalised.

- The sponsor gets 20% «promote» fee of the shares

- Sponsors have 2 years to find a company to acquire, in case if they are not able to find a target, investors monies is returned.

De-SPAC

After sponsors have found a company, the acquisition of a company and the terms of such an acquisition are discussed with the existing SPAC shareholders, and after the transaction, they usually receive not only a corresponding stake in the new company, but also options to purchase some more shares in the future.

- The target company is presented to shareholders, who have an opportunity to vote on the acquisition. They also can redeem their shares for their money back if sponsors chose a company that they don’t like even if the acquisition is approved.

- Once the final decision is made, the merger process starts. Traditional IPO takes from 24-36 months, while SPACs mergers process takes 3 to 4 month.

- The Target company appears in a public market under its name.

“SPACs have become a new way of doing an M.&A. deal,”.

Jeff Mortara, the head of equity capital markets origination at UBS

Why now for investors?

Lower risk for institutional investors, who receive warrants before the IPO, which allows them to buy more shares, after the target company is introduced, for a little bit more than the initial purchase price.

- Opportunity to redeem the shares if they are unsatisfied with the target company.

- Investing in SPACs can also be a convenient option for those who want to invest at the IPO stage, as a small investor, because in a normal placement as one can access the purchase of shares only after institutional investors, who have already bought the company’s shares at a significant discount.

- The greater reliability of such options allows SPACs to attract both IPO and direct placement investors.

Why now for companies?

- The attractiveness of SPAC for the founders of the company, which is planned to be made public is that the merger with SPAC avoids the lengthy, costly and rather complicated process of IPO with roadshows, negotiations with underwriters / brokers and institutional investors and other procedures. In the case of SPAC, negotiations are conducted with only one party, without the involvement of underwriters / brokers, and immediately after the completion of the transaction, the company receives all the benefits of going public.

- In SPACs, the company’s share price is assured and defined by investors preferences as well as market forces and by the valuation of the company’s fundamentals. A SPAC deal avoids price uncertainty, because the target company’s management is able to negotiate an exact purchase price. This is not the case for IPOs.

- Besides the easer and faster IPO process, companies also get a team of experienced advisors, who assist companies’ management on post IPO steps.

Challenges and concerns

- Investors investing in SPACs cannot expect a return too quickly, as the process of finding a company to buy can take up to two years.

- Shareholders invest in a company without knowing what exactly it will buy and whether the search for a company to acquire will be successful.

- The sponsor has 2 years to find and acquire a company, if that deadline is approaching, the sponsor may choose the wrong company to buy, that can be harmful for investors.

- Unlike a direct placement, a SPAC costs are similar than a traditional IPO, since in this case commissions are also paid to underwriters / brokers, bank consultations. Often SPACs turn out to be even more expensive than traditional IPOs.

“I believe that we’re at an interesting beginning point of a new place in the capital stack,”

Mark Pincus about SPACs

Looking ahead

Today, the main winners of the SPAC boom are the sponsors. With the growing popularity of SPACs, sponsors’ competition for deals is also growing. This can lead to a more company-friendly approach and less sponsor focused deal structures.

Resources

- Big Blank Checks. (2020, July 14). Retrieved December 23, 2020, from https://www.nytimes.com/2020/07/14/business/dealbook/spac-blank-check.html?searchResultPosition=8

- Rostan, S. (2020, October 09). How to assess the risks before you invest in a SPAC. Retrieved December 23, 2020, from https://www.marketwatch.com/story/how-to-assess-the-risks-before-you-invest-in-a-spac-11602261758

- Hrnjic, E. (2020, December 22). The shortcomings and hidden costs of SPACs. Retrieved December 23, 2020, from https://www.businesstimes.com.sg/opinion/the-shortcomings-and-hidden-costs-of-spacs

- The Urge to Reverse Merge. (2020, August 25). Retrieved December 23, 2020, from https://www.nytimes.com/2020/08/25/business/dealbook/spac-ipo-boom.html

- What Is A SPAC? (2020, December 17) from https://swissfinanciers.com/what-is-a-spac/