LeilAlia the iReceipt

LEILA is an new generation of application that is completely intuitive and fully integrated, for the very first time providing genuine real-time accounting capability through the

Revenue-Based Investing (RBI), Revenue-Sharing Financing (RSF) or Revenue Discount

The innovative business model is called “Revenue-Based Investing” (RBI), “Revenue-Sharing Financing” (RSF) or “Revenue Discount” (RD) and was invented by Marc René Deschenaux. In this

SPIC: Special Purpose Incorporation Company

A New Breed of SPAC Revolutionizing the Startup WorldofCompanies and Investment Funds An Innovative Approach In an ever-evolving investment landscape, the Special Purpose Incorporation Company

BookToneTM

BookTone™: The Innovative Ancestor of Booking.com Revolutionizing Hotel Reservations The Invention that Paved the Way for Modern Online Booking Before the era of online hotel

From the old Funding Rounds to the new Progressive or Incremental Price Method

In the early days of business funding, before 1995, the predominant method for raising capital was through “funding rounds.” This approach, although straightforward, had several

Intellectual Property Securities

We can legitimately wonder whether the traditional securities are sufficient to answering the modern investor’s needs, Are not you fed up to invest in basket

IPO Cascade

An IPO Cascade (Initial Public Offerings Cascade) is created by the fact that an issuer of equity stock, unable to finance its own IPO, commits

IPO Cascade of Perpetual Corporations

The combined characteristics of creating a Cascade Program focused exclusively on launching Perpetual Corporations results in a level of stability, continuity and perenniality that provides

MasterSPAC

A MasterSPAC is a Special Purpose Acquisition Company that acquires a target by financing its Initial Public Offering as described in this WhosWho article. This

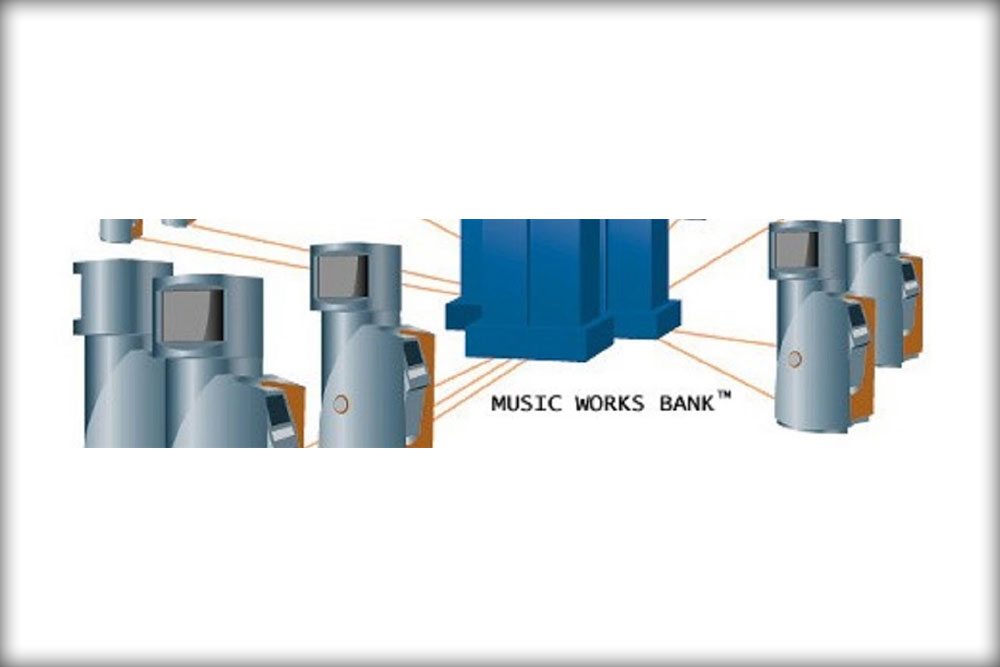

Music Point

CD World Corporation’s Pioneering Business Model from 1995-2000A Blast from the Past The Revolutionary Music Point™ and Music Bank™ Systems that changed the Music Industry In the

Perpetual Corporation

In this time of crisis, we systematically wonder about its causes, which are many. These include the low margins of the companies arising from laws

Transaction Financing

Problem – Corporate Situation A corporation needs equity financing and has sufficient time to make its Initial Public Offering,but, it does not have enough capital

Wrapper

Securitization is a financial process whereby an asset or group of assets is transformed into a security. The security can then be sold to investors