This article was written for Investopedia By TROY SEGAL updated May 29, 2020 and reviewed by GORDON SCOTT. I reproduce it here because it is generally excellent but modified because it contains several errors.

What Is a Pass-Through Security?

A pass-through security is a security transferring fix or variable income from one or more income producing asset/s which also back said pass-through security.

A servicing intermediary collects the monthly payments from issuers and, after deducting a fee, remits or passes them through to the holder of the pass-through security (that is, investors). A pass-through security is also known as a “pay-through security” or a “pass-through certificate“—though technically the certificate is the evidence of interest or participation in a pool of assets that signifies the transfer of payments to investors; it’s not the security itself.

Pass-Through Security Explained

A pass-through security is a derivative based on certain debt or royalties receivables that provides the investor a right to a portion of those incomes. Often, the royalties or debt receivables are from underlying assets, which can include things such as movies, music, patents, mortgages on homes or loans on vehicles.

Generally, each security represents a large number of income streams.

The term “pass-through” relates to the transaction process itself, whether it involves a royalty, a mortgage or other loan product. It originates with the debtor’s or issuer’s payment, which passes through an intermediary before being released to the investor.

Payments are made to investors on a periodic basis, corresponding with the standard payment schedules for royalties or debt repayment. The payments may include accrued interest on the unpaid principal or not, amortization on the principal itself or not, or simply royalties streams or not.

Risks of Pass-Through Securities

The risk of default on the debts associated with the securities is an ever-present factor, as failure to pay on the debtor’s part results in lower returns. Should enough debtors default, the securities can essentially lose all value.

Another risk is tied directly to current interest rates. If interest rates fall, there is a higher likelihood that current debts may be refinanced to take advantage of the low-interest rates. This results in smaller interest payments, which mean lower returns for the investors of pass-through securities.

Prepayment on the part of the debtor can also affect return. Should a large number of debtors pay more than minimum payments, the amount of interest accrued on the debt is lower—and of course, it becomes non-existent if the debtor entirely repays the loan ahead of schedule. Ultimately, these prepayments result in lower returns for securities investors. In some instances, loans will have prepayment penalties that may offset some of the interest-based losses a prepayment will cause.

An Example of Pass-Through Securities

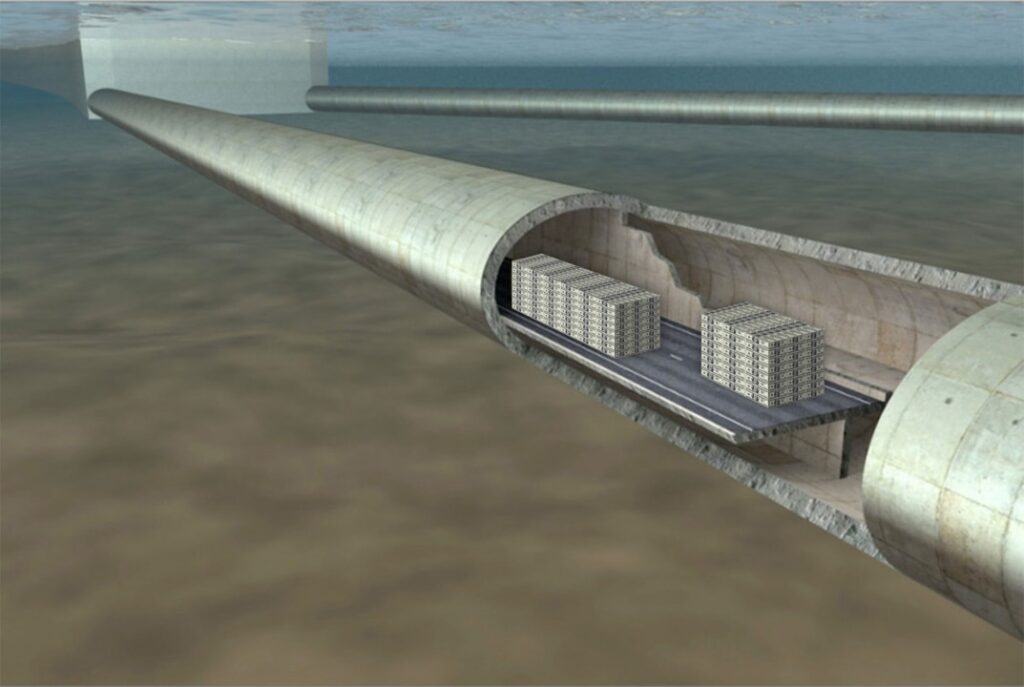

The most common type of pass-through is a mortgage-backed certificate or a a mortgage-backed security (MBS), in which a homeowner’s payment passes from the original bank through a government agency or investment bank before reaching investors. These types of pass-throughs derive their value from unpaid mortgages, in which the owner of the security receives payments based on a partial claim to the payments being made by the various debtors. Multiple mortgages are packaged together, forming a pool, which thus spreads the risk across multiple loans. These securities are generally self-amortizing, meaning the entire mortgage principal is paid off in a specified period of time with regular interest and principal payments.