This article was written for Investopedia By TROY SEGAL updated May 29, 2020 and reviewed by GORDON SCOTT. I reproduce it here because it is generally excellent but modified because it contains several errors.

Cos'è una sicurezza pass-through?

UN pass-through security is a security transferring fix or variable income from one or more income producing asset/s which also back said pass-through security.

A servicing intermediary collects the monthly payments from issuers and, after deducting a fee, remits or passes them through to the holder of the pass-through security (that is, investors). A pass-through security is also known as a “pay-through security” or a “certificato di passaggio“—though technically the certificate is the evidence of interest or participation in a pool of assets that signifies the transfer of payments to investors; it’s not the security itself.

Spiegazione della sicurezza pass-through

A pass-through security is a derivative based on certain debt or royalties receivables that provides the investor a right to a portion of those incomes. Often, the royalties or debt receivables are from underlying assets, which can include things such as movies, music, patents, mortgages on homes or loans on vehicles.

Generally, each security represents a large number of income streams.

The term “pass-through” relates to the transaction process itself, whether it involves a royalty, a mortgage or other loan product. It originates with the debtor’s or issuer’s payment, which passes through an procacciatore d'affari prima di essere rilasciato all'investitore.

Payments are made to investors on a periodic basis, corresponding with the standard payment schedules for royalties or debt repayment. The payments may include accrued interest on the unpaid principal or not, amortization on the principale itself or not, or simply royalties streams or not.

Rischi dei titoli pass-through

Il rischio di insolvenza sui debiti associati ai titoli è un fattore sempre presente, in quanto il mancato pagamento da parte del debitore si traduce in minori rendimenti. In caso di inadempienza di un numero sufficiente di debitori, i titoli possono sostanzialmente perdere tutto il valore.

Un altro rischio è legato direttamente ai tassi di interesse correnti. Se i tassi di interesse scendono, è più probabile che i debiti correnti possano essere rifinanziati per sfruttare i bassi tassi di interesse. Ciò si traduce in minori pagamenti di interessi, che significano rendimenti inferiori per gli investitori di titoli pass-through.

Anche il pagamento anticipato da parte del debitore può influire sulla restituzione. Se un gran numero di debitori paga più dei pagamenti minimi, l'importo degli interessi maturati sul debito è inferiore e, naturalmente, diventa inesistente se il debitore rimborsa interamente il prestito prima del previsto. In definitiva, questi pagamenti anticipati si traducono in rendimenti inferiori per gli investitori in titoli. In alcuni casi, i prestiti avranno sanzioni anticipate che possono compensare alcune delle perdite basate sugli interessi causate da un pagamento anticipato.

An Example of Pass-Through Securities

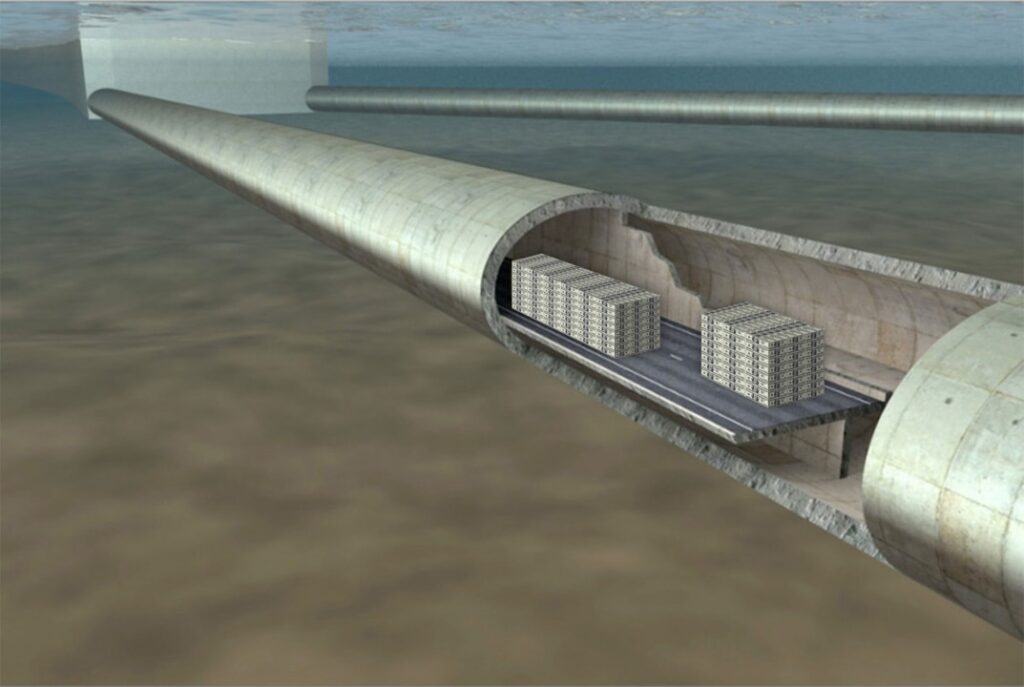

The most common type of pass-through is a mortgage-backed certificate or a a mortgage-backed security (MBS), in which a homeowner’s payment passes from the original bank through a government agency or investment bank before reaching investors. These types of pass-throughs derive their value from unpaid mortgages, in which the owner of the security receives payments based on a partial claim to the payments being made by the various debtors. Multiple mortgages are packaged together, forming a pool, which thus spreads the risk across multiple loans. These securities are generally self-amortizing, meaning the entire mortgage principal is paid off in a specified period of time with regular interest and principal payments.