Parley – Talks – Powwow

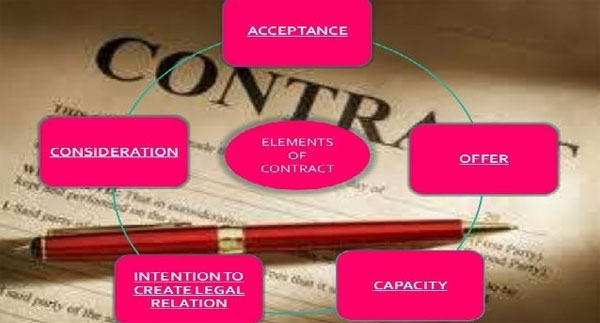

The Parley or the pre-contractual stage is a phase preceding the negotiation of a contract. To prepare for the successful conclusion of a contract, two parties can enter into talks in two different ways: either informally informal talks or formally formalized talks. The difference between these two modalities depends on the contract and the co-contracting … Read more