Page 136 - Initial Public Offering - An Introduction to IPO on Wall Street

P. 136

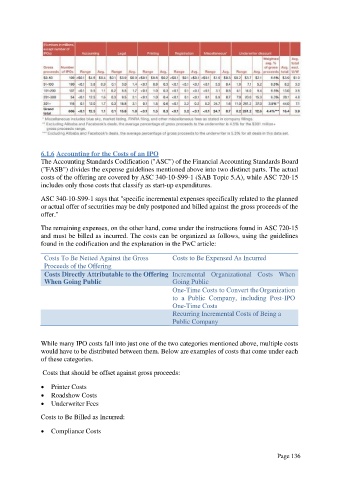

6.1.6 Accounting for the Costs of an IPO

The Accounting Standards Codification ("ASC") of the Financial Accounting Standards Board

("FASB") divides the expense guidelines mentioned above into two distinct parts. The actual

costs of the offering are covered by ASC 340-10-S99-1 (SAB Topic 5.A), while ASC 720-15

includes only those costs that classify as start-up expenditures.

ASC 340-10-S99-1 says that "specific incremental expenses specifically related to the planned

or actual offer of securities may be duly postponed and billed against the gross proceeds of the

offer."

The remaining expenses, on the other hand, come under the instructions found in ASC 720-15

and must be billed as incurred. The costs can be organized as follows, using the guidelines

found in the codification and the explanation in the PwC article:

Costs To Be Netted Against the Gross Costs to Be Expensed As Incurred

Proceeds of the Offering

Costs Directly Attributable to the Offering Incremental Organizational Costs When

When Going Public Going Public

One-Time Costs to Convert the Organization

to a Public Company, including Post-IPO

One-Time Costs

Recurring Incremental Costs of Being a

Public Company

While many IPO costs fall into just one of the two categories mentioned above, multiple costs

would have to be distributed between them. Below are examples of costs that come under each

of these categories.

Costs that should be offset against gross proceeds:

Printer Costs

Roadshow Costs

Underwriter Fees

Costs to Be Billed as Incurred:

Compliance Costs

Page 136