In an IPO, the primary market and the secondary market play different roles.

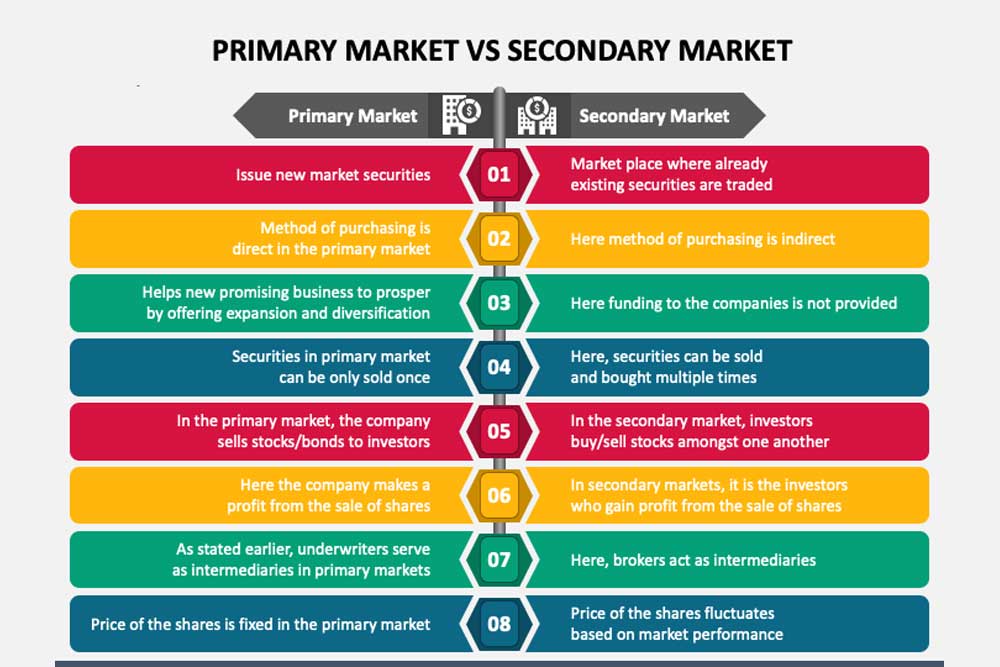

The primary market is where the shares of the newly listed company are first offered for sale to the public. In this market, the company and its underwriters (investment banks) determine the offering price and the number of shares to be sold. The proceeds from the sale of shares in the primary market go directly to the company, and not to the shareholders who are selling their shares. The primary market is also known as the “new issue market.”

On the other hand, the secondary market is where previously issued shares are traded between investors. In the secondary market, the price of shares is determined by supply and demand, and the proceeds from the sale of shares go to the shareholders who are selling them, rather than the company. The secondary market is also known as the “stock market” or “stock exchange.”

After the shares are initially sold in the primary market, they become available for trading on the secondary market, where their price can fluctuate based on various factors such as supply and demand, economic conditions, and company performance.

In summary, the primary market is where newly issued shares are first offered to the public, and the secondary market is where previously issued shares are traded between investors.