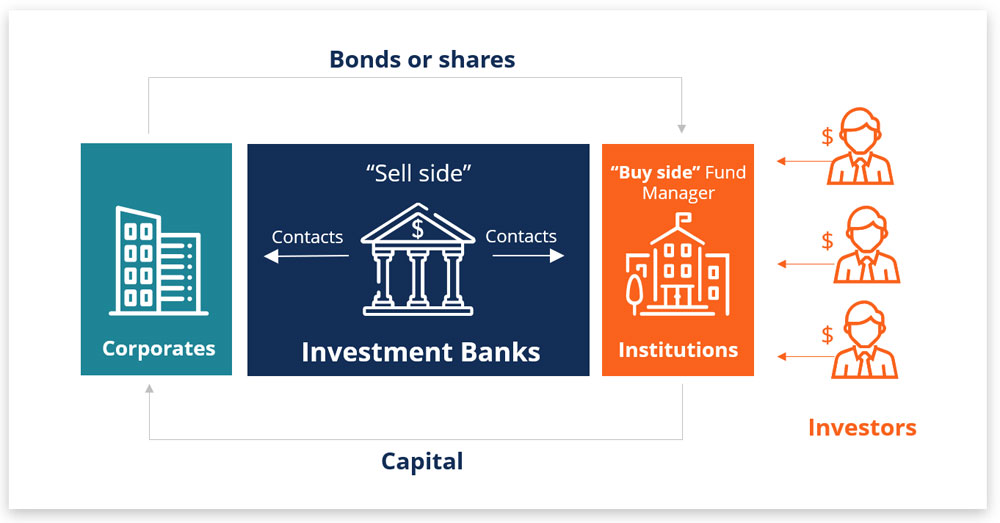

Investment banks play a crucial role in an IPO. They are hired by the company to help facilitate the offering and act as intermediaries between the company and the investors.

The main roles of investment banks in an IPO include:

Underwriting: Investment banks underwrite the offering by agreeing to purchase shares from the company at a predetermined price and then selling them to investors at a markup. This ensures that the company will receive the proceeds from the offering, even if the shares do not sell well.

Price setting: Investment banks work with the company to determine the offering price based on various factors such as the company’s financial performance, growth prospects, and market conditions. They also conduct a “roadshow” to gauge investor interest in the offering and adjust the offering price accordingly.

Marketing and distribution: Investment banks market the offering to potential investors, using their extensive networks to reach a broad range of investors. They also handle the distribution of the shares to investors, ensuring that the process is orderly and efficient.

Due diligence: Investment banks conduct extensive due diligence on the company, including reviewing its financial statements, management team, and operations, to ensure that the offering is viable and attractive to investors.

Regulatory compliance: Investment banks help ensure that the offering complies with all relevant regulations and requirements, including filing the necessary paperwork with regulatory bodies such as the SEC in the United States.

In summary, investment banks play a critical role in an IPO, underwriting the offering, setting the offering price, marketing and distributing the shares to investors, conducting due diligence, and ensuring regulatory compliance.