- All

- Intellectual Property

- IPO

- IPO Basic

- IPO Cost

- IPO Pro

- Languages

- SPAC

- SPAC Variants

218 Total posts:

Alice Corp. v. CLS Bank (2014): Decision and Impact on Patent Eligibility with help of ChatGPT

Background: Alice Corp. v. CLS Bank International was a landmark 2014 U.S. Supreme Court case addressing whether certain computer-implemented financial trading schemes…

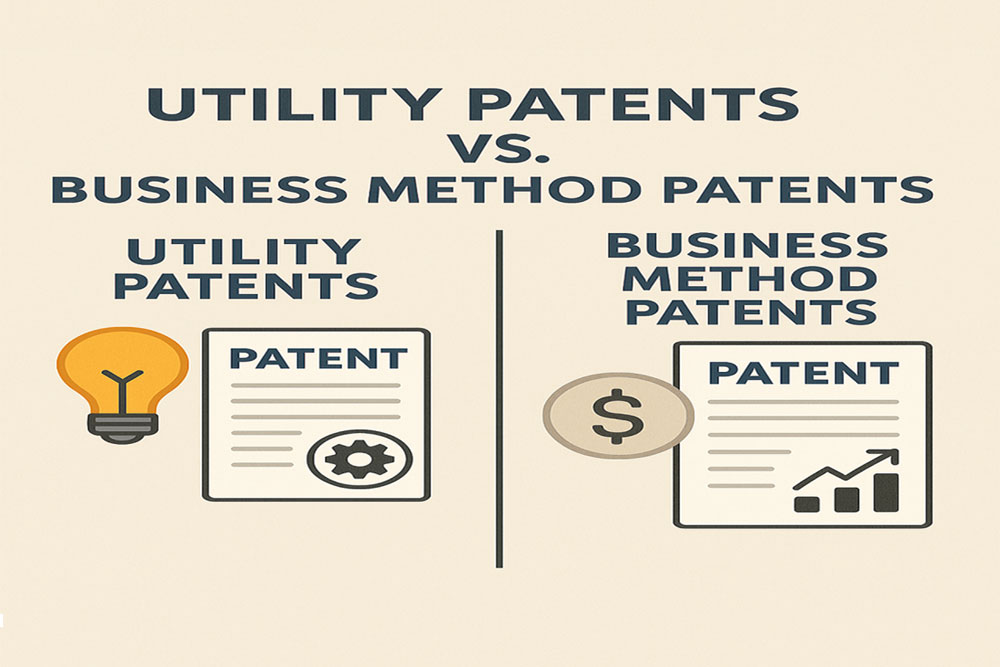

Process Patents vs. Business Method Patents with the help of ChatGPT

In U.S. patent law, an invention can take different forms – it might be a product, a machine, a composition of matter, or a process.

Difference between a Pending or Issued Patent

The world of intellectual property can be complex, with various terms and processes that may seem daunting to those who are not familiar with them…

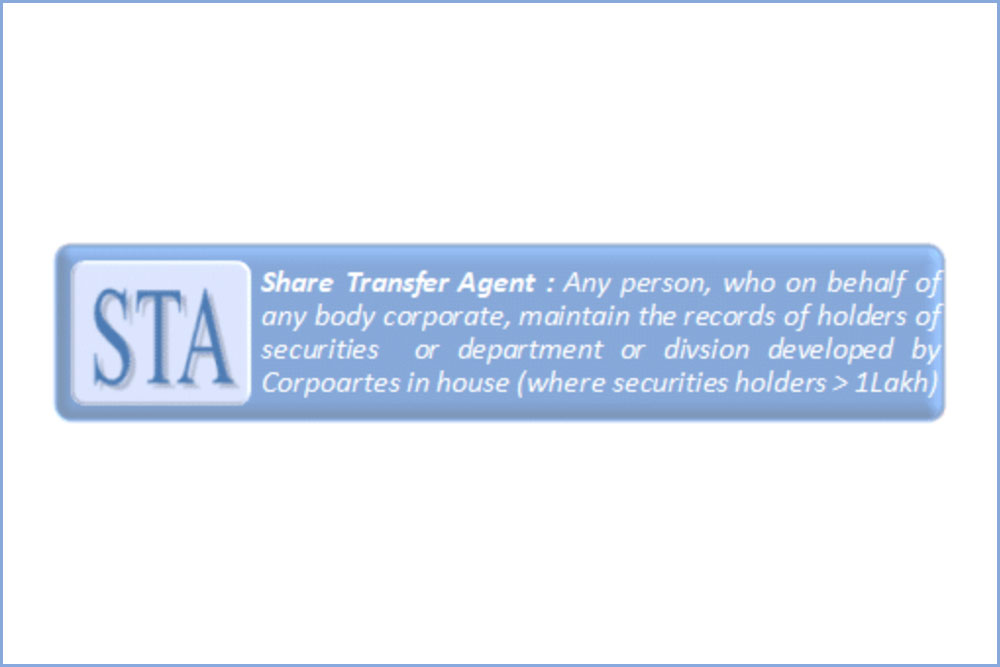

The Role of the Transfer Agent in the IPO

Initial Public Offerings (IPOs) are complex financial events that mark a significant milestone for companies seeking to raise capital by transitioning from private to public

The Role of the FINRA in the IPO Process

The Initial Public Offering (IPO) represents a significant milestone in a company’s growth, symbolizing its transition from a private entity to a publicly traded corporation.

The Role of the U.S. Securities & Exchange Commission in the IPO Process

The Initial Public Offering (IPO) is a transformative milestone for private companies looking to raise capital by offering shares to the public for the first

The Allocation of Shares in the IPO

Initial Public Offerings (IPOs) mark a significant milestone for a company transitioning from private to public ownership. For investors, IPOs represent an opportunity to invest

The IPO “Quiet Period” under U.S. Securities Law

Introduction The “quiet period” is a fundamental concept under U.S. securities law that governs communications by companies, underwriters, and insiders during the process of an

Definition of a Passthrough Security

This article was written for Investopedia By TROY SEGAL updated May 29, 2020 and reviewed by GORDON SCOTT. I reproduce it here because it is

The Consolidated Tape

In any financial market, the concept of the consolidated tape represents more than just a utility; it serves as the backbone of market transparency and

Plea for a Love Relationship Rooted in Passion

In the vast expanse of human connection, there exists a path that begins not with the gentle warmth of friendship but with the electric spark

Development Stages of a Film

The development of a movie typically follows several key stages, each of which is crucial to the successful creation and release of the film. Below

Factuality

The Factuality: The Compromise Between Reality and Perception The Factuality, at its core, is the bridge between objective reality and subjective perception. The term itself

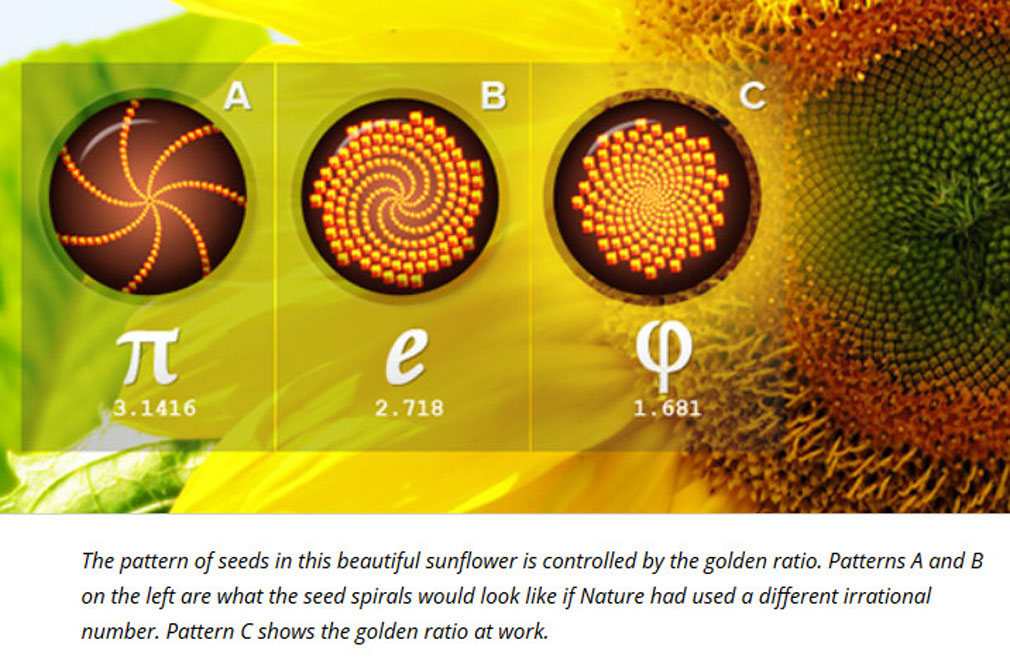

Relationships between PI, PHI the GOLDEN RATIO, e and FIBONACCI

Mathematics is often described as the language of the universe, filled with patterns and constants that govern everything from the growth of plants to the

TruePreIPO™ Certification

The IPO Institute, a globally recognized authority in financial certifications, has recently introduced the “True PreIPO™” certification. This certification aims to distinguish legitimate pre-initial public

Cross-Collateralization in the Music Industry

Cross-collateralization in the music business is a crucial yet complex topic that can significantly impact an artist’s financial future. This practice, widely used in record

Mechanical Rights in the Music Industry

Mechanical rights are a fundamental concept in the music industry, governing how songwriters, composers, and music publishers earn income from the reproduction of their compositions.

Publishing Rights of a Music Work

In the music industry, publishing rights are one of the most critical and valuable aspects of a song’s copyright. Often less visible to the public,

Compulsory Licensing for Music Works

In the music industry, copyright law protects the rights of creators, but it also provides mechanisms to balance these rights with the public’s need to

The Moral Right to a Music Work

The concept of “moral rights” in intellectual property law, especially in relation to songs, provides an essential layer of protection for creators, focusing not on

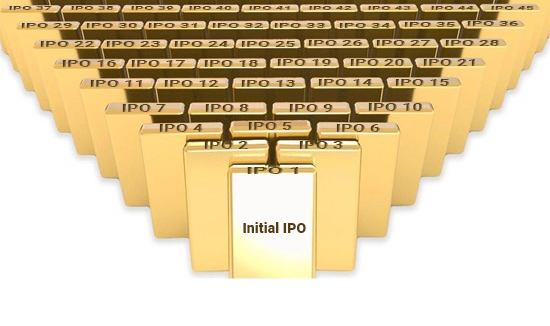

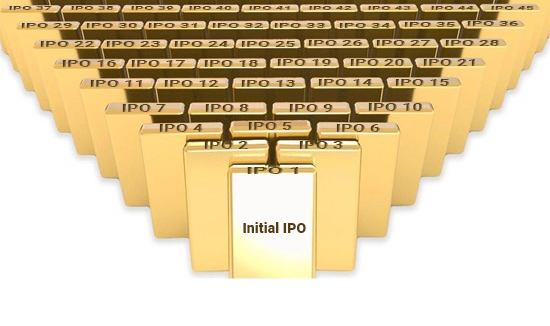

IPO Cascade – Cascade of Initial Public Offerings

The IPO Cascade is a patented process conceived by Marc Deschenaux and licensed exclusively to Market Street Capital Inc. A Company willing to issue equity

The Minority Shareholder’s Rights

Minority shareholders, while owning a smaller stake in a company, are still entitled to specific rights that protect their interests and allow them to participate

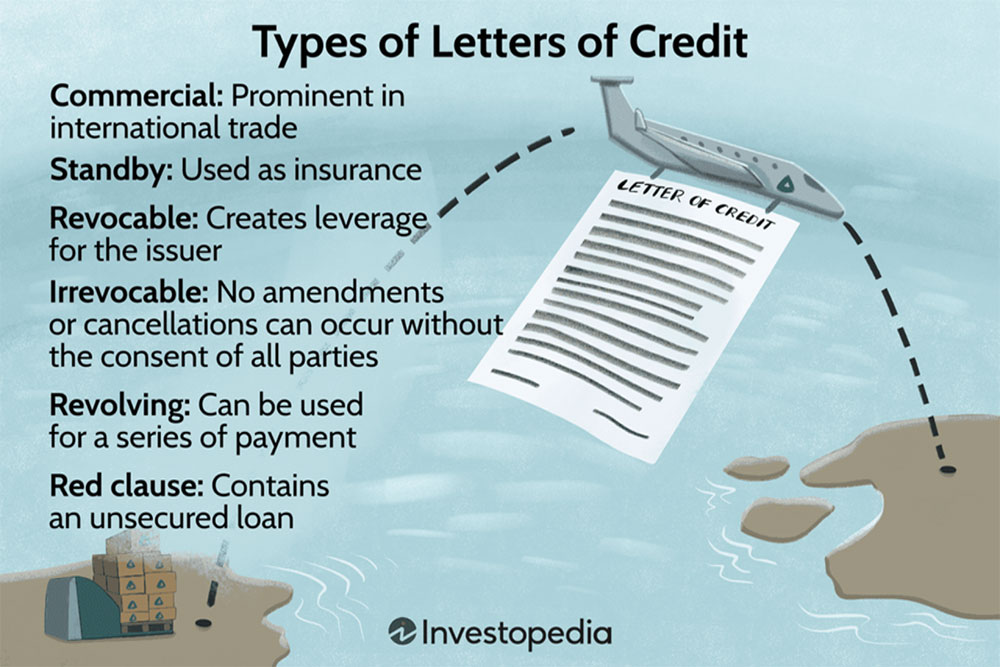

Commercial and Standby Letter of Credit

A Letter of Credit (LC) is a fundamental instrument used in international trade and commerce to ensure payment for goods and services between parties in

Insurance Dedicated or Directed Fund (IDF)

An Insurance Dedicated Fund (IDF) is a fund that is typically established as a segregated account within a life insurance company’s general account or a

Valuation of a Startup Company

Valuing a startup, thus a company without any revenue, can be one of the most challenging tasks in the business world. Traditional valuation methods, such

Buying a Bank

Purchasing a bank represents a monumental undertaking that requires a confluence of strategic planning, regulatory insight, and financial acumen. This article aims to serve as

How to Detect an Exit Opportunity

In the fast-paced world of finance and investments, timing is everything. Whether you’re a startup founder, a venture capitalist, or a stock market investor, knowing

Revenue-Based Investing (RBI), Revenue-Sharing Financing (RSF) or Revenue Discount

The innovative business model is called “Revenue-Based Investing” (RBI), “Revenue-Sharing Financing” (RSF) or “Revenue Discount” (RD) and was invented by Marc René Deschenaux. In this

Intellectual Property Rights Offering

Title: Unleashing Value through : A Comprehensive Legal Analysis Introduction: In today’s innovation-driven economy, intellectual property (IP) has emerged as a critical asset for businesses

The URGENT REFORM of the SWISS SCHOOL PROGRAM

NOBODY IS SUPPOSED TO IGNORE THE LAW! BUT IT IS NOT TEACHED OR AT LEAST BEFORE THE SECONDARY CYCLE… Then we are surprised that the

Controlled Failure

I. A Strategic Masterstroke in Equity Financing In the ever-evolving sphere of financial markets, every so often, there emerges a pioneering concept that disrupts traditional

Respect Yourself

1. Stop looking for who is not looking for you.2. Stop begging.3. Stop saying more than is necessary.4. When people disrespect you, confront them immediately.5.

