Page 95 - Initial Public Offering - An Introduction to IPO on Wall Street

P. 95

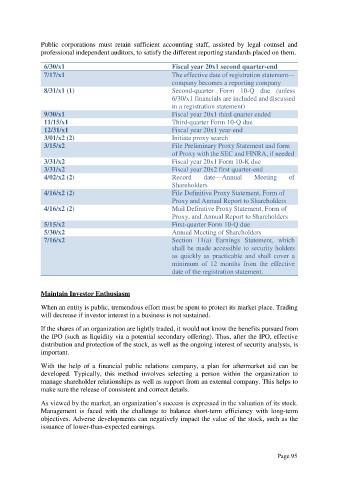

Public corporations must retain sufficient accounting staff, assisted by legal counsel and

professional independent auditors, to satisfy the different reporting standards placed on them.

6/30/x1 Fiscal year 20x1 second quarter-end

7/17/x1 The effective date of registration statement—

company becomes a reporting company

8/31/x1 (1) Second-quarter Form 10-Q due (unless

6/30/x1 financials are included and discussed

in a registration statement)

9/30/x1 Fiscal year 20x1 third quarter ended

11/15/x1 Third-quarter Form 10-Q due

12/31/x1 Fiscal year 20x1 year-end

3/01/x2 (2) Initiate proxy search

3/15/x2 File Preliminary Proxy Statement and form

of Proxy with the SEC and FINRA, if needed

3/31/x2 Fiscal year 20x1 Form 10-K due

3/31/x2 Fiscal year 20x2 first quarter-end

4/02/x2 (2) Record date—Annual Meeting of

Shareholders

4/16/x2 (2) File Definitive Proxy Statement, Form of

Proxy and Annual Report to Shareholders

4/16/x2 (2) Mail Definitive Proxy Statement, Form of

Proxy, and Annual Report to Shareholders

5/15/x2 First-quarter Form 10-Q due

5/30/x2 Annual Meeting of Shareholders

7/16/x2 Section 11(a) Earnings Statement, which

shall be made accessible to security holders

as quickly as practicable and shall cover a

minimum of 12 months from the effective

date of the registration statement.

Maintain Investor Enthusiasm

When an entity is public, tremendous effort must be spent to protect its market place. Trading

will decrease if investor interest in a business is not sustained.

If the shares of an organization are lightly traded, it would not know the benefits pursued from

the IPO (such as liquidity via a potential secondary offering). Thus, after the IPO, effective

distribution and protection of the stock, as well as the ongoing interest of security analysts, is

important.

With the help of a financial public relations company, a plan for aftermarket aid can be

developed. Typically, this method involves selecting a person within the organization to

manage shareholder relationships as well as support from an external company. This helps to

make sure the release of consistent and correct details.

As viewed by the market, an organization’s success is expressed in the valuation of its stock.

Management is faced with the challenge to balance short-term efficiency with long-term

objectives. Adverse developments can negatively impact the value of the stock, such as the

issuance of lower-than-expected earnings.

Page 95