Companies go public through an IPO for several reasons:

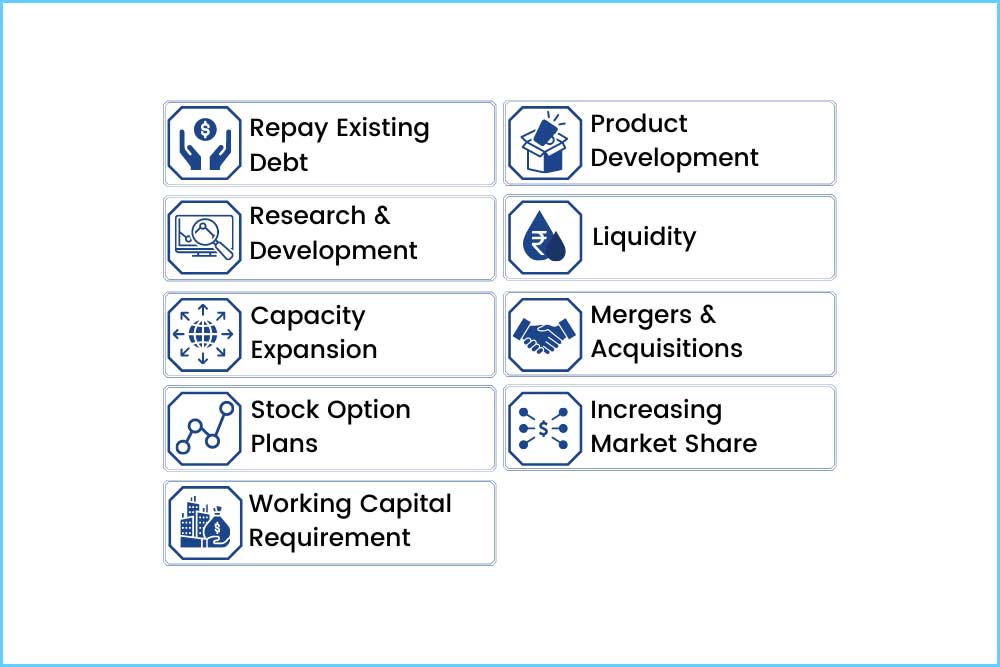

Capital raising: One of the main reasons for going public is to raise capital for the company. By issuing shares to the public, the company can raise a large amount of money quickly and use it to fund growth and expansion plans.

Liquidity for shareholders: Going public also provides liquidity for the company’s shareholders, including the founders, early investors, and employees. They can sell their shares on the public markets, which makes it easier to realize their investment and potentially generate a significant return.

Public visibility: Going public can also increase the company’s public visibility and raise its profile, which can help to attract new customers, partners, and employees. It can also improve the company’s reputation and credibility in the market.

Currency for acquisitions: Public companies have a more liquid and valuable currency to use for acquisitions, which can help them to grow and expand more rapidly.

Regulatory requirements: Finally, going public comes with increased regulatory requirements, such as financial reporting and disclosure, which can improve the company’s governance and transparency. This can be attractive to investors and other stakeholders who value responsible corporate behavior.