The Sacrificial Imperative

Before starting I would like to reaffirm that I am no leftist or democrat. I am a convinced Capitalist because I believe that it is

Inventors and Small Businesses Licensing to Large Corporations

In today’s knowledge-driven economy, licensing intellectual property (IP) has become a vital strategy for monetization, providing a crucial revenue stream for inventors and small businesses.

Legal Perspective on the Unintended Consequences of Decoupling Intellectual Property from Corporate Financing

Intellectual property (IP) — encompassing patents, trademarks, and copyrights — has become a cornerstone of corporate valuation and financing. With the advent of knowledge-based economies,

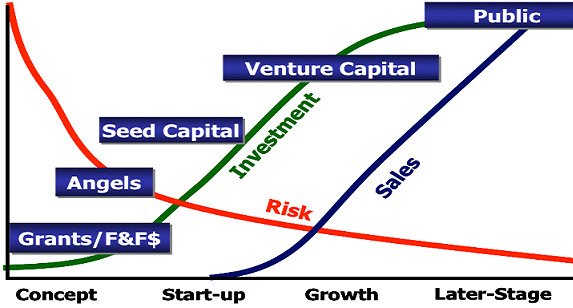

Duration of Equity Fundraising

Fundraising is a critical activity in the life cycle of a business. It not only provides the necessary capital to initiate operations but also supports

From the old Funding Rounds to the new Progressive or Incremental Price Method

In the early days of business funding, before 1995, the predominant method for raising capital was through “funding rounds.” This approach, although straightforward, had several

Intellectual Property Securities

We can legitimately wonder whether the traditional securities are sufficient to answering the modern investor’s needs, Are not you fed up to invest in basket

MasterSPAC

A MasterSPAC is a Special Purpose Acquisition Company that acquires a target by financing its Initial Public Offering as described in this WhosWho article. This

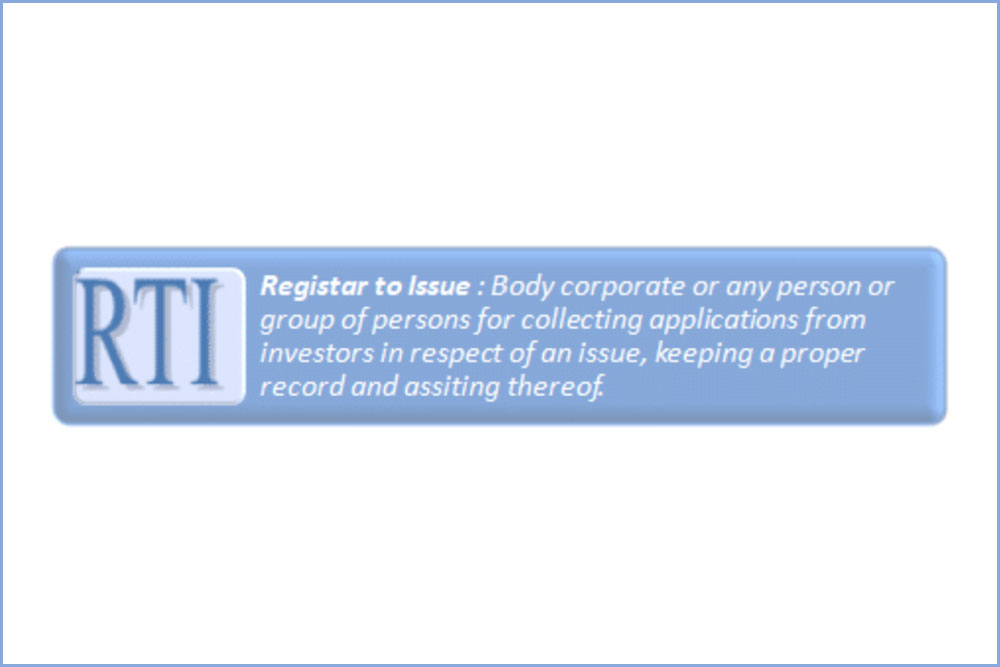

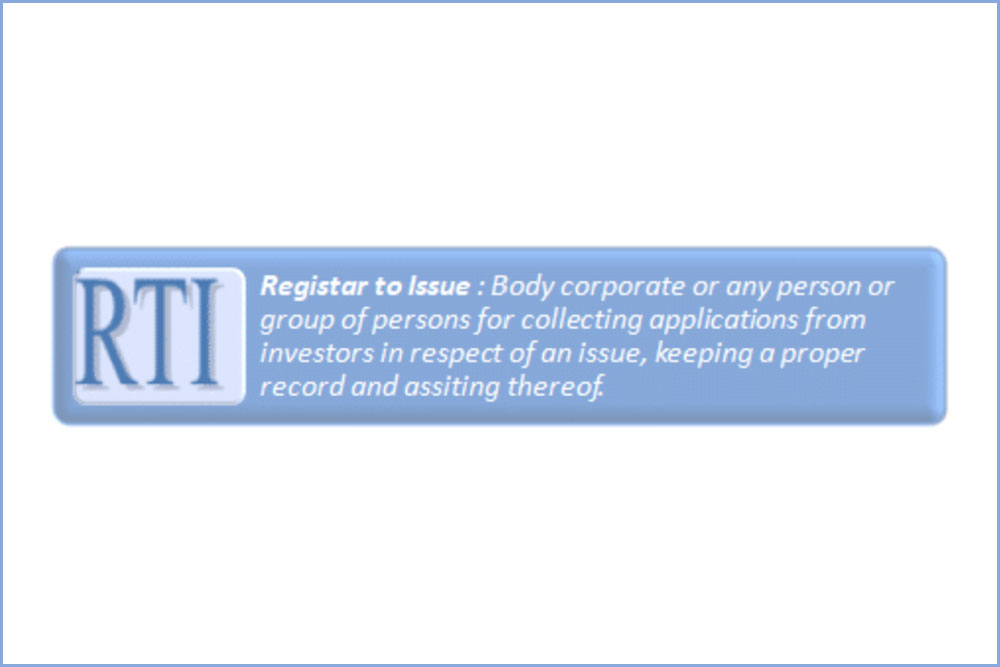

What is the role of the REGISTRAR in an IPO, and what services do they provide?

In an IPO, the Registrar plays an important role as a key intermediary between the company going public and its investors. Here are some of

IPO Challenges, Pitfalls & Mitigation

The IPO process can be complex and challenging for companies, and there are several pitfalls that can arise along the way. Here are some common

How do the risks associated with an IPO compare to those associated with other forms of financing, such as private equity or debt financing?

The risks associated with an IPO can be different from those associated with other forms of financing, such as private equity or debt financing. One

How can companies prepare for the ongoing reporting and disclosure requirements after an IPO, and what are the key requirements for maintaining compliance with securities laws?

Companies can prepare for ongoing reporting and disclosure requirements after an initial public offering (IPO) by implementing effective corporate governance practices, developing strong internal controls,

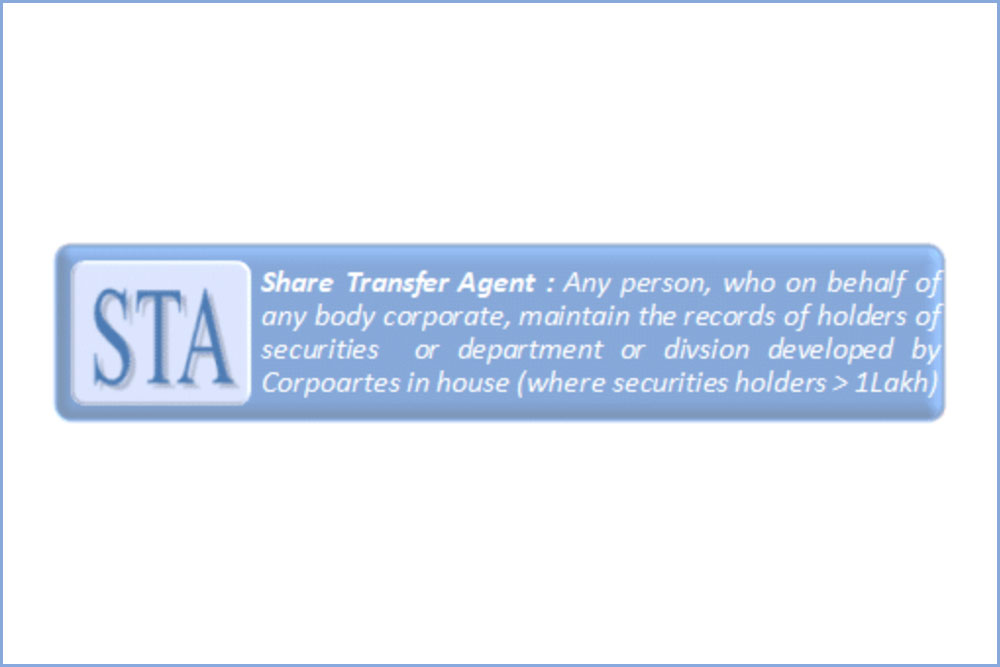

Stock / Share Transfer Agent

A transfer agent plays an important role in an initial public offering (IPO) by serving as an intermediary between a company going public and its

How is the lock-up period determined, and what are the implications of the lock-up period for investors and the company?

The lock-up period is determined by the underwriters of the Initial Public Offering (IPO) and is agreed upon between the underwriters and the company. The

What is the process of stabilizing the price of shares in an IPO, and what are the rules and restrictions on stabilization activities?

Stabilizing the price of shares in an initial public offering (IPO) is the process of supporting the share price in the secondary market during the

IPO Pricing and Shares Offered Dynamics

The market reaction to an Initial Public Offering (IPO) is typically assessed by measuring the performance of the shares in the aftermarket. The aftermarket refers

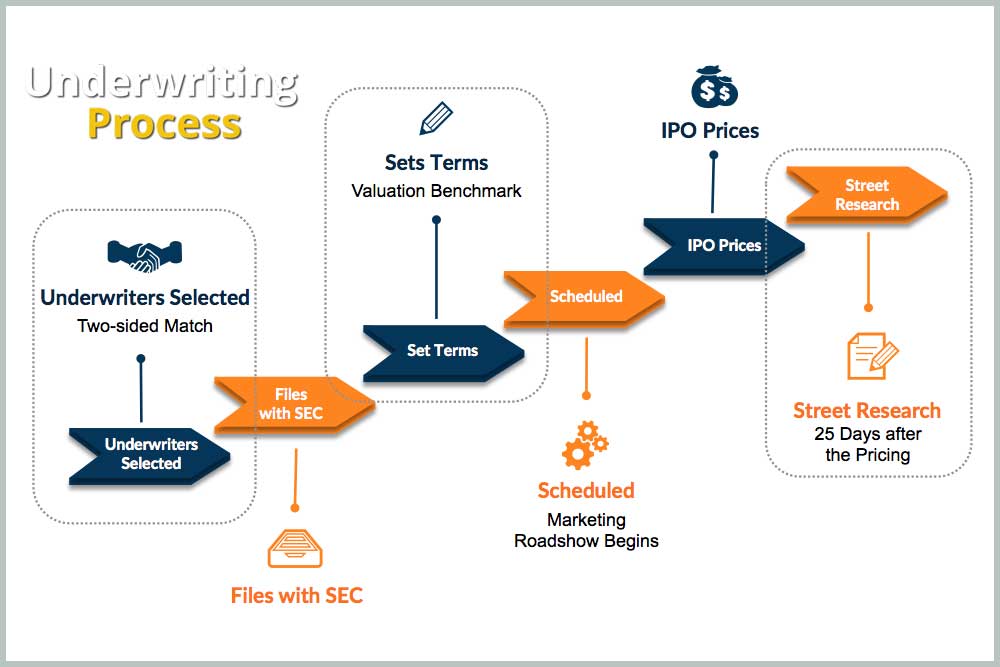

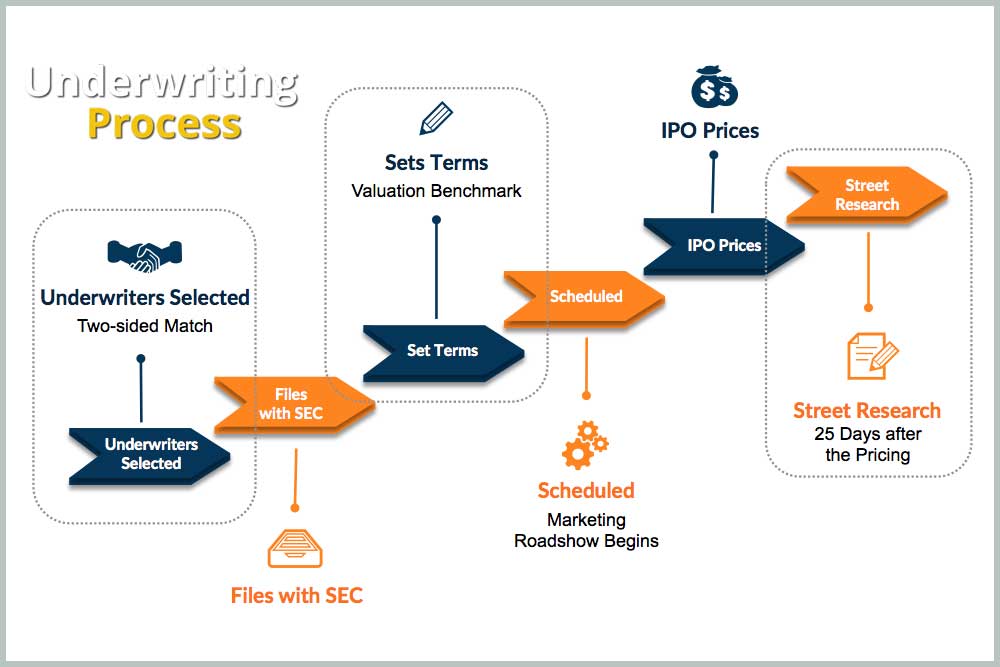

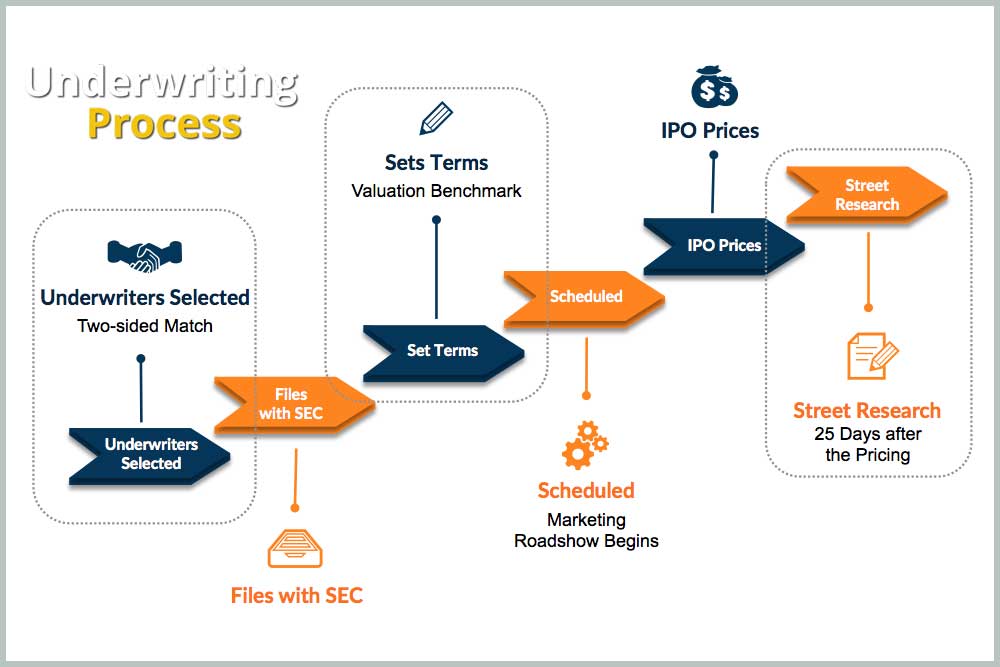

Underwriting

What is the role of the syndicate in an IPO, and how are the roles and responsibilities of the lead underwriter and other underwriters determined?

