I often heard the following question:

How is it possible that the price of the Bid is higher than the price of Ask and no trade takes place ?

The answer seems obvious to me, but as I was asked that questions so many times:, here is the answer:

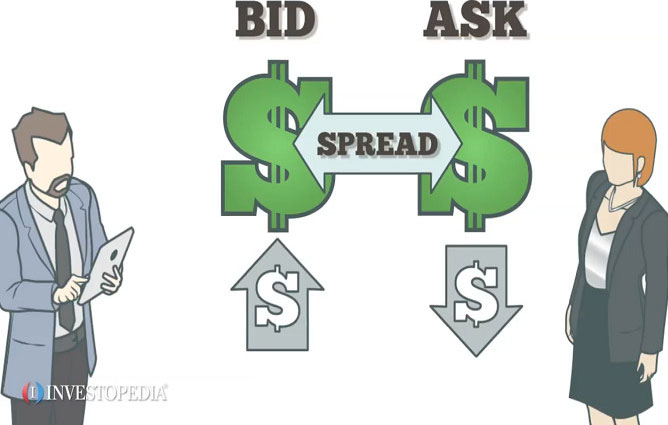

Bid means Bid Price thus represents the Demand, not the offer.

The Bid Price is the price at which a security or an asset can be sold on the market. As an obvious consequence:

Ask means Ask Price thus represents the Offer, not the demand.

The Ask Price is the price at which a security or an asset can be purchased on the market.

The Spread is the difference between the bid and the ask price of a security or of an asset. For example, on a securities market, if the ask price of a stock is 63 and the bid price is 61 then the spread is 2.

The spread is a measure of market liquidity generally expressed in a currency or fraction of currency, but not always i.e. interest rates.

The closer the spread is to zero, the easier the transactions are.