Page 130 - Initial Public Offering - An Introduction to IPO on Wall Street

P. 130

Auditor fees are normally between $0.5 and $1.2 million, but they can differ based on the size

of the offering, as is the case for most IPO-related fees. The number of problems reported by

the auditors as well as the duration of the SEC comment letter procedure will be mirrored by

the auditor's fees. The most common companies used to perform auditing for IPOs include EY,

KPMG, PwC, and Deloitte.

IPO Consultant

In addition to employing an external auditor, most organizations need to employ a team of IPO

advisors to assist with IPO planning and execution. There are several ways in which these IPO

advisors or consultants can help including the following:

Working for both managers and the audit committee as company advisors

Facilitate the filing of the statement of registration, which could include helping to answer

the SEC's comment letters and offering guidance on the financial reports.

Ensuring the completion of financial details for the pre-IPO period

Providing an unbiased review of the readiness of the IPO and assisting in any required

changes in preparing to go public

The fees are divided into two sections for this job; the more specialized accounting-related fees

vary from $0.3 million to $0.8 million on average, while consultative fees mostly range from

$0 to $0.5 million. It should be mentioned that these fees, with costs ranging up to 10 million,

will far transcend the average amounts specified for a complicated or large IPO.

Printer

A cost of between $0.3 million-$0.5 million can be incurred for the planning, delivery, and

management of marketing collateral, the filling with the SEC, and all other paper processing

and management requirements. Usually, these specialized services are necessary for a

successful IPO transaction.

Listing Fees

A business must start by paying an upfront application fee of $25,000 that will be added to

other listing fees, a per-share payment of $0.004, and a one-time payment of $50,000, as per

the NYSE Listed Company Manual (other than the listing fee). The NYSE has stated that there

is a base listing fee of $150,000 and a peak charge of $295,000 for first-time issuers.

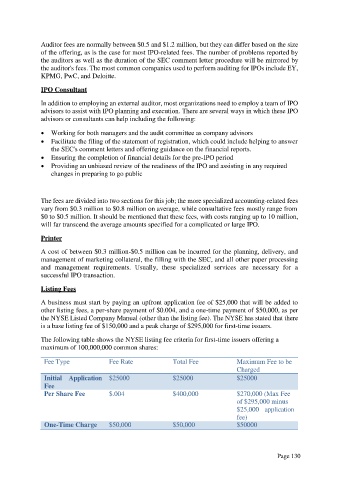

The following table shows the NYSE listing fee criteria for first-time issuers offering a

maximum of 100,000,000 common shares:

Fee Type Fee Rate Total Fee Maximum Fee to be

Charged

Initial Application $25000 $25000 $25000

Fee

Per Share Fee $.004 $400,000 $270,000 (Max Fee

of $295,000 minus

$25,000 application

fee)

One-Time Charge $50,000 $50,000 $50000

Page 130