Underwriting Structure & Fees

The fees for underwriting an Initial Public Offering (IPO) are typically structured as a percentage of the total amount raised through the IPO. This fee

What is the difference between a firm commitment underwriting and a best efforts underwriting, and what are the advantages and disadvantages of each approach?

Firm commitment underwriting is when the underwriter agrees to purchase all the securities being issued by the issuer and then resell them to investors. In

Bookbuilding process, and how is it used to determine pricing and allotment in an IPO?

The bookbuilding process is a mechanism used by investment banks to determine the demand for shares in an initial public offering (IPO) and set an

Filing and IPO Registration Statement & Prospectus

Filing an IPO registration statement is a complex process that involves several steps. Here are the key components: Selection of underwriters: The company selects one

What is the role of the Securities and Exchange Commission (SEC) in the IPO process?

Overview The Securities and Exchange Commission (SEC) plays a crucial role in the IPO process. It is the primary regulator of the securities markets in

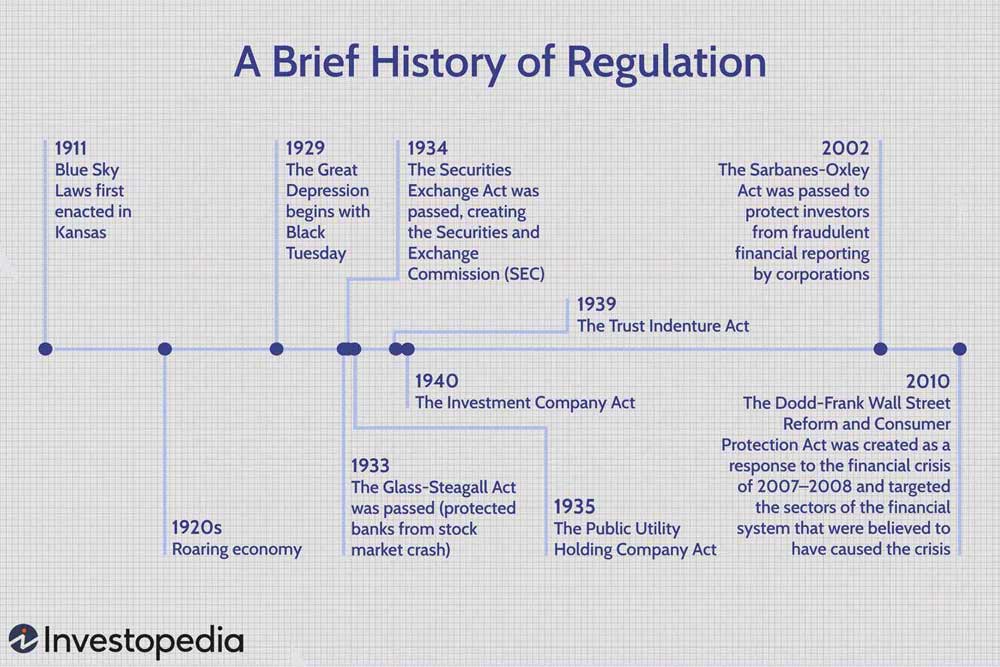

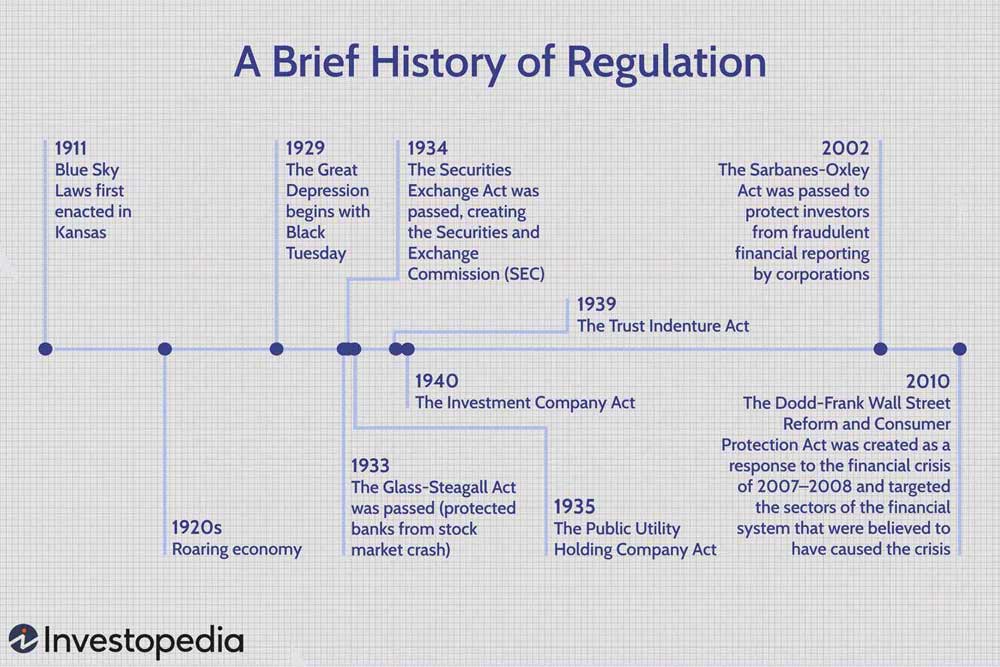

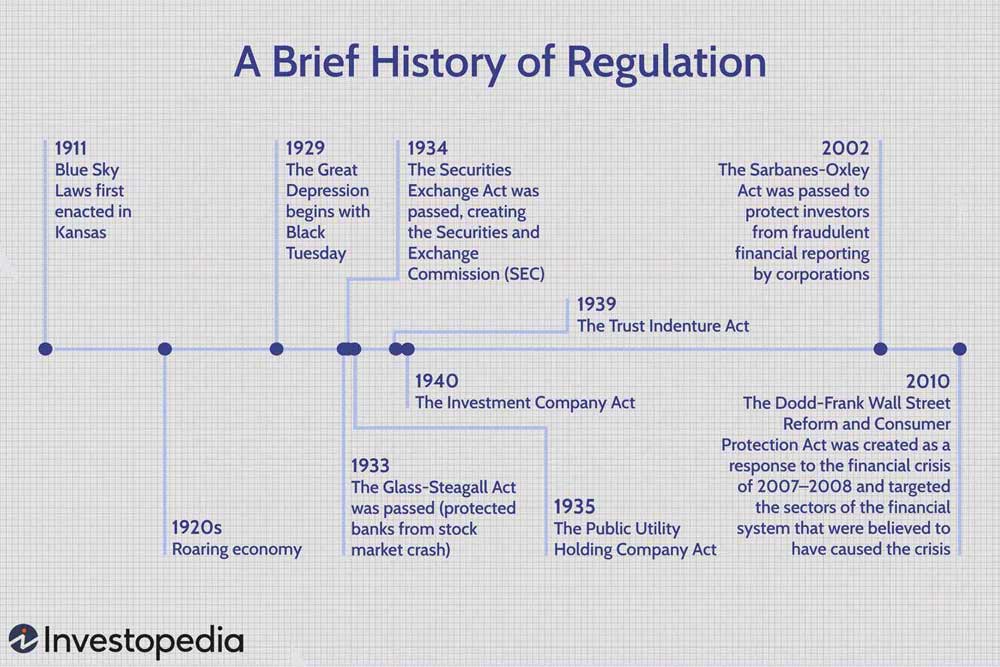

How are the securities laws and regulations relevant to an IPO, and what is the process of obtaining regulatory approvals?

The securities laws and regulations are highly relevant to an IPO. The primary law that governs IPOs in the United States is the Securities Act

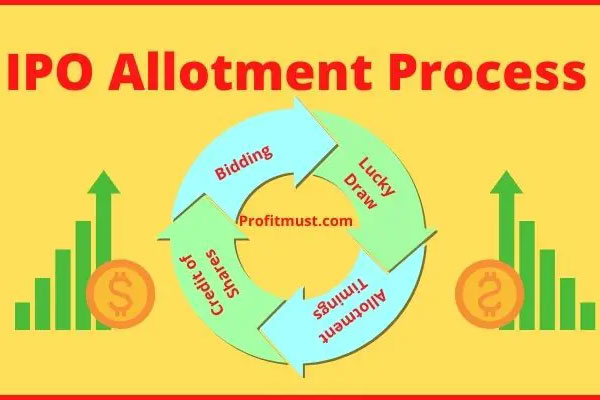

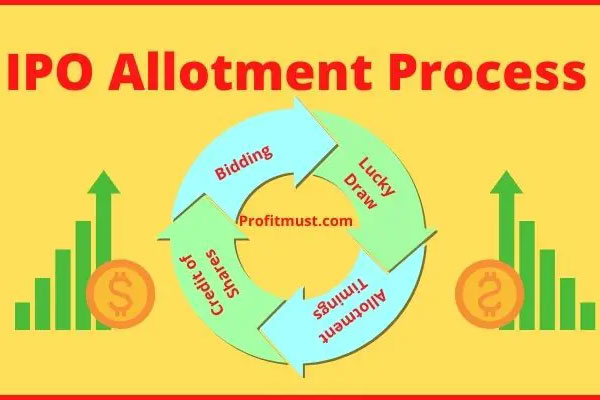

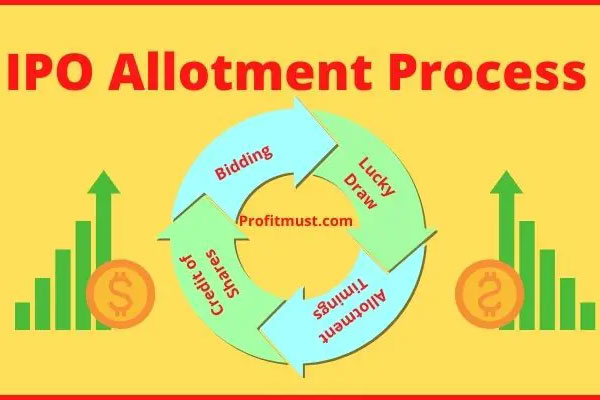

IPO Allotment Process

The allocation of shares in an IPO is typically handled by the underwriting investment banks. The banks will typically conduct a roadshow in which they

Selecting, Pitching and Convincing an Investment Bank to underwrite Your IPO

Selecting investment banks to underwrite an IPO is an important decision for a company, and there are several key considerations to keep in mind. Here

How important is the timing of an IPO, and what factors should a company consider when deciding when to go public?

The timing of an IPO can be critical for a company’s success. There are several factors a company should consider when deciding when to go

What are the regulatory requirements for a company to go public through an IPO?

In order to go public through an IPO, a company must meet certain regulatory requirements. These requirements are designed to protect investors and ensure that

What are some common mistakes to avoid when investing in an IPO?

Investing in an IPO can be a high-risk, high-reward proposition, and there are several common mistakes that investors should try to avoid. Here are a

How does an IPO affect the existing shareholders of a company?

An IPO can have both positive and negative effects on the existing shareholders of a company. On the positive side, an IPO can provide existing

Can anyone invest in an IPO?

Technically, anyone can invest in an IPO, as long as they meet the requirements set by the underwriters and the stock exchange where the IPO

What is the difference between a direct listing and an IPO?

A direct listing and an IPO are both ways for a company to become publicly traded, but they differ in several important ways. In an

What is the quiet period in an IPO?

The quiet period in an IPO is a period of time during which the company and its underwriters are prohibited from making public statements or

What is the lock-up period in an IPO?

The lock-up period is a period of time following an IPO during which certain shareholders are prohibited from selling their shares in the company imposed

What happens to a company’s stock after an IPO?

After an IPO, a company’s stock begins trading on a public stock market or exchange, and its price can rise or fall depending on a

How much money can a company raise through an IPO?

The amount of money a company can raise through an IPO depends on several factors, such as the number of shares being offered, the offering

How long does an IPO process typically take?

The duration of an IPO process can vary depending on a number of factors, such as the size of the offering, the complexity of the

What is the underwriting process in an IPO?

