Page 128 - Initial Public Offering - An Introduction to IPO on Wall Street

P. 128

In this section, we will discuss three main topics related to IPO costs: 1) the required resources

and their relative costs to account for during the IPO process; 2) The systemic improvements

and their relative costs that need to be made before and after an IPO; and 3) The appropriate

way to account for the discussed expenses.

6.1 The Costs

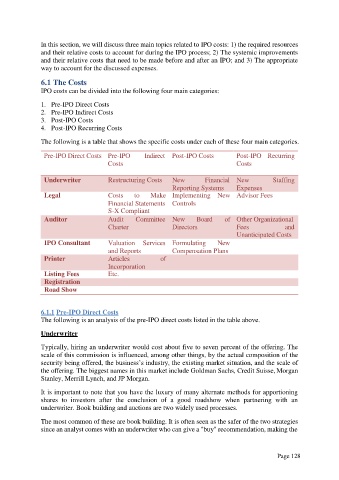

IPO costs can be divided into the following four main categories:

1. Pre-IPO Direct Costs

2. Pre-IPO Indirect Costs

3. Post-IPO Costs

4. Post-IPO Recurring Costs

The following is a table that shows the specific costs under each of these four main categories.

Pre-IPO Direct Costs Pre-IPO Indirect Post-IPO Costs Post-IPO Recurring

Costs Costs

Underwriter Restruc turing Costs New Financial New Staffing

Reporting Systems Expenses

Legal Costs to Make Implementing New Advisor Fees

Financial Statements Controls

S-X Compliant

Auditor Audit Committee New Board of Other Organizational

Charter Directors Fees and

Unanticipated Costs

IPO Consultant Valuation Services Formulating New

and Reports Compensation Plans

Printer Articles of

Incorporation

Listing Fees Etc.

Registration

Road Show

6.1.1 Pre-IPO Direct Costs

The following is an analysis of the pre-IPO direct costs listed in the table above.

Underwriter

Typically, hiring an underwriter would cost about five to seven percent of the offering. The

scale of this commission is influenced, among other things, by the actual composition of the

security being offered, the business’s industry, the existing market situation, and the scale of

the offering. The biggest names in this market include Goldman Sachs, Credit Suisse, Morgan

Stanley, Merrill Lynch, and JP Morgan.

It is important to note that you have the luxury of many alternate methods for apportioning

shares to investors after the conclusion of a good roadshow when partnering with an

underwriter. Book building and auctions are two widely used processes.

The most common of these are book building. It is often seen as the safer of the two strategies

since an analyst comes with an underwriter who can give a "buy" recommendation, making the

Page 128