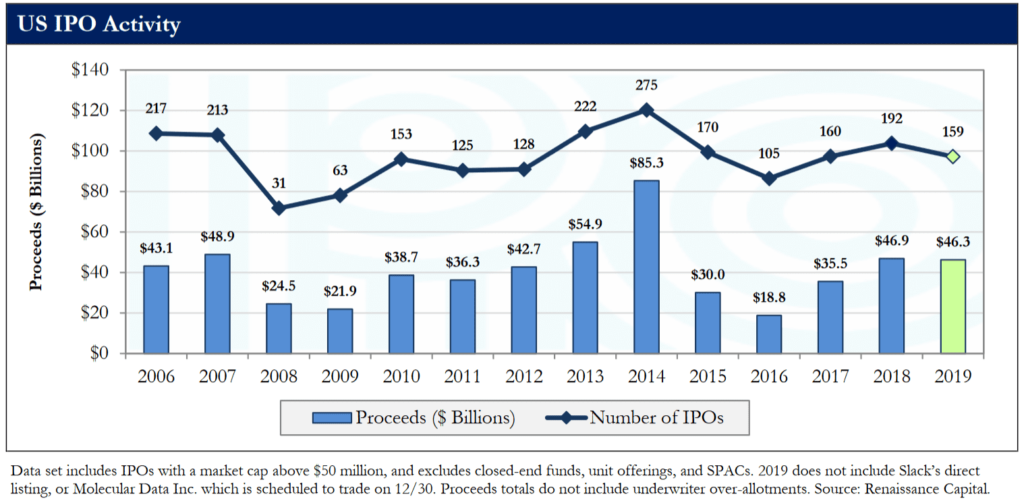

The long-awaited debuts of mega unicorns Uber and Lyft were mega busts, capped off by WeWork’s kamikaze IPO attempt in September. But beyond these headline-grabbing disappointments, the IPO market had a mostly good year. Returns averaged 20%, with 159 IPOs raising $46 billion in proceeds. Biotechs remained the single most active sector, followed closely by technology. While tech unicorn Slack failed to hold up after its direct listing, fast growing software makers with a clear path to profitability like Zoom Video and Bill.com had strong trading with traditional IPOs. High growth consumer names had mixed receptions, with Beyond Meat soaring while Peloton and SmileDirect suffered. Blank check IPOs were active, with Virgin Galactic successfully going public from a SPAC acquisition. Entering 2020, the IPO backlog of billion-dollar companies is larger than ever, underpinning another fairly active year.

Key Takeaways:

- US IPO Count Falls to 159, Proceeds About Flat

- IPOs Average a 20% Gain, Driven by Strong First-Days and Several 200%+ Returns

- Renaissance IPO Index Returns 34%, Outperforming the Broader Market

- 9 IPOs Raise Over $1 Billion, with Listings from Mega Unicorns Uber, Lyft, Pinterest, and Slack

- Healthcare and Tech Dominate IPO Activity for the Fifth Straight Year

- 2020’s Massive Backlog Will See Excitement for Some and Down Rounds for Others