The underwriting process in an IPO involves the investment bank, or group of investment banks, acting as intermediaries between the company issuing the shares and

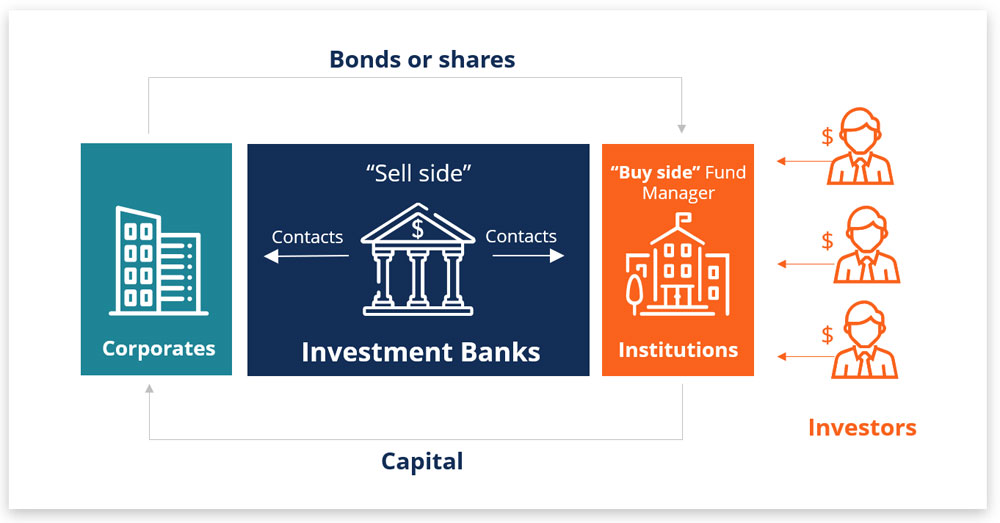

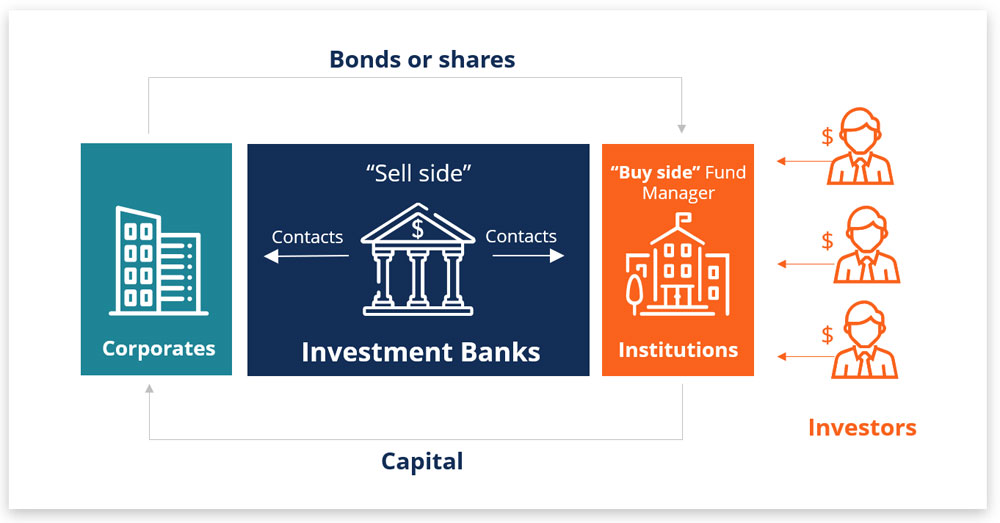

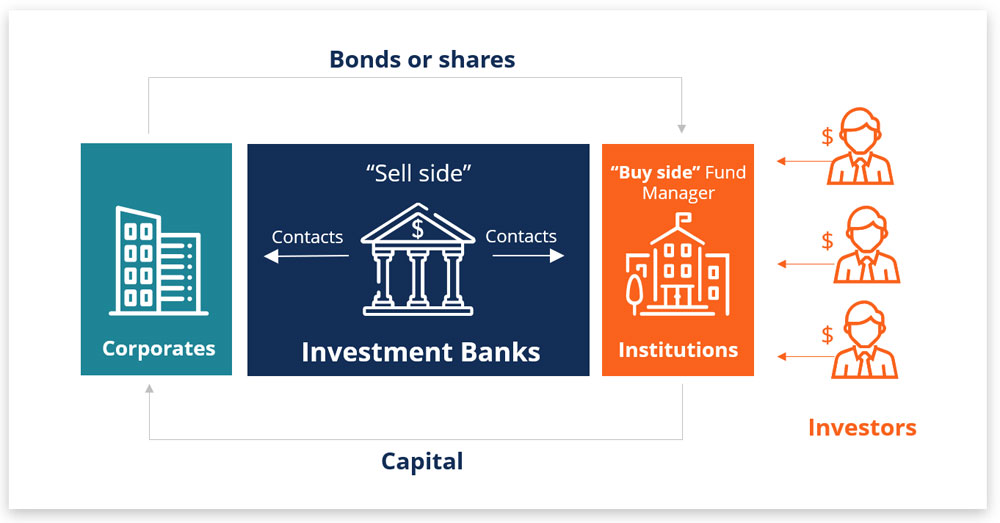

What is the role of investment banks in an IPO?

Investment banks play a crucial role in an IPO. They are hired by the company to help facilitate the offering and act as intermediaries between

Who sets the price of an IPO?

In an IPO, the price of the shares is determined by the underwriters, who are investment banks hired by the company to help facilitate the

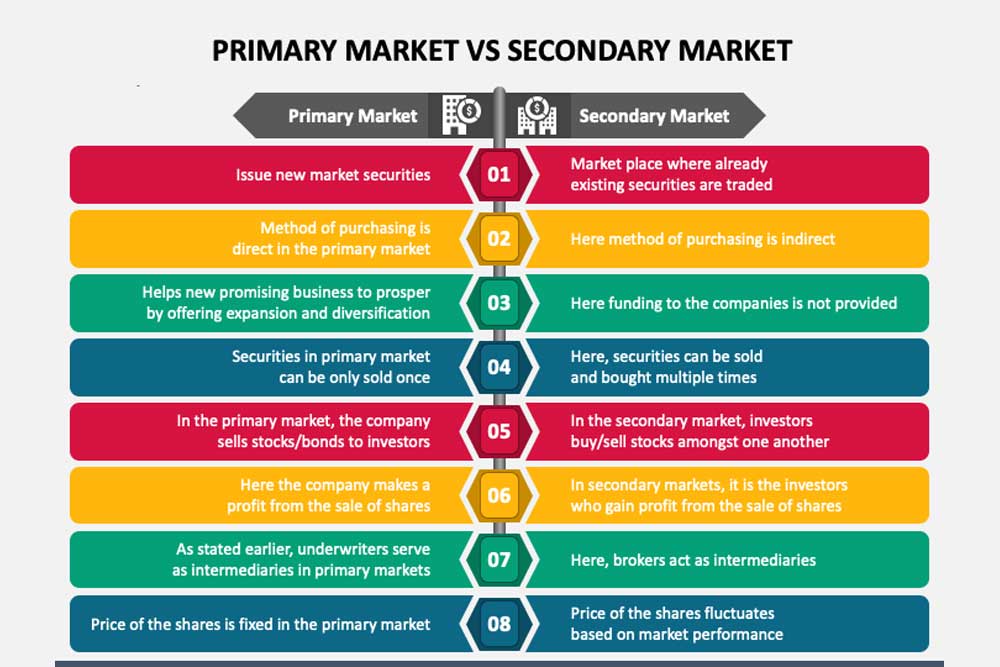

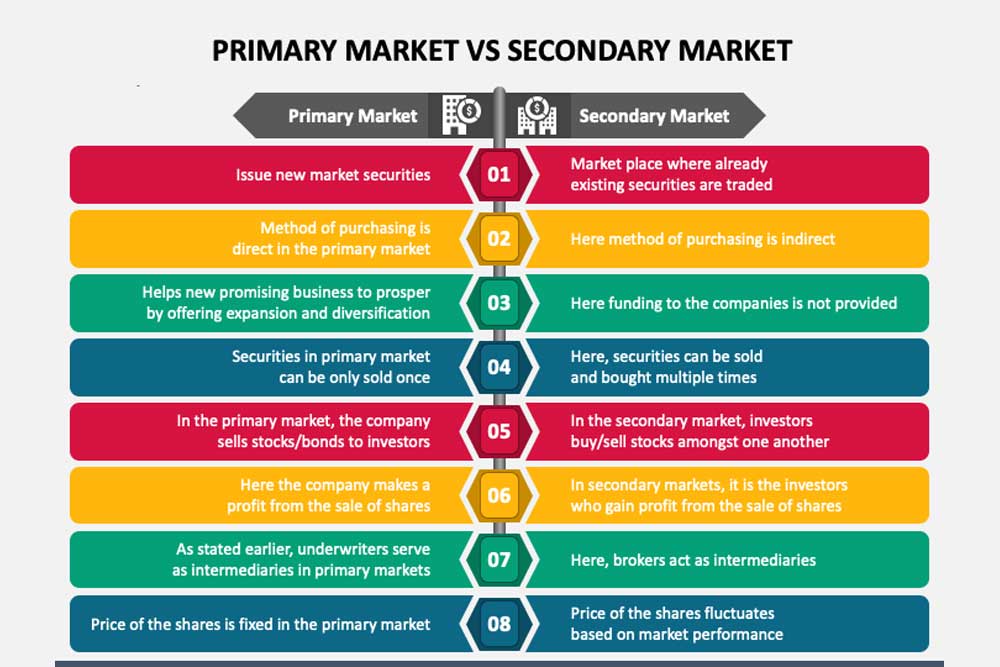

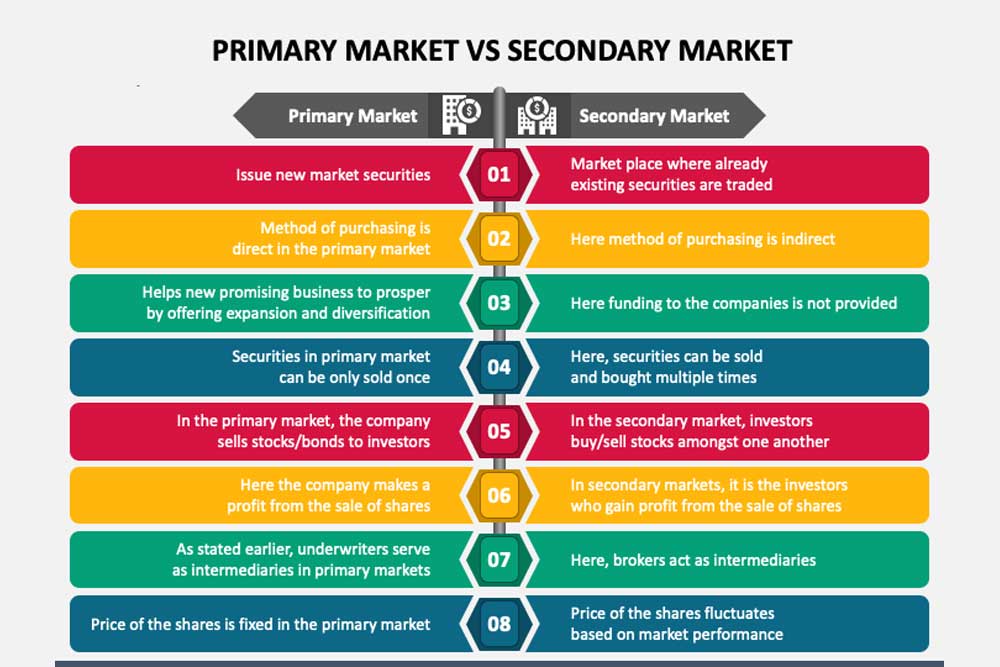

What is the difference between the primary market and the secondary market in an IPO?

In an IPO, the primary market and the secondary market play different roles. The primary market is where the shares of the newly listed company

How do you invest in an IPO?

Investing in an IPO typically involves the following steps: Research the company in the websites offering Pre-IPOs: Before investing in an IPO, it is important

What are the risks involved in investing in an IPO?

There are several risks involved in investing in an IPO: Uncertain valuations: The price at which an IPO is offered can be based on various

