Page 92 - Initial Public Offering - An Introduction to IPO on Wall Street

P. 92

Large accelerated filer—A corporation whose value in the market of publicly traded shares as

of the last business day of the firm's most recently concluded second fiscal quarter is equal to

or greater than $700 million.

Accelerated filer—An organization whose value in the market of publicly traded shares, as of

the last business day of the firm's most recently concluded second fiscal quarter, is between

$75 million and $700 million.

In addition to the criteria for capitalization in the market, to be listed as a large accelerated filer

or an accelerated filer, as of the conclusion of its fiscal year, a corporation must fulfill the

following criteria:

For a minimum duration of 12 months, the corporation was subject to SEC reporting

provisions (especially Section 13(a) or 15(d) of the 1934 Act);

A minimum of one annual report has already been submitted by the organization as defined

in section 13(a) and 15(d); and

The entity is not qualified to use the standards for SRCs

Businesses that do not fulfill such criteria are deemed non-accelerated filers. Notice that in the

first year, businesses would usually be treated as non-accelerated filers as a public corporation,

because the standards are determined at the end of the fiscal year and, as a general rule, a newly

public listed corporation will not have issued an annual report for the previous year.

To assess if the assigned filer category has changed, accelerated filer status must be evaluated

at the end of each year.

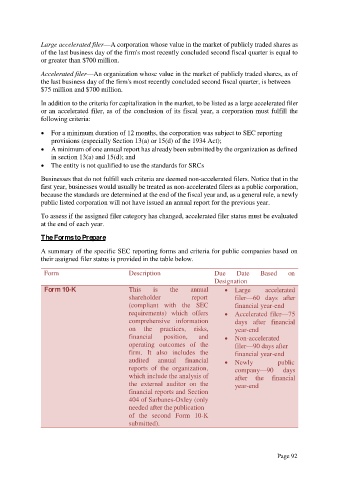

The Forms to Prepare

A summary of the specific SEC reporting forms and criteria for public companies based on

their assigned filer status is provided in the table below.

Form Description Due Date Based on

Designation

Form 10-K This is the annual Large accelerated

shareholder report filer—60 days after

(compliant with the SEC financial year-end

requirements) which offers Accelerated filer—75

comprehensive information days after financial

on the practices, risks, year-end

financial position, and Non-accelerated

operating outcomes of the filer—90 days after

firm. It also includes the financial year-end

audited annual financial Newly public

reports of the organization, company—90 days

which include the analysis of after the financial

the external auditor on the year-end

financial reports and Section

404 of Sarbanes-Oxley (only

needed after the publication

of the second Form 10-K

submitted).

Page 92