投资银行在 IPO 中的作用是什么?

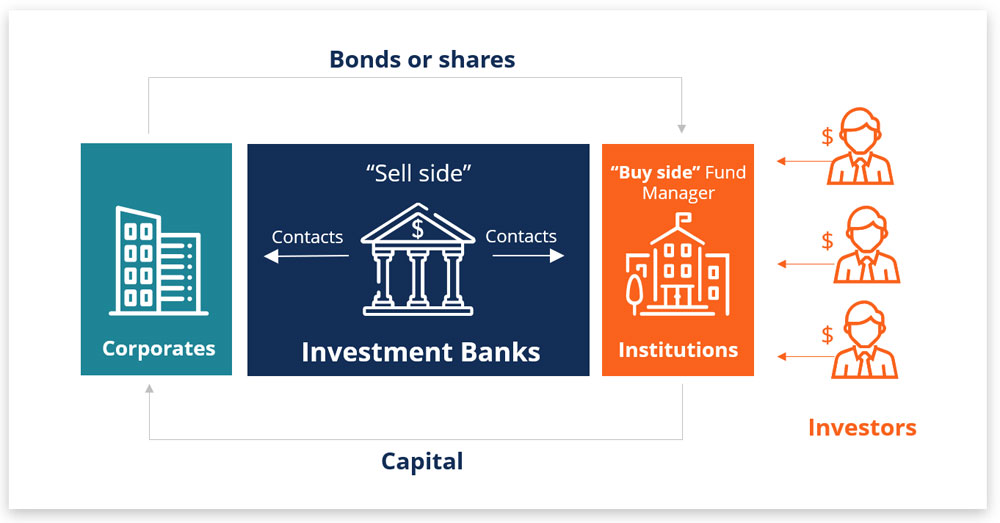

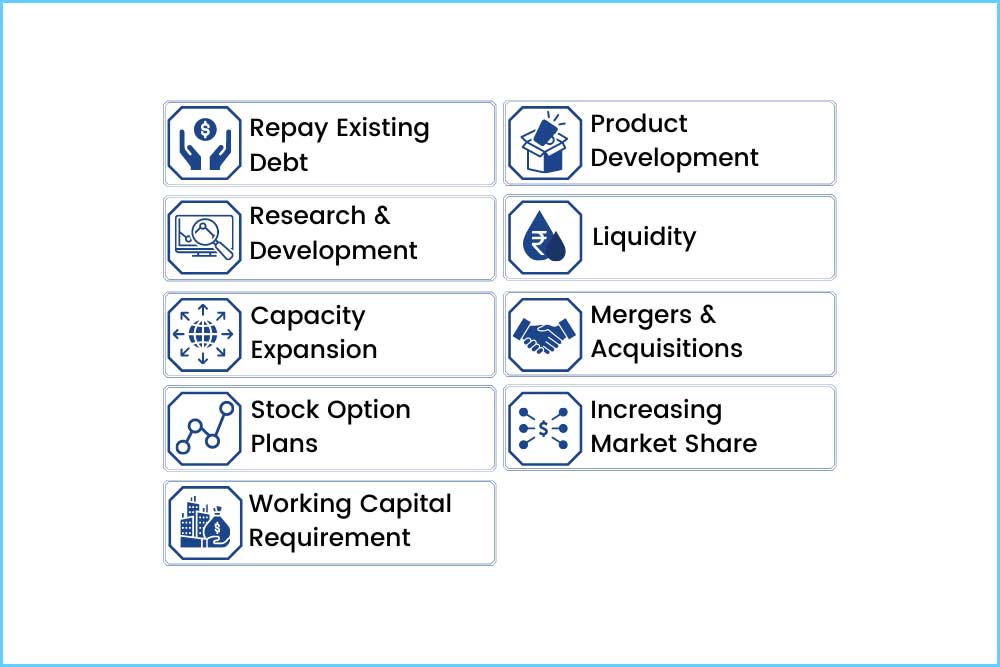

Investment banks play a crucial role in an IPO. They are hired by the company to help facilitate the offering and act as intermediaries between the company and the investors. The main roles of investment banks in an IPO include: Underwriting: Investment banks underwrite the offering by agreeing to purchase shares from the company at … 阅读更多