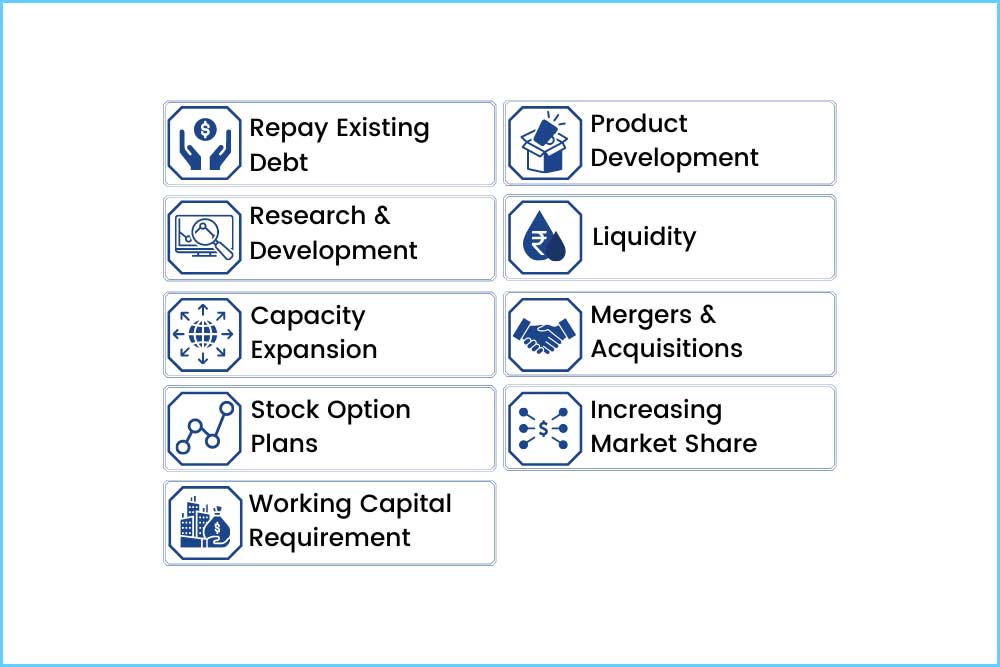

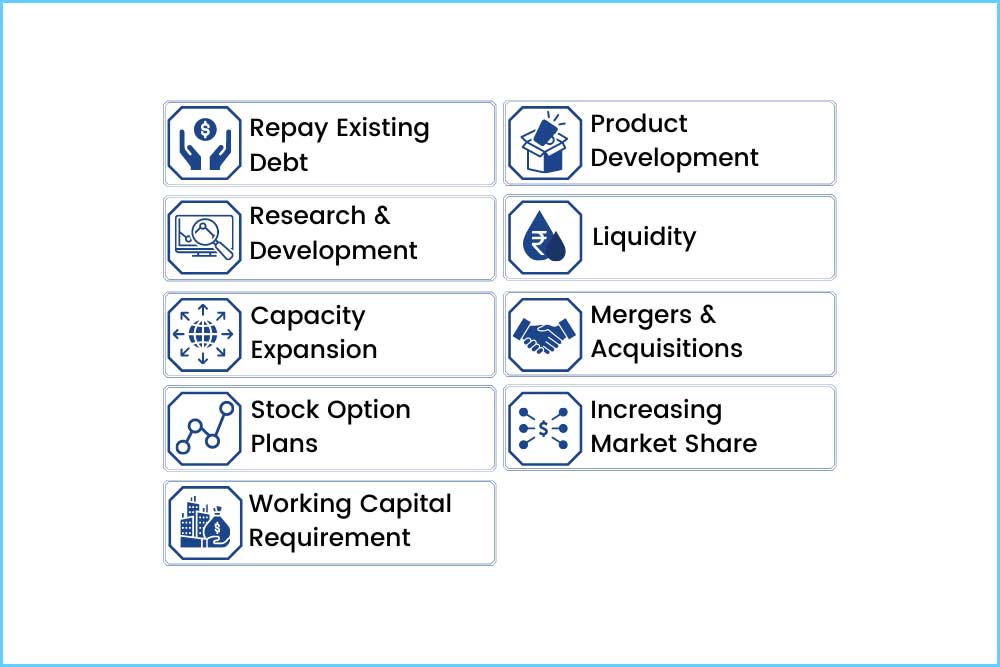

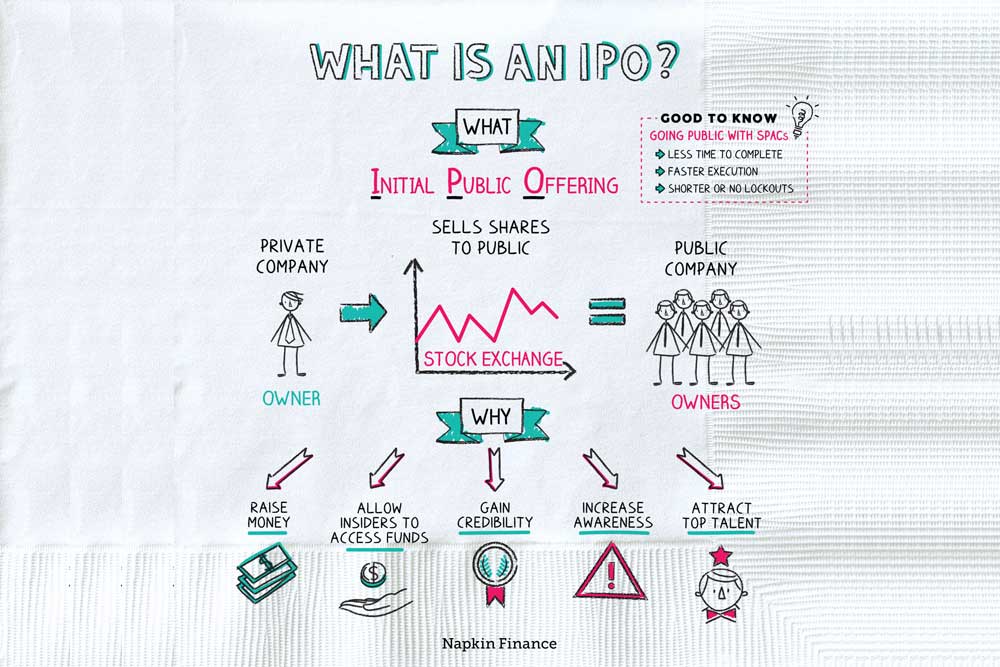

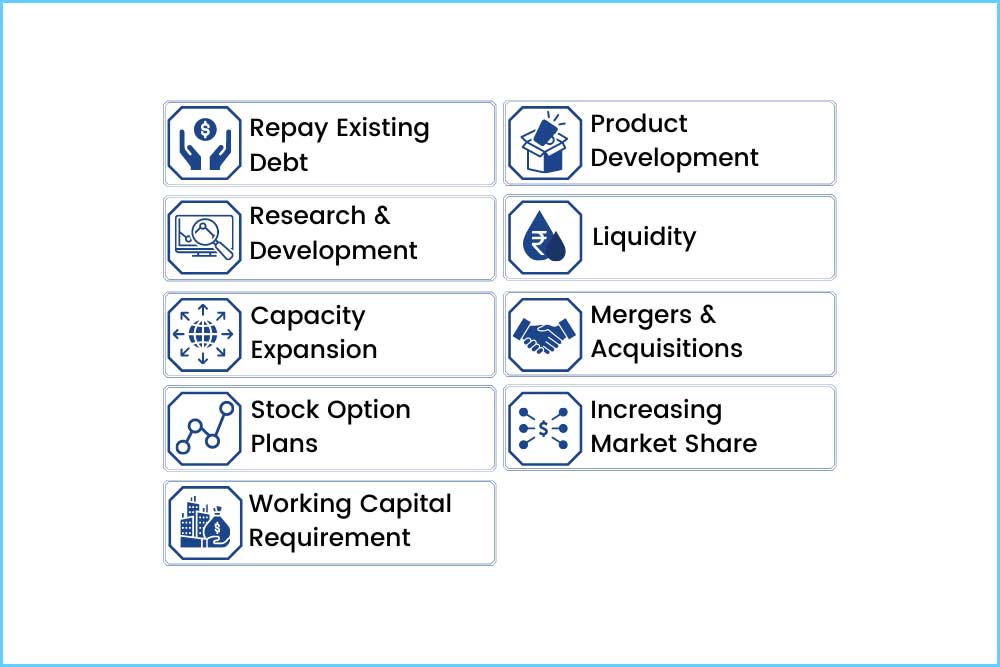

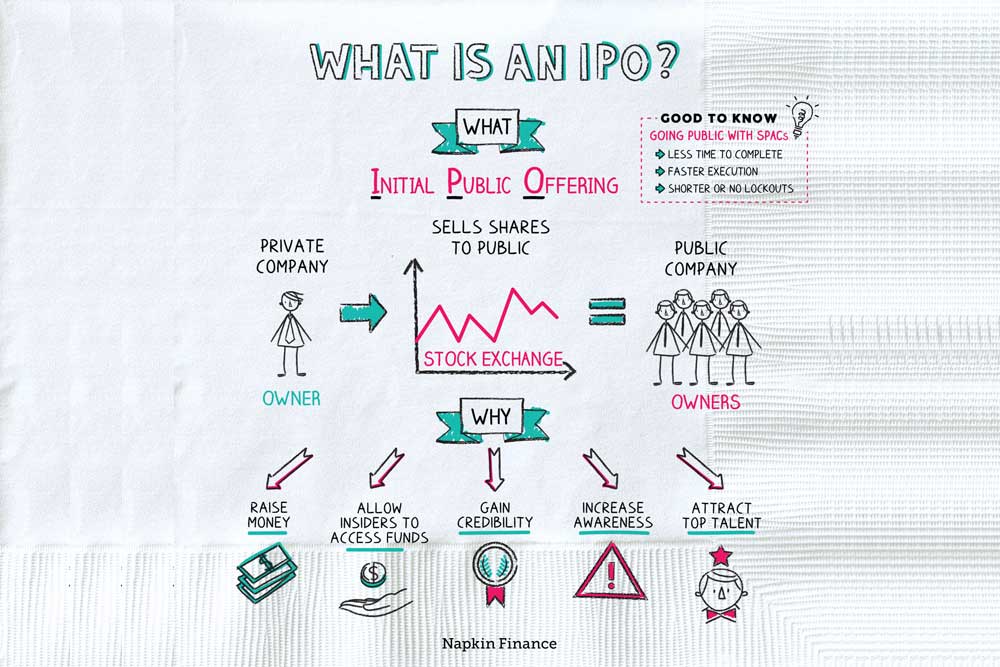

What are the benefits of going public through an IPO?

There are several benefits of going public through an IPO: Access to capital: Going public provides companies with access to a large pool of capital

Why do companies go public through an IPO ?

Companies go public through an IPO for several reasons: Capital raising: One of the main reasons for going public is to raise capital for the

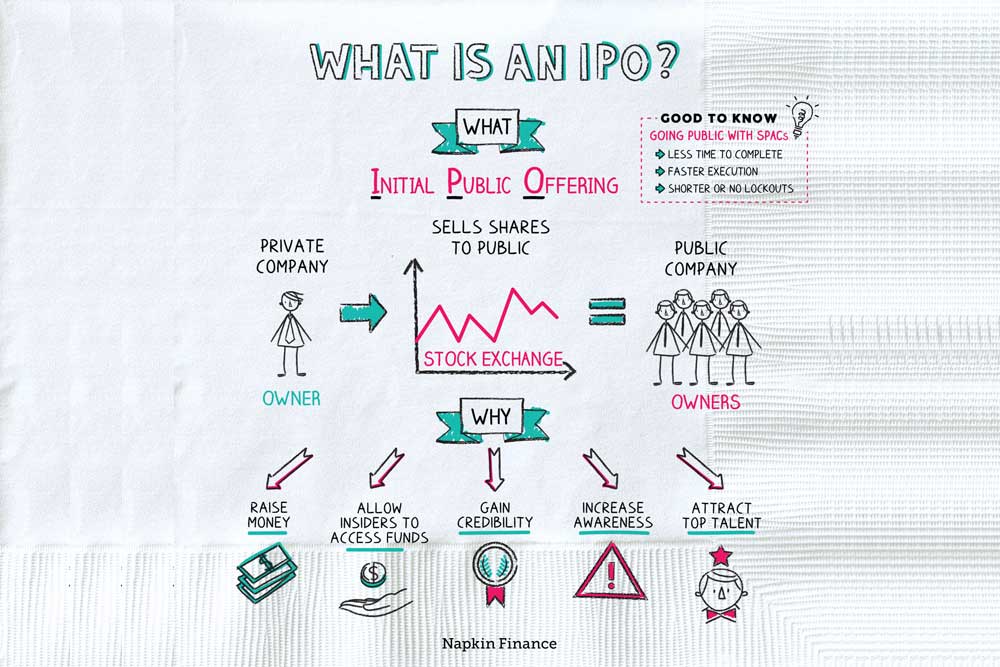

What is an IPO?

An IPO, or initial public offering, is a process by which a privately held company offers shares of its stock to the public for the

Shareholder’s or Partner’s Right of Compensation

Shareholder meetings are a cornerstone of corporate governance. These meetings enable shareholders to exercise their voting rights on significant matters concerning the company, such as

Loan in Bad Faith / Mala Fide

A loan in bad faith refers to a situation where a lender provides a loan to a borrower knowing that the borrower is unlikely to

The IPO Process – The Initial Public Offering Process

An Initial Public Offering (IPO) is a complex process that involves several steps and requires careful planning and preparation. The following are the general steps

Criteria to become an Expert

It should be noted that not only is the definition of the word Expert unclear, as noted in my previous articles on the subject, but that the criteria vary considerably from one branch of activity to another.

The IPO Organizational Meeting

Once your company has convinced the managing underwriters for the offering and wants to begin the IPO process in earnest, an organizational meeting with management,

The Benefits of an Initial Public Offering

Marc Deschenaux is the founder and managing partner of Deschenaux & Partners LLP. Throughout an illustrious career, he has been involved in 169 IPO’s and more than 240 private offerings.

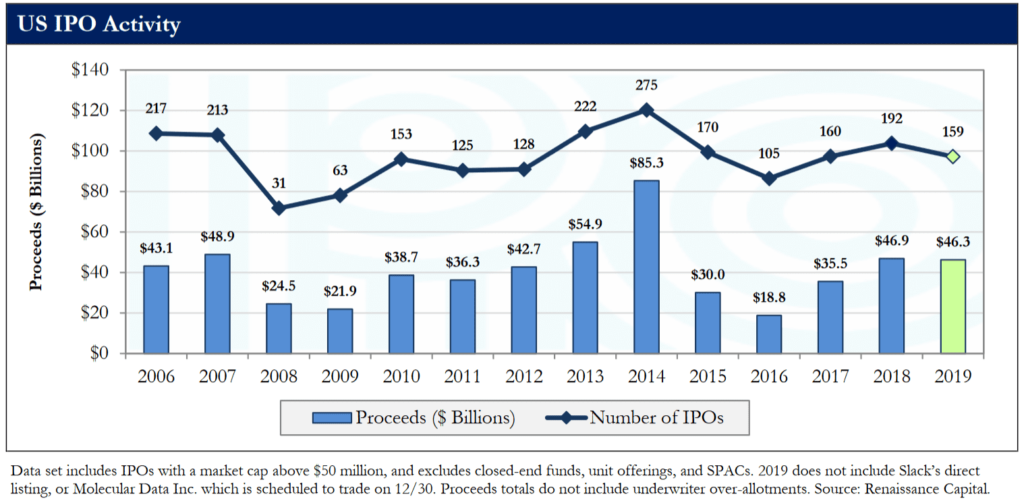

2019 IPO Market: Better Than the Headlines

The long-awaited debuts of mega unicorns Uber and Lyft were mega busts, capped off by WeWork’s kamikaze IPO attempt in September. But beyond these headline-grabbing

Private Financing

SHARES OF STOCK ISSUES I. GENERAL RULES AND CLASSIC FINANCING METHODS An entrepreneur or a company is looking to raise capital to undertake a project.

IPO Allotment

IPO Allotment is a process where the “registrar to the offer” with the help of a lottery system finalize the process of allocating the IPO

Pass-Through Securities

A pass-through security is backed by one or more income generating assets. A servicing intermediary collects the monthly payments from the issuer/s and, after deducting a fee, remits or passes them through

Weather SPAC

This SPAC’s theme is the Weather Industry. Today it is possible to make rain anywhere needed, without chemical products. Tomorrow this industry will be able

Water SPAC

This SPAC – Special Purpose Acquisition Corporation- focuses on all types of water supplies from drinking to industrial applications. Visit Website

Wall Street SPAC

a Special Purpose Acquisition Corporation- intends to expand Wall Street internationalisation both businesswise and culturally, to create merchandising thereto pertaining, to found a Wall Street

Visitor Info SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of companies providing visitor information around the world, to guide travelers to

Viet SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to develop foreign investments in Vietnam in the sectors of infrastructures, telecommunications, hotels and energy. It

Tourism SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of companies in the field of tourism who provide alternative spectacular ways

Tokens SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of tokens companies and to assembly them into a large multinational company.

Tech SPAC

This SPAC – Special Purpose Acquisition Corporation- is structured as a MasterSPAC in order to capture the difference of valuations between private and public equities

Swiss SPAC

Swiss inventions in technologies have always been at the leading edge of research. Due to the lack of risk capital in Switzerland these technologies are

Sport SPAC

This SPAC – Special Purpose Acquisition Corporation- intends to acquire spot teams, sport events and sport facilities and stadiums worldwide either already in activity or

Sponsor of SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to finance SPACs looking for Sponsors and unable to afford the large costs of their IPOs.

SPACs’ SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to incubate and develop themed SPACs already financed and thus transaction ready. Visit Website

SDG SPAC

The Sustainable Development Goals or Global Goals are a collection of 17 interlinked global goals designed to be a “blueprint to achieve a better and

Rain SPAC

This SPAC’s theme is the Precipitation technologies Industry as it is now possible to make rain anywhere needed, without chemical products. Visit Website

PreIPO SPAC

PreIPO stocks are distinguished from Private Equity stocks by the fact that an Initial Public Offering is underway. The IPO is not simply within the

Perfume SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire true perfume manufacturers and to consolidate them in the first perfume multinational company focused

Patent SPAC

This SPAC – Special Purpose Acquisition Corporation- aims at acquiring patents and managing their international licensing and distribution as well as securing the royalties collection

Oil SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire mobile oil refineries on boats to avoid oil leaks in the oceans. Visit Website

News SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to unite the emerging media world through the development of a media agency focusing on influencers,

Network SPAC

This SPAC aims at acquiring ownership or majority control of international product distribution companiess. Thereby it intends to create a global distribution network able to

Morocco SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to develop foreign investments in Morocco and to assist in exporting Moroccan goods and services worldwide.

Monkey SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to produce the first animal based reality show and to promote laughvest, a new kind of

MLM SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to focus on providing tools and services such as global accounts needed in the multilevel marketing

Mindfullness SPAC

Mindfulness – the practice of focusing on the present – is a growing trend within businesses. Leaders who provide mindfulness resources for their employees often

Media SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire medias of the new generation and to consolidate them into a modern global organization.

