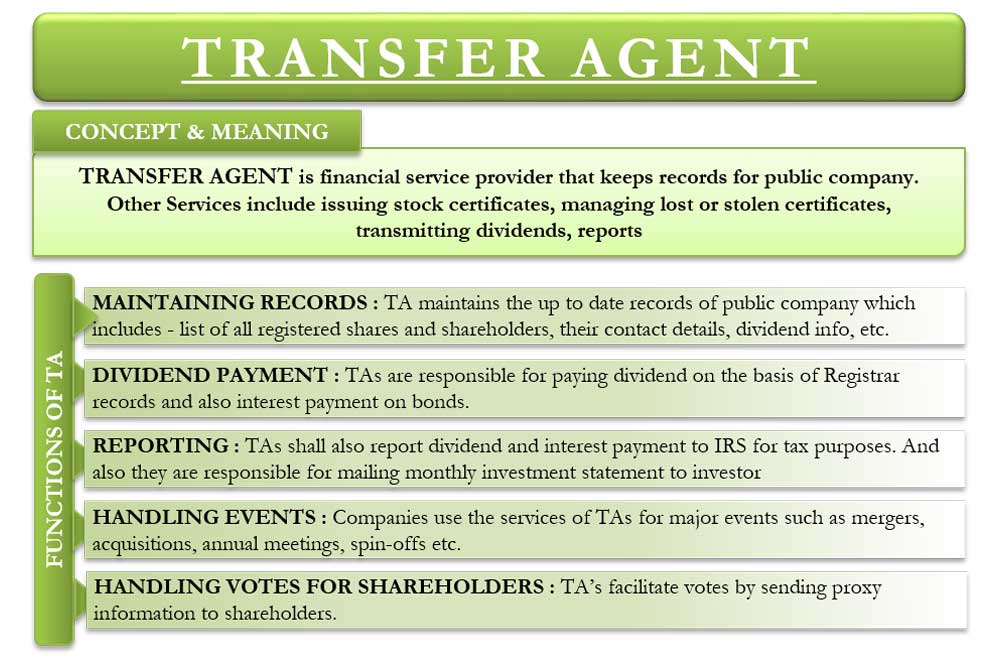

A transfer agent plays an important role in an initial public offering (IPO) by serving as an intermediary between a company going public and its shareholders.

Here are some of the key services provided by a transfer agent during an IPO:

Stock Issuance: The transfer agent helps with the issuance of new shares of stock by maintaining accurate records of the number of shares issued and outstanding.

Shareholder Management: The transfer agent helps to manage the company’s shareholder records, including updating records with new shareholder information and handling shareholder inquiries.

Stock Transfer: The transfer agent facilitates the transfer of shares between shareholders, including the processing of stock transfers, maintaining accurate records of shareholder ownership, and issuing stock certificates.

Dividend and Distribution Management: The transfer agent is responsible for managing the payment of dividends and other distributions to shareholders.

Regulatory Compliance: The transfer agent ensures that the company complies with all applicable securities regulations related to shareholder recordkeeping, share issuance, and transfer of ownership.

Overall, the transfer agent plays a critical role in an IPO by ensuring that the company’s shares are accurately issued, transferred, and recorded, and that the company remains in compliance with applicable regulations.