Idea

The first milestone of the Lifecycle of a Company is having the Idea that will be the birth of the concept.

For an idea to become a business concept, one must identify a business model.

Concept

For a business concept to become a project, one must identify its various sources of income, in other words its revenue models.

Project

For a project to become a Company in Formation, one must:

- Identify its various organs and build a team.

- Analyze the market(s) the Company wants to address.

- Define a market positioning and a pricing policy in accordance with it.

Company in Formation

To become an actual company, one must proceed with the incorporation process.

Incorporation

The incorporation process begins by contacting either the local correspondent of an incorporator like Deschenaux Hornblower & Partners, LLP or in the country of incorporation a Registered Agent.

Choose Your Business Name

The first step is choosing a name for your business. An effective business name should fit what you do, how you do it and the audience you are trying to reach. It should be something people will understand and remember.

Once you create a business name, you should check with your state’s corporate filing office as well as federal and state trademark registrars to see if it’s available. It’s also a good idea to come up with an alternate name in case your first choice is not available.

Identify Your Location

Next, you need to select a state as your headquarters’ location. This doesn’t necessarily need to be where you live or even where you expect to do the majority of your business, although sticking with your home state may be an easier process.

Some factors to consider when choosing a state for incorporation include the cost to incorporate, taxation and corporate laws.

Select the Type of Corporation

Now, it’s time to decide what type of corporation you will form. You can incorporate your business as a C Corporation, an S Corporation or an LLC. Each of these types has their own advantages and disadvantages, so you should explore the explanations of each corporation type and consult a tax accountant for advice.

Name the Company Directors

The next step involves selecting the directors. A corporation is required to have a board of directors who are effectively responsible for running the corporation. The selection of directors is a very important decision and can impact your business in many ways. It is essential to have at least two members of the board who are non executive, meaning not employees of the corporation.

Name the Company Management

The next step involves selecting the managers. A corporation is required to have a management for running the day to day business of the corporation. The selection of managers can be done within the members of the board of directors.

Determine the Type of Shares

Next, you will select the type of shares your corporation will sell to stockholders. In many cases, corporations are private, limiting the availability of the shares to only a few individuals (your directors).

Obtain a Certificate of Incorporation

You will then obtain and complete a Certificate of Incorporation, available from your state’s corporate filing office. It will include your company name, the purpose of the business, location and other information gathered in the previous steps.

Process and File the Paperwork

The final step of incorporation involves submitting the articles of incorporation you prepared in the last step to the state, along with the required registration fee.

You have the option of filing the paperwork yourself, through your attorney or by using a third-party service. You should choose the option that you are most comfortable with and the one that works within your budget.

Company Formed or Incorporated

Once the Secretary of State or the Register of Commerce has published the incorporation, the corporation legally exists. As a new born child it will need to be fed, generally with money, but sometimes also with intellectual, material or real property. It can also need some rights or some authorizations from the competent authorities.

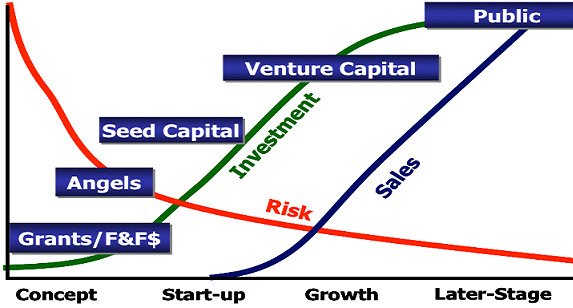

Initial or Seed Capital

The first capital brought by the founders or by very early investors, angels or venture capitalists, before the corporation has done anything is called initial or seed capital.

Startup

When the corporation is structured but is not yet ready to bill any client for products or services, it is in the startup phase and thus, called a startup.

Ready To Bill

Once the corporation is sufficiently organized and ready to receive and handle a client’s order, it is said to be ready to bill.

Development or Second Stage

Once the corporation has handled and brought to completion at least one client’s order or, depending on the nature of the products or services it supplies, a critical mass of such orders, it is said to be in development or second stage.

Cash Flow Positive

When the corporation generates periodically (typically monthly) more cash than it is spending, without amortizing the initial or seed capital, it is said to be cash flow positive.

Growth or Third Stage

Third state in a corporation’s life cycle where sales revenue of products and/or services rise rapidly and the sales margins are optimized.

Mezzanine or Pre-public

Mezzanine stage is a post growth level where the corporation needs debt financing, equity financing, or an hybrid of both. It provides the corporation with the financial means to organiuze its IPO and the lender with the right to convert to an equity interest in the company in case of default, generally, after venture capital companies and other senior lenders are paid.

I.P.O. Initial Public Offering

This stage is the one when the corporation opens its equity and thus its capital to public investments. Generally, unless the bylaws state otherwise on a justified discrimination, anybody can become a shareholder owning a piece of the corporation. As I have broadly described that concept in several articles, but mainly this one, I invite the reader who wants to dig into this subject to read my article The Initial Public Offering.