Magic SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to produce magic entertainment shows in castles and to turn them into an international magic productions

Luxury SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to develop environmentally conscious luxury brands answering modern lifestyle trends. Visit Website

Logistic SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire transportation vehicles in order to satisfy existing contracts and to capture large margins and

Life SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire, merge and consolidate life settlements insurance companies. Life settlement has been the booming and

Legal SPAC

This SPAC – Special Purpose Acquisition Corporation- is acquiring business law firms to consolidate them into an international corporation dealing with multinational companies and owning

Landowners SPAC

This SPAC – Special Purpose Acquisition Corporation- acquires large land properties and finances the project on them through Initial Public Offerings. Visit Website

Law SPAC

This SPAC – Special Purpose Acquisition Corporation- is acquiring litigation law firms to consolidate them into an international litigation organization dealing with across borders litigation

IPOs SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to finance companies ready for their Initial Public Offering but unable to afford its costs, thereby

IP SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of Intellecual Property companies and to consolidate them into a large Intellecual

Hollywood SPAC

The Major Studios need to consolidate to increase selling clout and accelerate cost savings. This is the right moment to acquire several studios and create

Health SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire health companies of all kinds, with the restriction that they have to supply natural

Heal SPAC

This SPAC – Special Purpose Acquisition Corporation- has the purpose of building a Health and Wellness group dealing exclusively in technics not recognized by the

H2O SPAC

The Water Technology sector provides top-quality water. In so doing it keeps pressure on the living environment as low as possible. Knowledge and technology developed

Green SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of green companies and to assembly them into a large multinational green

Golden Foam SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire and create brands of sparkling gin, rhum, tequila, vodka, whisky and liquors with lots

Funds SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire investment, pension and hedge funds of the same sector worldwide and to consolidate them

Food Tech SPAC

FoodTech can be defined as “the intersection between food and technology; the application of technology to improve agriculture and food production, the supply chain and

Foot SPAC

This SPAC aims at acquiring ownership or majority control of United States National Football League and World Major League Soccer clubs. Thereby it intends to

Financier SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire ownership of financing organizations and offer them an investment exit or divestment opportunity, through

Fashion SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire luxury fashion brands and targets especially family controled or owned brands. Visit Website

Family Offices Corp

Family Offices Corp is structuring, acquiring and restructuring family offices, implementing custom standard processes, organizing orderly successions and helping family offices improve their risk /

Event SPAC

This SPAC – Special Purpose Acquisition Corporation- acquires existing large events organization companies and develops new ones, restructures them and integrates them into a large

EV SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to finance and acquire Electric Vehicles manufactures and technologies, to use their synergies and to consolidate

Eiffel SPAC

This SPAC – Special Purpose Acquisition Corporation- has the purpose of keeping Gustave Eiffel’s legacy alive, to make it evolve into the 21st century and

Cryptos SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of cryptocurrencies companies and to assembly them into a large multinational company

Croatian Invest

This SPAC – Special Purpose Acquisition Corporation- is intended to develop foreign investments in Croatia and to assist in exporting Croatian goods and services worldwide.

Cosmetic SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire natural cosmetic technologies to create leading edge and non polluting products under both acquired

Cold Fusion SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of non-nuclear and natural cold fusion companies and to assembly them into

Cine SPAC

This SPAC – Special Purpose Acquisition Corporation- intends to establish new ways of producing international and emerging markets movies by providing complete film set technical

China SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to develop foreign investments in China and to assist in exporting Chinese goods and services worldwide.

Castle SPAC

This SPAC – Special Purpose Acquisition Corporation- acquires historic and landmark properties, restores them and reintegrates them in current life and activities by renting them

Camping SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of campings worldwide and consolidate them into an international corporation. Visit Website

Broadway SPAC

After the devastating effects of the pandemic crisis, Broadway theaters, production companies and artists need help. This is a good opportunity for a SPAC to

Bollywood SPAC

Tender Offer on the Major Bollywood Studios The Major Studios need to consolidate to increase selling clout and accelerate cost savings. This is the right

Bio Energie SPAC

This SPAC – Special Purpose Acquisition Corporation- intends to establish new new technologies in the bio energies field. Visit Website

Beau SPAC

This SPAC will be the one-stop shop assembling a large set of effective or fast Beauty Technologies and Anti-Aging Technologies, from cosmetic products to full

B/D SPAC

This SPAC – Special Purpose Acquisition Corporation- intends to acquire duly licensed broker/dealers internationally to setup the first worldwide securities distribution network of United States

Bank SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire local savings & loans and to turn them into an international business banking network

Mini SPAC

Introducing the SPAC at a reduced price by doing a Regulation A+ Issue instead of a Regulation S-1 or F-1 Initial Public Offering opening the

Master SPAC

New SPAC approach developed by Swiss Financiers which acquirers target underlying private companies by funding an IPO to execute the transaction. Visit Website

SPACs and Master SPACs

Special Purpose Acquisition Companies A SPAC is a public shell company created to acquire a private company and put it into the public markets. SPACs

What is a SPAC?

A Special Purpose Acquisition Company Is a public shell company created to acquire a private company and put it into the public markets. SPACs are

Financial Liquidity & Market Liquidity

The term “Liquidity” may seem straightforward at a glance, often mistakenly equated to the term cash in popular understanding. However, within the financial realm, its

Par Value Stock vs. No-Par Value Stock: An Overview

A share of stock in a company may have a par value or no-par value. These categories are both pretty much a historical oddity and

Work for Hire

In almost all jurisdictions, a work made for hire (work for hire or WFH) is a work created by an employee or a subcontractor as

The Wagons Theory applied to Initial Public Offerings (I.P.Os)

As discussed in my previous article “Is your company ready for an I.P.O. Initial Public Offering ?”, the main barriers preventing an IPO to happen

The Theory of Objects (a Summary)

The Theory of Objects was born from the conception of object-oriented programming but its use expanded from computers to business analysis in general thereby giving

The Costs of the Deal

Many businesspeople come to me to ask me help them close multimillion and sometimes multibillion deals. They are broke but in their mind, this is

The Securities Subscription Agreement

Definition The Subscription is a form of purchase agreement that differentiates itself from the classic purchase and sale agreement of securities, because it creates said

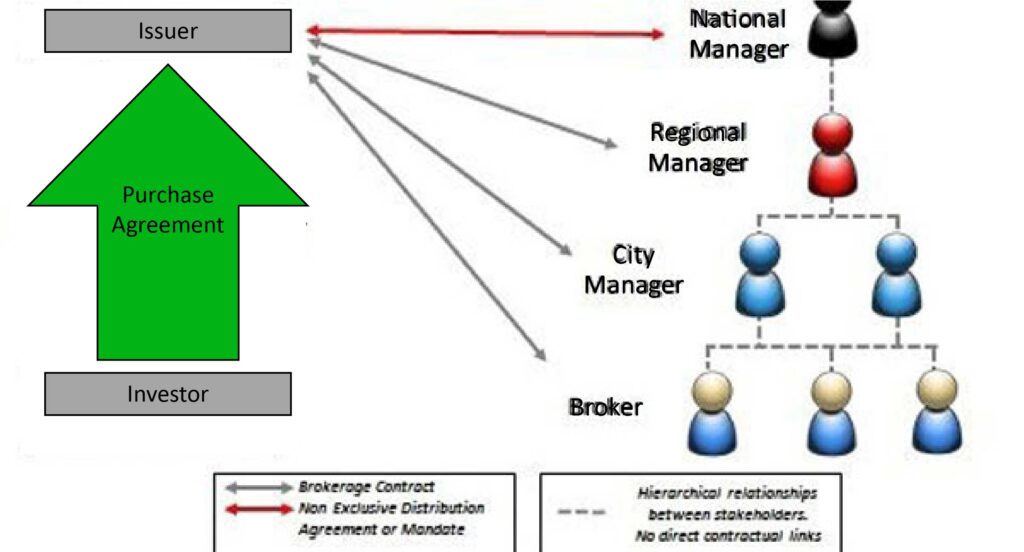

The Securities Brokerage Network

A company was just transformed into a Securities Issuer by Deschenaux Hornblower & Partners, LLP who prepared a Private Offering Memorandum describing its securities issue

Roadshow

The Roadshow is a presentation organized by an issuer of securities and the syndicate of brokers and investment banks underwriting an issue of securities, aiming

The Power of One or the Definition of Genius

This is a true story, just as it happened. In these times, Mohamed and I were spending our time in the Noga Hilton –today called

The Multilevel Brokerage Network

The Multilevel Brokerage Network (MBN) is a unique evolution in the realm of multilevel marketing networks. As the model can work both for the Busines-to-Business

The Matching Funds Process

The investment analysis, due diligence and selection processes tend to be long and expensive. These are the reasons why many investors try to avoid those

The Jurist or Non-Bar Lawyer under Swiss Law

The Definition of the word Jurist The word Jurist is of Latin origin: iuris, “right”. According to the spirit of Roman law, the jurist is

The Idea

Il a des idées sur tout, mais il a surtout des idées. Coluche He has ideas over all, but overall he only has ideas. Coluche

The Domino Effect

A domino effect or chain reaction is the cumulative effect produced when one event sets off a chain of similar events. The term is best known

The Cycle of the Action

Every action produces a reaction and a result which in turn produce repercussions. The child throws the ball (action) which pushes the air (reaction) which

The “simple” Solution to Inflation

Which currency is stable over time and not subject to inflation? None. The reason why is simple: Every currency is: A borrowing tool for the

Term Sheets

A Term Sheet is a non binding document outlining the terms and conditions of a transaction, a contract, or of an offering. A Term Sheet

Story for understanding music Neighboring Rights

Sequel to my article: Story for understanding music Copyrights As the music score is only the dna of a music work, Mr. Composer Author and

Little Story to Understand Authoring Rights

First, let’s understand authoring rights: Mr. Composer Author married Ms. Lyricist Author, and thus they became the Co-Author couple. Together, they embarked on the creative

Stock Quote Solidity and Breakpoint

When one sees a stock quote, especially when one possesses this stock, one always thinks that this price applies to its entire participation. Besides, is

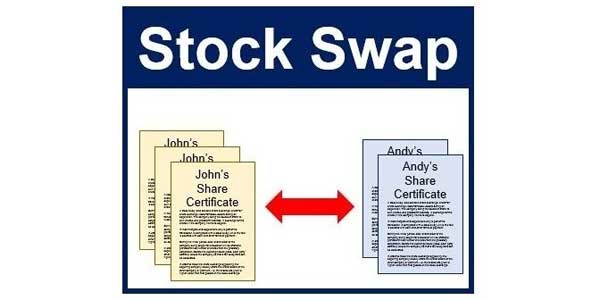

Stock Swap

When we organize the initial public offering of a foreign company in the United States, we usually need to make the foreign company become a

Secret, Confidentiality, Non Disclosure

The Secret originates from the law, either as attributed to a profession, then it will be called Professional Secret or as attributed to those who

Smart Contract

The smart contract is a small computer application simulating the operation of a contract: The manifestation of reciprocal and concordant wills, materialized by several valid

Relative Amount – Part 1: Probability Index

Principle The purpose of financial projections is to estimate the future performance of a particular issuer using the necessary assumptions in order to prepare the

Recognize a Manipulator

excerpt from Isabelle Nazare-Aga’s book “The manipulators are among us“. I have been hesitating a long time to publish an article where more than 80%

Private Equity Investment:

Where is the Exit, please?

Most entrepreneurs write their business plan as a shopping list and a description of how they intend to build their project. Except for themselves and

Private Equity Secondary Market (Private Equity Secondaries or Secondaries)

In finance, the private equity secondary market (also often called private equity secondaries secondaries) refers to the buying and selling of pre-existing investor commitments to private

Private Equity

In finance, private equity is a type of investment where the investor participates in the ownership of the company contrarily to a creditor or debt

Private Distribution of Securities

The distribution of shares of stock, of bonds or of any other sort of securities can be done in a private or public manner. Everywhere

Primary and Secondary Markets

Securities markets play a crucial role in the financial ecosystem by enabling capital allocation and investment. These markets are broadly categorized into primary and secondary

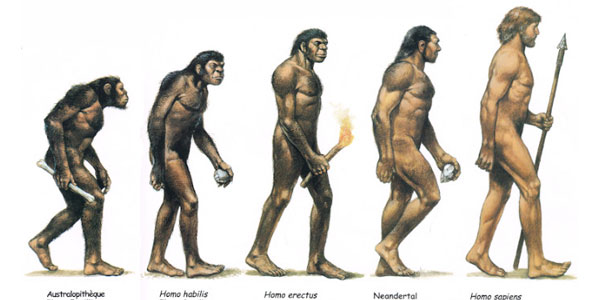

Prehistorical Finance

In the beginning of our story there was the homo putans (the thinking human being), the first prehistorical human who began to analyze and control

Parley – Talks – Powwow

The Parley or the pre-contractual stage is a phase preceding the negotiation of a contract. To prepare for the successful conclusion of a contract, two

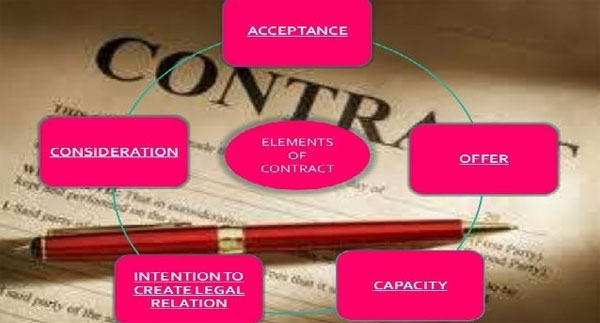

Offer and Acceptance

The offer must be precise and complete, it may be tacit, implied or express and can not be withdrawn before the fixed date or a

Mezzanine Financing

Mezzanine Financing or Mezzanine Capital refers to subordinated debt or preferred equity securities that often represent the most junior portion of a company’s capital structure, but that is still senior to the

Letter of Intent – L.O.I.

Definition A Letter Of Intent L.O.I. or LOI is different from a term sheet because whether binding or not, it expresses consent to certain terms, whether preliminary

Legal Engineering Tool: The Ownership Loop

From a legal standpoint, the owner is way too often liable of many things unknown to him or her. On several occasions, I have been

Is your company ready for an I.P.O. Initial Public Offering?

This question is always a topic of discussion among the various actors of and around the company, from the entrepreneur to the investment bankers, going

Investor’s Moods

Abstract from Investment Madness by John R. Nofsinger In order to operate in the financial markets, it is crucial to understand the investor’s psychology. Every

Investment Principle and Capital Raise

To invest money an investor asks the typical following questions: How much do You need in total for Your project ? How do I recover

Investment Exit or Disinvestment

Everyone talks about investing in private equity, especially the entrepreneur and the venture capitalist. But, the problem for the investor is less to invest than

Imaginary International Trade

The Grand Hotel Palace shone under the sun in the late afternoon. There was no crowd at that hour. The man who went there with

Icebreaking Method to Learn a New Language

It is always difficult to begin learning a new language. The term used by the specialists is clear: they refer to it as language barriers.

