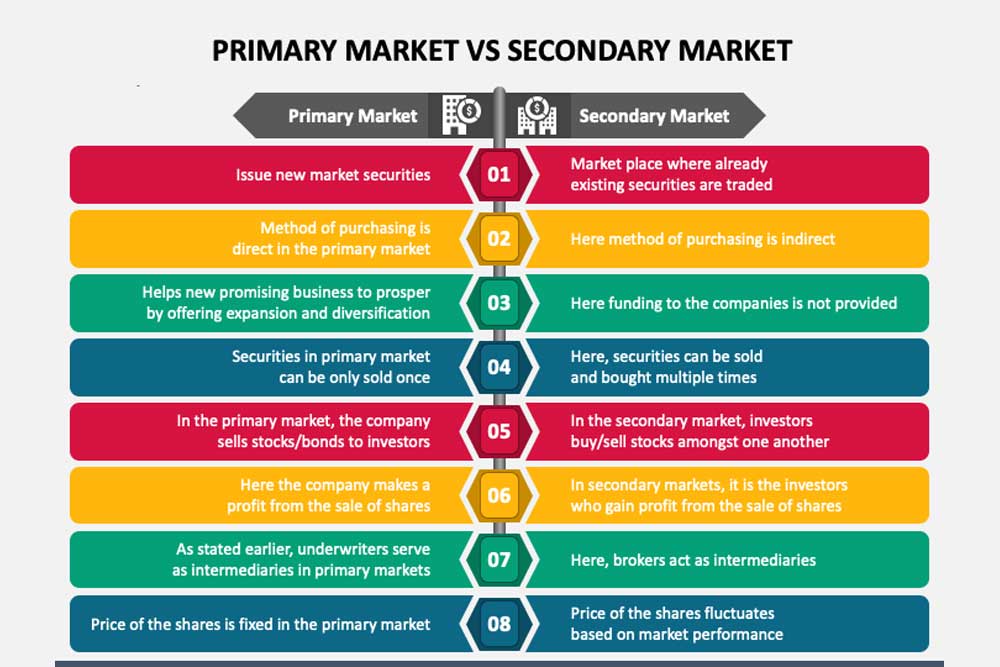

What is the difference between the primary market and the secondary market in an IPO?

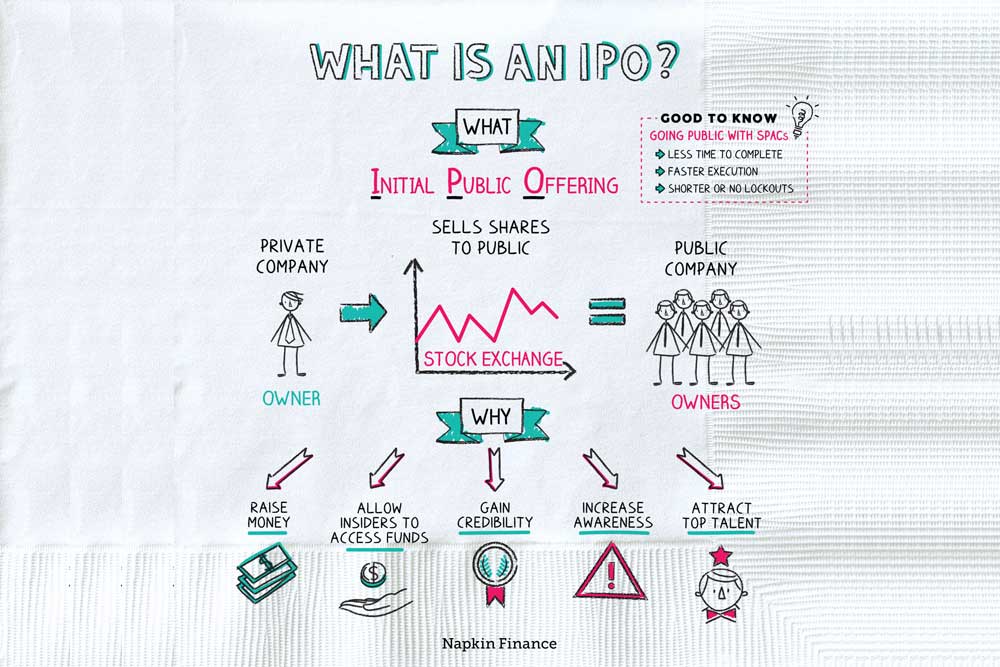

In an IPO, the primary market and the secondary market play different roles. The primary market is where the shares of the newly listed company are first offered for sale to the public. In this market, the company and its underwriters (investment banks) determine the offering price and the number of shares to be sold. … Read more