Souscription

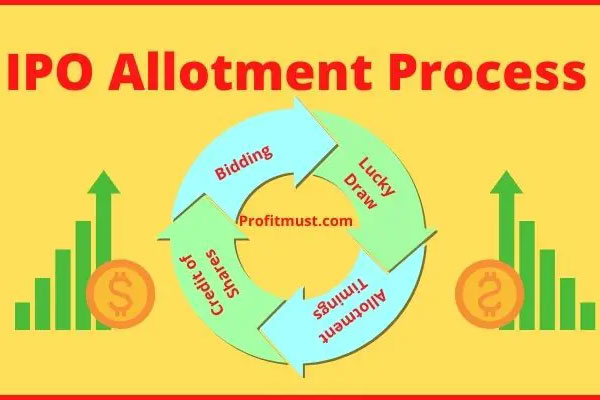

What is the role of the syndicate in an IPO, and how are the roles and responsibilities of the lead underwriter and other underwriters determined? The syndicate is a group of underwriters who work together to underwrite an IPO. The syndicate is usually headed by a lead underwriter (also known as the bookrunner), who is … Lire la suite