A company was just transformed into a Securities Issuer by Deschenaux Hornblower & Partners, LLP who prepared a Private Offering Memorandum describing its securities issue and filed it with the Securities & Exchange Commission through a Regulation D filing.

Now comes the really hard part: where to find accredited investors willing to invest in this issue ? That is exactly the reason for the Securities Brokerage Network to exist.

The Securities Brokerage Network is a Multilevel Brokerage Network arising from the Private Equity Network composed of full time and part time professionals who distribute private issues to accredited, sophisticated or institutional investors such as family offices, wealth managers, investment and hedge funds investment banks, securities broker dealers, commercial and merchant banks.

How to Join the Securities Brokerage Network?

When someone joins the network, except as a Finder, s/he must meet some admission criteria and learn the rules of the Private Distribution of Securities applicable to the area s/he intends to sell securities in. This can include obtaining a license where required, although most jurisdictions do not require such license or provide for an exemption when selling a securities issue to accredited, sophisticated or institutional investors.

Upon completion of this learning either through the Securities Brokerage Network e-learning website or through one of their training sessions, s/he must pass an exam and meet a minimum of 80% score.

Organization of the Securities Brokerage Network

First, out of the hierarchy is the investors Finder. S/he is an intervener that only provides an address, a contact or introduction to an investment source without entering into the negotiation or the transaction.

The hierarchy of the Interveners members of the Securities Brokerage Network is geographical due to national securities regulations and composed of the following grades from bottom to top:

The Broker

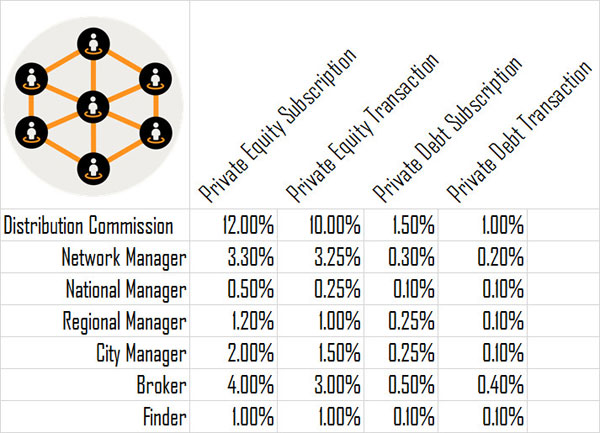

The Broker is an intermediary between Investors and a Securities Issuer. In the Securities Brokerage Network s/he is part of a team under the instructions of a City Manager. Each time the Broker concludes a Subscription or a Transaction, s/he earns a commission of 4% on a private equity subscription, 3% on a private equity transaction, 0,5% on a private debt subscription, 0,4% on a private debt transaction.

The City Manager

All commission rates through the hierarchy are down cumulative. This means that a City Manager selling directly to an investor will get his/her Broker’s commission and his/her own commission.

The Regional Manager

The Regional Manager manages a team of at least six City Managers operating in a region, province, canton or department of a country. Thus, the Regional Manager has at least 42 persons to train and manage.

Each time one of the Brokers of his/her City Managers concludes a Subscription or a Transaction, the Regional Manager earns an overhead commission of 1,2% on top of that private equity subscription or of 1% on top of that private equity transaction and of 0,25% on a private debt subscription, 0,1% on a private debt transaction.

All commission rates through the hierarchy are down cumulative. This means that a Regional Manager selling directly to an investor will get the Broker of his/her City Manager’s commission, his/her City Manager’s commission and his/her own commission as a Regional Manager altogether.

The National Manager

The National Manager manages a team of at least six Regional Managers operating in a country. Thus, the Regional Manager has at least 258 persons to train and manage.

Each time one of the Brokers of his/her Regional Managers concludes a Subscription or a Transaction, the National Manager earns an overhead commission of 0,5% on top of that private equity subscription or of 0,25% on top of that private equity transaction and of 0,1% on a private debt subscription, 0,1% on a private debt transaction.

The Network Manager

The Network Manager is a financial company. It earns the spread between the percentage of the distribution commission agreed with the issuer minus the total of the commissions paid to the Interveners.

The traditional distribution commissions agreed with the issuer are 12% of each private equity subscription, 10%of each private equity transaction and of 1,5% of each private debt subscription, 1% of each private debt transaction.

Generalities about Commissions

Debt Securities Commissions

There are two commissions paid to the Interveners on Debt Securities:

- One time subscription commission on each subscription

- Continuing commissions on debt securities are paid to the Interveners of the Network yearly at the end of the anniversary year of the loan, for the duration of the loan by the Network Manager but only if

- he loan Issuer is both actually and currently honoring the debt service payments

and - the Network Manager actually received its commission dues.

- he loan Issuer is both actually and currently honoring the debt service payments