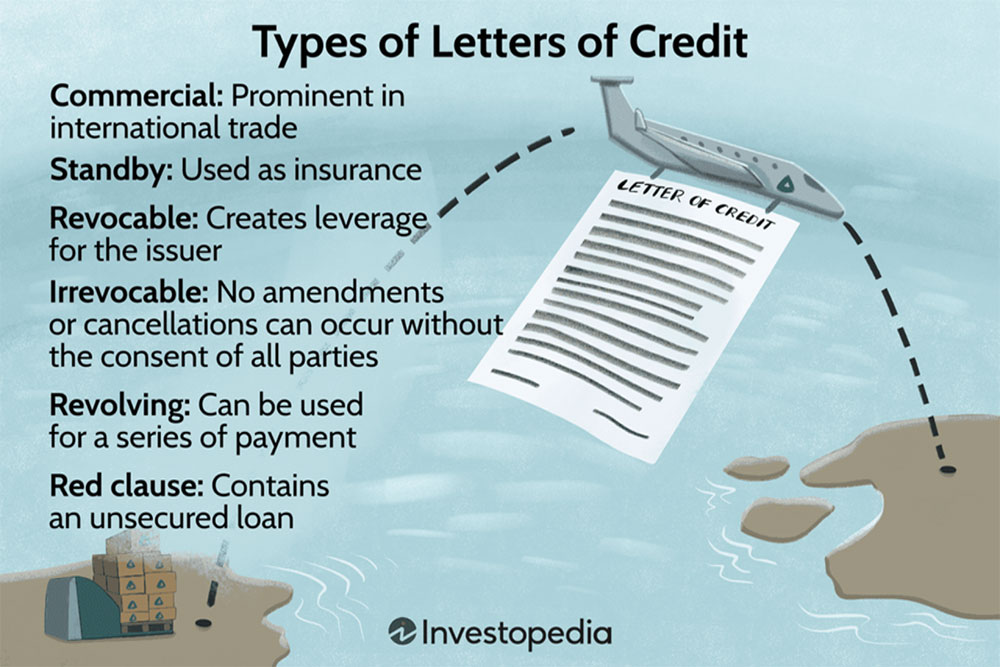

UN Letter of Credit (LC) is a fundamental instrument used in international trade and commerce to ensure payment for goods and services between parties in different countries. There are two primary types of letters of credit: the Commercial Letter of Credit (CLC) and the Standby Letter of Credit (SLC). Though they both provide payment security, they have distinct purposes, operational mechanisms, and implications for the parties involved.

Understanding the Basics

1. Commercial Letter of Credit (CLC)

UN Commercial Letter of Credit is a financial instrument used primarily in international trade transactions. It is a short-term, negotiable instrument issued by a bank at the request of the buyer (importer) to ensure that the seller (exporter) receives payment once specific documents verifying the shipment of goods are provided.

In this scenario, the bank acts as an intermediary, reducing the risk of non-payment for the seller and assuring the buyer that the goods will be delivered as agreed. It is used in situations where trust levels between buyer and seller are still being built, or where political or economic risks exist.

Key Characteristics of a Commercial Letter of Credit:

- Purpose: Facilitates the actual payment of goods and services.

- Transaction Type: Primarily used in the ordinary course of international and domestic trade transactions.

- Document Presentation: Payment is made when the seller provides specified documents (e.g., bill of lading, commercial invoice, packing list, etc.) that prove shipment or delivery of the goods.

- Revocability: Usually irrevocable, meaning that it cannot be amended or canceled without the consent of all parties involved.

- Time Frame: The LC is generally set for the duration of the trade cycle, usually ranging from a few weeks to a few months.

- Form of Payment: It can be paid at sight (immediate payment upon presentation of documents) or on a deferred basis (future payment based on the agreed-upon terms).

2. Standby Letter of Credit (SLC)

A Standby Letter of Credit, in contrast, serves as a secondary or “backup” payment mechanism. It is a guarantee that a bank provides on behalf of a client, ensuring the payment of a financial obligation if the client fails to fulfill their obligations. It functions more like a financial safety net and is not intended to be drawn upon in normal circumstances.