The Initial Public Offering – I.P.O. – IPO

The Initial Public Offering Definition The Initial Public Offering is the event defined as the first time that the shares of stock of a sstock

Perpetual Corporation

In this time of crisis, we systematically wonder about its causes, which are many. These include the low margins of the corporations arising from laws

How to get Financing ?

Financing is the act of finding solutions to bring to completion. By extension, the solution most often used being money, it represents the act of

How & Why an IPO – Initial Public Offering makes Money

Many entrepreneurs do not understand the reasons why the Initial Public Offering of a share of common stock (also known as “IPO “) makes money?

Gentlemen’s Agreement

A gentlemen’s agreement litterally agreement among gentlemen is an informal agreement between two or more parties. It can be written, oral, or implicit by communicating a non-verbal

From Cash Money Need to Private Capital

A company is in need of capital for any reason that it demonstrates can generate profits and amortize within a reasonable time frame. In the

Financing

Deriving from the word Finance, the definition of the word Financing is therefore the Act of finding solutions to carry out. By extension, the most

Finance, Economy, and Currency: A Journey Through Origins, Concepts, and Implications

Understanding the intricate dynamics of our global systems—whether in business, governance, or individual decision-making—requires a profound grasp of three fundamental concepts: Finance, Economy, and Currency.

Equity Dilution

Equity Dilution, also known as Stock Dilution or Share Dilution, is the decrease in percentage of existing shareholders’ ownership of a company as a result

Due Diligence

Definition Due Diligence is an English term used to describe all procedures that verify the situation and the verbal or written statements of a legal

Consent

In law of obligations, Consent is the act of pronouncing in favor of a legal act, in the broad sense, and especially of any convention,

Compliance, a Spy Pretext

Under the pretext of fighting against dirty money, banks mandated but also threatened by the financial authorities of governments, supported by duly enacted laws and

Capital Raise Timings or When shall we receive the money ?

How long will it take to raise the money we intend to raise?How long does it usually take to raise X million?When can you guarantee

Capital Acquisition Brokers: Regulation and Registration

In 2016 the U.S. Securities and Exchange Commission (SEC) approved the Financial Industry Regulatory Authority (FINRA) Rules relating to capital acquisition brokers (CABs).

Business Plan: a simple Financial Definition

A business plan is a document demonstrating the feasibility of a prospective new business and providing a roadmap for its first several years of operation.(Source:

Business Model: a simple Financial Definition

“In theory and practice, the term business model is used for a broad range of informal and formal descriptions to represent core aspects of a

Business Conceptualization

Conceptualization is the phase during which the Entrepreneur writes his ideas on paper to identify the concepts that will later layout the foundations of his

Breeding a Unicorn

In the world of business, Unicorn is the new jargon name given to start-up companies that will ideally create their market or become the market

Bid, Ask & Spread Definitions

I often heard the following question: How is it possible that the price of the Bid is higher than the price of Ask and no

Assumptions & Financial Projections

When an entrepreneur writes a business plan he generally finishes it with financial projections without explaining how s/he came up with these figures. Without reading

The “Agreement in Principle”

en collaboration avec Mademoiselle Wafa Essanhaji Notion arising from french law, the Agreement in Principle is one through which two or more parties stipulate only a

The Deal

At its most basic level, the term ‘deal‘ signifies a sense of agreement or consent in common parlance. Nevertheless, when we delve into the realm

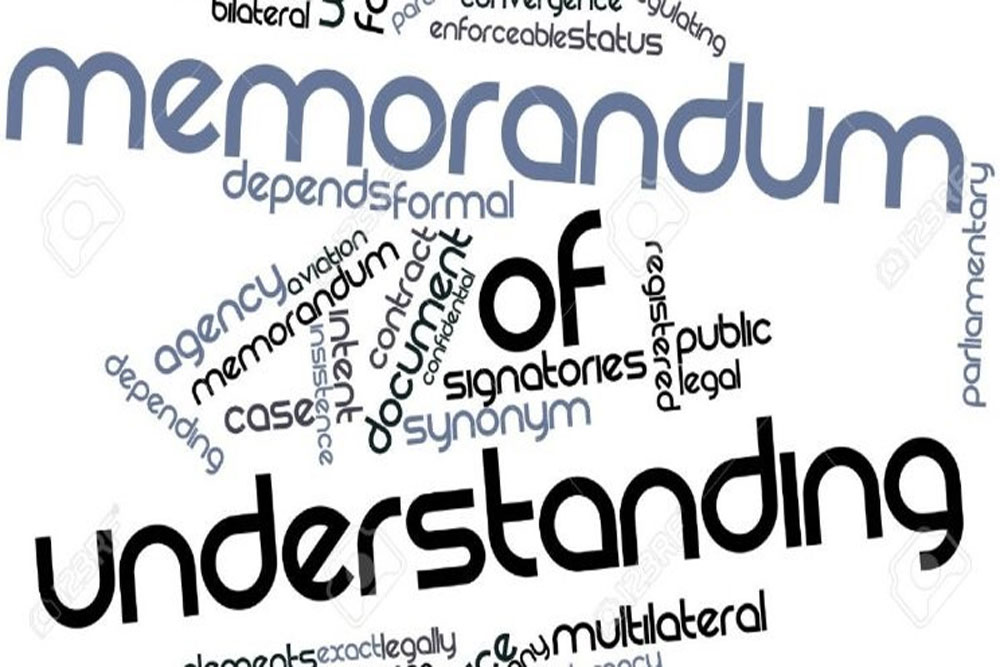

Memorandum of Understanding

A Memorandum of Understanding MoU describes a bilateral or multilateral agreement between two or more parties. It expresses a convergence of wills between the parties,

IdeaS for a Better World

Since birth, I never liked politics. Even when I joined a municipal elections candidates team at age 18, I have always considered politics like the

Usual Errors in the Business Plan

As many colleagues lawyers, investment bankers, business angels, venture capitalists and other members of the financial community, I look at business plans daily. In my

Necessary Evolution of the Law

Current definition By its very definition Law, is the set of legal, interpretative or directive provisions which, at a given time and in a specific

From an Idea to an Institution Phases of the Lifecycle of a Company

Idea The first milestone of the Lifecycle of a Company is having the Idea that will be the birth of the concept. For an idea

Michael Jackson’s Black Diamond Dice on auction by Deschenaux Hornblower & Partners LLP

Deschenaux Hornblower & Partners LLP are proud to annonce they were mandated by Premier Entertainment Inc. for selling The Black Diamond Dice, former property of

FUNDRAISING or IPO INCUBATOR A Modern Transaction Financing Tool

Problematic: A common problematic in business is: from the investor’s standpoint: how to invest for a short period of time and make a significant profit

Cascading Initial Public Offerings An application of The Theory of Wagons

Problematic: It is often difficult to raise the budget of an IPO (Initial Public Offering). Moreover, there is a widely held wrong belief that an

Charity IPO Charitable Initial Public Offering (IPO)

What would a Charity Initial Public Offering (IPO) look like? The idea is to raise a large amount of money in order to make a

The Area of Expertise

After the overview of the definitions of Expert and Expertise, let us approach that of the Domain of Expertise. But before entering into the content

Launch of the World Federation of International Experts Experts Without Borders

Press release For immediate releaseThe authorities and the courts are facing more and more complex issues, leading to an increased risk of error. In several

The Expertise

Definition Expertise means examining something with a view to its estimation, its evaluation. It is normally produced by an expert or by several experts (college

To Be or Not to be Expert: That is The Question

The need for experts has never been greater historically than it is today. Whether in a political, scientific, institutional, technological, urbanistic or judicial framework, everywhere,

Wealth Managers and Trustees: New Laws or the End of the Profane

aims to protect the clients of the financial service providers as well as to set comparable conditions for the provision of financial services offered by

U.S. Securities Markets Access Regulation

REGULATION A + Title IV of the JOBS Act, also known as Regulatory A + or Reg A +, represents a new form of securities

The Costs of the IPO – Initial Public Offering

An Initial Public Offering (IPO) is a significant event in the life of a company, marking its transition from a privately held organization to a

Standard Documentation of a Securities Issuer

After describing the Financing principle in a previous article, it is now time to describe the Standard Documentation of a Securities Issuer but I feel

Shareholders’ Agreement

In most jurisdictions, the only real obligation of the shareholder is to release the subscription amount of his participation, that is, to pay it. If

Momentum

Initialement, le Momentum désignait un facteur d’analyse technique utilisé par les intervenants en bourse. À l’instar d’autres indicateurs techniques, il donne des signaux d’achat ou

Ways of Going Public to the Stock Market

Comparison with Water Have you played with a waterspout in the garden when you were a kid ? If so, then you surely put your

The Protocol of Agreement

The Protocol of Agreement is: an act under private seal, between natural or legal persons,or a public or international act between subjects of public law

3 Total posts in “Intellectual Property”:

Alice Corp. v. CLS Bank (2014): Decision and Impact on Patent Eligibility with help of ChatGPT

Background: Alice Corp. v. CLS Bank International was a landmark 2014 U.S. Supreme Court case addressing whether certain computer-implemented financial trading schemes…

Process Patents vs. Business Method Patents with the help of ChatGPT

In U.S. patent law, an invention can take different forms – it might be a product, a machine, a composition of matter, or a process.

Difference between a Pending or Issued Patent

The world of intellectual property can be complex, with various terms and processes that may seem daunting to those who are not familiar with them…

54 Total posts in “IPO”:

The Role of the Transfer Agent in the IPO

Initial Public Offerings (IPOs) are complex financial events that mark a significant milestone for companies seeking to raise capital by transitioning from private to public

The Role of the FINRA in the IPO Process

The Initial Public Offering (IPO) represents a significant milestone in a company’s growth, symbolizing its transition from a private entity to a publicly traded corporation.

The Role of the U.S. Securities & Exchange Commission in the IPO Process

The Initial Public Offering (IPO) is a transformative milestone for private companies looking to raise capital by offering shares to the public for the first

The Allocation of Shares in the IPO

Initial Public Offerings (IPOs) mark a significant milestone for a company transitioning from private to public ownership. For investors, IPOs represent an opportunity to invest

The IPO “Quiet Period” under U.S. Securities Law

Introduction The “quiet period” is a fundamental concept under U.S. securities law that governs communications by companies, underwriters, and insiders during the process of an

Definition of a Passthrough Security

This article was written for Investopedia By TROY SEGAL updated May 29, 2020 and reviewed by GORDON SCOTT. I reproduce it here because it is

Development Stages of a Film

The development of a movie typically follows several key stages, each of which is crucial to the successful creation and release of the film. Below

TruePreIPO™ Certification

The IPO Institute, a globally recognized authority in financial certifications, has recently introduced the “True PreIPO™” certification. This certification aims to distinguish legitimate pre-initial public

IPO Cascade – Cascade of Initial Public Offerings

The IPO Cascade is a patented process conceived by Marc Deschenaux and licensed exclusively to Market Street Capital Inc. A Company willing to issue equity

Controlled Failure

I. A Strategic Masterstroke in Equity Financing In the ever-evolving sphere of financial markets, every so often, there emerges a pioneering concept that disrupts traditional

Duration of Equity Fundraising

Fundraising is a critical activity in the life cycle of a business. It not only provides the necessary capital to initiate operations but also supports

What is the role of the REGISTRAR in an IPO, and what services do they provide?

In an IPO, the Registrar plays an important role as a key intermediary between the company going public and its investors. Here are some of

IPO Challenges, Pitfalls & Mitigation

The IPO process can be complex and challenging for companies, and there are several pitfalls that can arise along the way. Here are some common

How do the risks associated with an IPO compare to those associated with other forms of financing, such as private equity or debt financing?

The risks associated with an IPO can be different from those associated with other forms of financing, such as private equity or debt financing. One

How can companies prepare for the ongoing reporting and disclosure requirements after an IPO, and what are the key requirements for maintaining compliance with securities laws?

Companies can prepare for ongoing reporting and disclosure requirements after an initial public offering (IPO) by implementing effective corporate governance practices, developing strong internal controls,

Stock / Share Transfer Agent

A transfer agent plays an important role in an initial public offering (IPO) by serving as an intermediary between a company going public and its

How is the lock-up period determined, and what are the implications of the lock-up period for investors and the company?

The lock-up period is determined by the underwriters of the Initial Public Offering (IPO) and is agreed upon between the underwriters and the company. The

What is the process of stabilizing the price of shares in an IPO, and what are the rules and restrictions on stabilization activities?

Stabilizing the price of shares in an initial public offering (IPO) is the process of supporting the share price in the secondary market during the

IPO Pricing and Shares Offered Dynamics

The market reaction to an Initial Public Offering (IPO) is typically assessed by measuring the performance of the shares in the aftermarket. The aftermarket refers

Underwriting

What is the role of the syndicate in an IPO, and how are the roles and responsibilities of the lead underwriter and other underwriters determined?

Underwriting Structure & Fees

The fees for underwriting an Initial Public Offering (IPO) are typically structured as a percentage of the total amount raised through the IPO. This fee

What is the difference between a firm commitment underwriting and a best efforts underwriting, and what are the advantages and disadvantages of each approach?

Firm commitment underwriting is when the underwriter agrees to purchase all the securities being issued by the issuer and then resell them to investors. In

Bookbuilding process, and how is it used to determine pricing and allotment in an IPO?

The bookbuilding process is a mechanism used by investment banks to determine the demand for shares in an initial public offering (IPO) and set an

Filing and IPO Registration Statement & Prospectus

Filing an IPO registration statement is a complex process that involves several steps. Here are the key components: Selection of underwriters: The company selects one

What is the role of the Securities and Exchange Commission (SEC) in the IPO process?

Overview The Securities and Exchange Commission (SEC) plays a crucial role in the IPO process. It is the primary regulator of the securities markets in

How are the securities laws and regulations relevant to an IPO, and what is the process of obtaining regulatory approvals?

The securities laws and regulations are highly relevant to an IPO. The primary law that governs IPOs in the United States is the Securities Act

IPO Allotment Process

The allocation of shares in an IPO is typically handled by the underwriting investment banks. The banks will typically conduct a roadshow in which they

Selecting, Pitching and Convincing an Investment Bank to underwrite Your IPO

Selecting investment banks to underwrite an IPO is an important decision for a company, and there are several key considerations to keep in mind. Here

How important is the timing of an IPO, and what factors should a company consider when deciding when to go public?

The timing of an IPO can be critical for a company’s success. There are several factors a company should consider when deciding when to go

What are the regulatory requirements for a company to go public through an IPO?

In order to go public through an IPO, a company must meet certain regulatory requirements. These requirements are designed to protect investors and ensure that

What are some common mistakes to avoid when investing in an IPO?

Investing in an IPO can be a high-risk, high-reward proposition, and there are several common mistakes that investors should try to avoid. Here are a

How does an IPO affect the existing shareholders of a company?

An IPO can have both positive and negative effects on the existing shareholders of a company. On the positive side, an IPO can provide existing

Can anyone invest in an IPO?

Technically, anyone can invest in an IPO, as long as they meet the requirements set by the underwriters and the stock exchange where the IPO

What is the difference between a direct listing and an IPO?

