Processus de bookbuilding, et comment est-il utilisé pour déterminer le prix et l'attribution dans une introduction en bourse ?

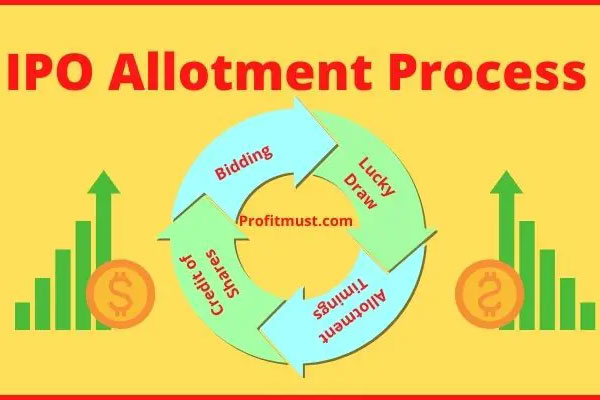

The bookbuilding process is a mechanism used by investment banks to determine the demand for shares in an initial public offering (IPO) and set an appropriate price range for the shares. It involves collecting and compiling orders from institutional investors, including mutual funds, pension funds, and hedge funds, as well as high-net-worth individuals. During the … Lire la suite