While a commercial LC is transactional in nature, the SLC is more akin to a guarantee, similar to a performance bond or insurance. It is frequently used in industries such as construction, real estate, and finance to provide assurance of contract fulfillment.

Key Characteristics of a Standby Letter of Credit:

- Purpose: Acts as a fail-safe in the event of non-performance or non-payment by the principal (the bank’s customer).

- Transaction Type: It is often used in contracts that are not primarily for the trade of goods but for securing financial obligations or ensuring contract performance.

- Document Presentation: The beneficiary can demand payment by presenting a document stating that the applicant has failed to meet their obligations (e.g., a statement of default).

- Revocability: Also generally irrevocable but can be structured to include conditions for amendments or cancellation.

- Time Frame: It can last for longer periods, often coinciding with the duration of the underlying obligation (e.g., a long-term lease or construction contract).

- Form of Payment: The payment under an SLC is only made if the primary obligation is not fulfilled, thus providing a safety net rather than facilitating the primary transaction.

Key Differences Between Commercial and Standby Letters of Credit

- Primary vs. Secondary Role

- CLC: Functions as the primary payment mechanism in trade transactions, ensuring that the seller receives payment for goods/services provided.

- SLC: Acts as a secondary payment mechanism, similar to a guarantee, and is only invoked when the applicant fails to fulfill their contractual or financial obligations.

- Transactional vs. Backup Nature

- CLC: Is transaction-based and is triggered by the shipment of goods or provision of services.

- SLC: Is obligation-based and is triggered by non-performance or default of the underlying contract.

- Document Requirements

- CLC: Requires detailed and specific documentation, such as shipping documents, inspection certificates, and invoices, to prove that the goods/services were delivered as per the agreement.

- SLC: Typically requires only a statement of default, which asserts that the applicant has not fulfilled their obligations. The process is generally simpler, as the SLC is not tied to the specifics of a trade transaction.

- Regulatory and Legal Differences

- CLC: Heavily governed by the rules of the International Chamber of Commerce (ICC), specifically under the Uniform Customs and Practice for Documentary Credits (UCP 600).

- SLC: Operates under a different set of rules, primarily the International Standby Practices (ISP98) or sometimes the UCP 600 if explicitly mentioned.

- Risk Mitigation vs. Assurance of Performance

- CLC: Aims to mitigate risks inherent in international trade, such as non-payment or non-receipt of goods.

- SLC: Provides assurance of performance or payment, but it’s intended to be a safety net and not the primary payment instrument.

- Industry Usage

- CLC: Widely used in international trade sectors, such as commodities, manufacturing, and general import/export businesses.

- SLC: Common in construction, leasing, and services industries, as well as in financial guarantees such as covering loan repayment or bond issuances.

- Implications for Credit

- CLC: Impacts the credit limits of the issuing bank’s client because it involves a commitment to pay for goods or services.

- SLC: Also impacts the client’s credit limits but primarily as a contingent liability, activated only upon default or failure to perform.

Real-World Applications

Commercial Letters of Credit:

- Example 1: A U.S. company purchases goods from a supplier in China. To ensure the supplier receives payment after the goods are shipped, the buyer arranges a commercial letter of credit through its bank. Once the supplier submits the required shipping documents, payment is released.

- Example 2: An Indian firm exports textiles to a retailer in Europe. The retailer opens a commercial LC with a bank to confirm that payment will be made upon the successful delivery of the textiles.

Standby Letters of Credit:

- Example 1: A construction company secures a large building contract. The client requires an SLC from the construction company to ensure completion of the project. If the company fails to complete the project, the client can draw on the SLC.

- Example 2: A U.S. exporter wants to assure an overseas customer that it will fulfill its service contract. The exporter provides a standby LC as a form of guarantee, which the customer can draw upon if the exporter fails to perform as agreed.

Conclusione

IL Commercial Letter of Credit and the Standby Letter of Credit both play crucial roles in international trade and finance but serve different purposes. While the CLC is designed to facilitate actual payments for trade transactions, the SLC is intended as a guarantee of performance or payment, providing a safety net for the beneficiary. Understanding the differences between these instruments is vital for businesses to effectively manage risk, enhance creditworthiness, and maintain trust in global commerce.