A direct listing and an IPO are both ways for a company to become publicly traded, but they differ in several important ways. In an

What is the quiet period in an IPO?

The quiet period in an IPO is a period of time during which the company and its underwriters are prohibited from making public statements or

What is the lock-up period in an IPO?

The lock-up period is a period of time following an IPO during which certain shareholders are prohibited from selling their shares in the company imposed

What happens to a company’s stock after an IPO?

After an IPO, a company’s stock begins trading on a public stock market or exchange, and its price can rise or fall depending on a

How much money can a company raise through an IPO?

The amount of money a company can raise through an IPO depends on several factors, such as the number of shares being offered, the offering

How long does an IPO process typically take?

The duration of an IPO process can vary depending on a number of factors, such as the size of the offering, the complexity of the

What is the underwriting process in an IPO?

The underwriting process in an IPO involves the investment bank, or group of investment banks, acting as intermediaries between the company issuing the shares and

What is the role of investment banks in an IPO?

Investment banks play a crucial role in an IPO. They are hired by the company to help facilitate the offering and act as intermediaries between

Who sets the price of an IPO?

In an IPO, the price of the shares is determined by the underwriters, who are investment banks hired by the company to help facilitate the

What is the difference between the primary market and the secondary market in an IPO?

In an IPO, the primary market and the secondary market play different roles. The primary market is where the shares of the newly listed company

How do you invest in an IPO?

Investing in an IPO typically involves the following steps: Research the company in the websites offering Pre-IPOs: Before investing in an IPO, it is important

What are the risks involved in investing in an IPO?

There are several risks involved in investing in an IPO: Uncertain valuations: The price at which an IPO is offered can be based on various

What are the benefits of going public through an IPO?

There are several benefits of going public through an IPO: Access to capital: Going public provides companies with access to a large pool of capital

Why do companies go public through an IPO ?

Companies go public through an IPO for several reasons: Capital raising: One of the main reasons for going public is to raise capital for the

What is an IPO?

An IPO, or initial public offering, is a process by which a privately held company offers shares of its stock to the public for the

The IPO Organizational Meeting

Once your company has convinced the managing underwriters for the offering and wants to begin the IPO process in earnest, an organizational meeting with management,

Financing IPO Costs through Debt

Swiss Financiers has developed solutions to support businesses that are seeking a listing. Candidate companies are appraised to assess eligibility. We take on mandates that

Financing the IPO costs through Equity

Taking a company public demands a certain amount of disposable cash that often is considered a high barrier to entry. By using Swiss Financiers proprietary

Is your company ready for an I.P.O. Initial Public Offering?

This question is always a topic of discussion among the various actors of and around the company, from the entrepreneur to the investment bankers, going

How & Why an IPO – Initial Public Offering makes Money

Many entrepreneurs do not understand the reasons why the Initial Public Offering of a share of common stock (also known as “IPO “) makes money?

The Costs of the IPO – Initial Public Offering

An Initial Public Offering (IPO) is a significant event in the life of a company, marking its transition from a privately held organization to a

22 Total posts in “IPO Basic”:

TruePreIPO™ Certification

The IPO Institute, a globally recognized authority in financial certifications, has recently introduced the “True PreIPO™” certification. This certification aims to distinguish legitimate pre-initial public

Controlled Failure

I. A Strategic Masterstroke in Equity Financing In the ever-evolving sphere of financial markets, every so often, there emerges a pioneering concept that disrupts traditional

Duration of Equity Fundraising

Fundraising is a critical activity in the life cycle of a business. It not only provides the necessary capital to initiate operations but also supports

What are some common mistakes to avoid when investing in an IPO?

Investing in an IPO can be a high-risk, high-reward proposition, and there are several common mistakes that investors should try to avoid. Here are a

How does an IPO affect the existing shareholders of a company?

An IPO can have both positive and negative effects on the existing shareholders of a company. On the positive side, an IPO can provide existing

Can anyone invest in an IPO?

Technically, anyone can invest in an IPO, as long as they meet the requirements set by the underwriters and the stock exchange where the IPO

What is the difference between a direct listing and an IPO?

A direct listing and an IPO are both ways for a company to become publicly traded, but they differ in several important ways. In an

What is the quiet period in an IPO?

The quiet period in an IPO is a period of time during which the company and its underwriters are prohibited from making public statements or

What is the lock-up period in an IPO?

The lock-up period is a period of time following an IPO during which certain shareholders are prohibited from selling their shares in the company imposed

What happens to a company’s stock after an IPO?

After an IPO, a company’s stock begins trading on a public stock market or exchange, and its price can rise or fall depending on a

How much money can a company raise through an IPO?

The amount of money a company can raise through an IPO depends on several factors, such as the number of shares being offered, the offering

How long does an IPO process typically take?

The duration of an IPO process can vary depending on a number of factors, such as the size of the offering, the complexity of the

What is the underwriting process in an IPO?

The underwriting process in an IPO involves the investment bank, or group of investment banks, acting as intermediaries between the company issuing the shares and

What is the role of investment banks in an IPO?

Investment banks play a crucial role in an IPO. They are hired by the company to help facilitate the offering and act as intermediaries between

Who sets the price of an IPO?

In an IPO, the price of the shares is determined by the underwriters, who are investment banks hired by the company to help facilitate the

What is the difference between the primary market and the secondary market in an IPO?

In an IPO, the primary market and the secondary market play different roles. The primary market is where the shares of the newly listed company

How do you invest in an IPO?

Investing in an IPO typically involves the following steps: Research the company in the websites offering Pre-IPOs: Before investing in an IPO, it is important

What are the risks involved in investing in an IPO?

There are several risks involved in investing in an IPO: Uncertain valuations: The price at which an IPO is offered can be based on various

What are the benefits of going public through an IPO?

There are several benefits of going public through an IPO: Access to capital: Going public provides companies with access to a large pool of capital

Why do companies go public through an IPO ?

Companies go public through an IPO for several reasons: Capital raising: One of the main reasons for going public is to raise capital for the

What is an IPO?

An IPO, or initial public offering, is a process by which a privately held company offers shares of its stock to the public for the

The IPO Organizational Meeting

Once your company has convinced the managing underwriters for the offering and wants to begin the IPO process in earnest, an organizational meeting with management,

3 Total posts in “IPO Cost”:

Financing IPO Costs through Debt

Swiss Financiers has developed solutions to support businesses that are seeking a listing. Candidate companies are appraised to assess eligibility. We take on mandates that

Financing the IPO costs through Equity

Taking a company public demands a certain amount of disposable cash that often is considered a high barrier to entry. By using Swiss Financiers proprietary

The Costs of the IPO – Initial Public Offering

An Initial Public Offering (IPO) is a significant event in the life of a company, marking its transition from a privately held organization to a

21 Total posts in “IPO Pro”:

Controlled Failure

I. A Strategic Masterstroke in Equity Financing In the ever-evolving sphere of financial markets, every so often, there emerges a pioneering concept that disrupts traditional

What is the role of the REGISTRAR in an IPO, and what services do they provide?

In an IPO, the Registrar plays an important role as a key intermediary between the company going public and its investors. Here are some of

IPO Challenges, Pitfalls & Mitigation

The IPO process can be complex and challenging for companies, and there are several pitfalls that can arise along the way. Here are some common

How do the risks associated with an IPO compare to those associated with other forms of financing, such as private equity or debt financing?

The risks associated with an IPO can be different from those associated with other forms of financing, such as private equity or debt financing. One

How can companies prepare for the ongoing reporting and disclosure requirements after an IPO, and what are the key requirements for maintaining compliance with securities laws?

Companies can prepare for ongoing reporting and disclosure requirements after an initial public offering (IPO) by implementing effective corporate governance practices, developing strong internal controls,

Stock / Share Transfer Agent

A transfer agent plays an important role in an initial public offering (IPO) by serving as an intermediary between a company going public and its

How is the lock-up period determined, and what are the implications of the lock-up period for investors and the company?

The lock-up period is determined by the underwriters of the Initial Public Offering (IPO) and is agreed upon between the underwriters and the company. The

What is the process of stabilizing the price of shares in an IPO, and what are the rules and restrictions on stabilization activities?

Stabilizing the price of shares in an initial public offering (IPO) is the process of supporting the share price in the secondary market during the

IPO Pricing and Shares Offered Dynamics

The market reaction to an Initial Public Offering (IPO) is typically assessed by measuring the performance of the shares in the aftermarket. The aftermarket refers

Underwriting

What is the role of the syndicate in an IPO, and how are the roles and responsibilities of the lead underwriter and other underwriters determined?

Underwriting Structure & Fees

The fees for underwriting an Initial Public Offering (IPO) are typically structured as a percentage of the total amount raised through the IPO. This fee

What is the difference between a firm commitment underwriting and a best efforts underwriting, and what are the advantages and disadvantages of each approach?

Firm commitment underwriting is when the underwriter agrees to purchase all the securities being issued by the issuer and then resell them to investors. In

Bookbuilding process, and how is it used to determine pricing and allotment in an IPO?

The bookbuilding process is a mechanism used by investment banks to determine the demand for shares in an initial public offering (IPO) and set an

Filing and IPO Registration Statement & Prospectus

Filing an IPO registration statement is a complex process that involves several steps. Here are the key components: Selection of underwriters: The company selects one

What is the role of the Securities and Exchange Commission (SEC) in the IPO process?

Overview The Securities and Exchange Commission (SEC) plays a crucial role in the IPO process. It is the primary regulator of the securities markets in

How are the securities laws and regulations relevant to an IPO, and what is the process of obtaining regulatory approvals?

The securities laws and regulations are highly relevant to an IPO. The primary law that governs IPOs in the United States is the Securities Act

IPO Allotment Process

The allocation of shares in an IPO is typically handled by the underwriting investment banks. The banks will typically conduct a roadshow in which they

Selecting, Pitching and Convincing an Investment Bank to underwrite Your IPO

Selecting investment banks to underwrite an IPO is an important decision for a company, and there are several key considerations to keep in mind. Here

How important is the timing of an IPO, and what factors should a company consider when deciding when to go public?

The timing of an IPO can be critical for a company’s success. There are several factors a company should consider when deciding when to go

What are the regulatory requirements for a company to go public through an IPO?

In order to go public through an IPO, a company must meet certain regulatory requirements. These requirements are designed to protect investors and ensure that

Is your company ready for an I.P.O. Initial Public Offering?

This question is always a topic of discussion among the various actors of and around the company, from the entrepreneur to the investment bankers, going

1 Total posts in “Languages”:

Icebreaking Method to Learn a New Language

It is always difficult to begin learning a new language. The term used by the specialists is clear: they refer to it as language barriers.

64 Total posts in “SPAC”:

Weather SPAC

This SPAC’s theme is the Weather Industry. Today it is possible to make rain anywhere needed, without chemical products. Tomorrow this industry will be able

Water SPAC

This SPAC – Special Purpose Acquisition Corporation- focuses on all types of water supplies from drinking to industrial applications. Visit Website

Wall Street SPAC

a Special Purpose Acquisition Corporation- intends to expand Wall Street internationalisation both businesswise and culturally, to create merchandising thereto pertaining, to found a Wall Street

Visitor Info SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of companies providing visitor information around the world, to guide travelers to

Viet SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to develop foreign investments in Vietnam in the sectors of infrastructures, telecommunications, hotels and energy. It

Tourism SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of companies in the field of tourism who provide alternative spectacular ways

Tokens SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of tokens companies and to assembly them into a large multinational company.

Tech SPAC

This SPAC – Special Purpose Acquisition Corporation- is structured as a MasterSPAC in order to capture the difference of valuations between private and public equities

Swiss SPAC

Swiss inventions in technologies have always been at the leading edge of research. Due to the lack of risk capital in Switzerland these technologies are

Sport SPAC

This SPAC – Special Purpose Acquisition Corporation- intends to acquire spot teams, sport events and sport facilities and stadiums worldwide either already in activity or

Sponsor of SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to finance SPACs looking for Sponsors and unable to afford the large costs of their IPOs.

SPACs’ SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to incubate and develop themed SPACs already financed and thus transaction ready. Visit Website

SDG SPAC

The Sustainable Development Goals or Global Goals are a collection of 17 interlinked global goals designed to be a “blueprint to achieve a better and

Rain SPAC

This SPAC’s theme is the Precipitation technologies Industry as it is now possible to make rain anywhere needed, without chemical products. Visit Website

PreIPO SPAC

PreIPO stocks are distinguished from Private Equity stocks by the fact that an Initial Public Offering is underway. The IPO is not simply within the

Perfume SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire true perfume manufacturers and to consolidate them in the first perfume multinational company focused

Patent SPAC

This SPAC – Special Purpose Acquisition Corporation- aims at acquiring patents and managing their international licensing and distribution as well as securing the royalties collection

Oil SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire mobile oil refineries on boats to avoid oil leaks in the oceans. Visit Website

News SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to unite the emerging media world through the development of a media agency focusing on influencers,

Network SPAC

This SPAC aims at acquiring ownership or majority control of international product distribution companiess. Thereby it intends to create a global distribution network able to

Morocco SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to develop foreign investments in Morocco and to assist in exporting Moroccan goods and services worldwide.

Monkey SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to produce the first animal based reality show and to promote laughvest, a new kind of

MLM SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to focus on providing tools and services such as global accounts needed in the multilevel marketing

Mindfullness SPAC

Mindfulness – the practice of focusing on the present – is a growing trend within businesses. Leaders who provide mindfulness resources for their employees often

Media SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire medias of the new generation and to consolidate them into a modern global organization.

Magic SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to produce magic entertainment shows in castles and to turn them into an international magic productions

Luxury SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to develop environmentally conscious luxury brands answering modern lifestyle trends. Visit Website

Logistic SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire transportation vehicles in order to satisfy existing contracts and to capture large margins and

Life SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire, merge and consolidate life settlements insurance companies. Life settlement has been the booming and

Legal SPAC

This SPAC – Special Purpose Acquisition Corporation- is acquiring business law firms to consolidate them into an international corporation dealing with multinational companies and owning

Landowners SPAC

This SPAC – Special Purpose Acquisition Corporation- acquires large land properties and finances the project on them through Initial Public Offerings. Visit Website

Law SPAC

This SPAC – Special Purpose Acquisition Corporation- is acquiring litigation law firms to consolidate them into an international litigation organization dealing with across borders litigation

IPOs SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to finance companies ready for their Initial Public Offering but unable to afford its costs, thereby

IP SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire a portfolio of Intellecual Property companies and to consolidate them into a large Intellecual

Hollywood SPAC

The Major Studios need to consolidate to increase selling clout and accelerate cost savings. This is the right moment to acquire several studios and create

Health SPAC

This SPAC – Special Purpose Acquisition Corporation- is intended to acquire health companies of all kinds, with the restriction that they have to supply natural

Heal SPAC

This SPAC – Special Purpose Acquisition Corporation- has the purpose of building a Health and Wellness group dealing exclusively in technics not recognized by the

H2O SPAC

The Water Technology sector provides top-quality water. In so doing it keeps pressure on the living environment as low as possible. Knowledge and technology developed

Green SPAC