Molti imprenditori non capiscono i motivi per cui l'Offerta Pubblica Iniziale di una quota di azioni ordinarie (nota anche come “IPO”) fa soldi?

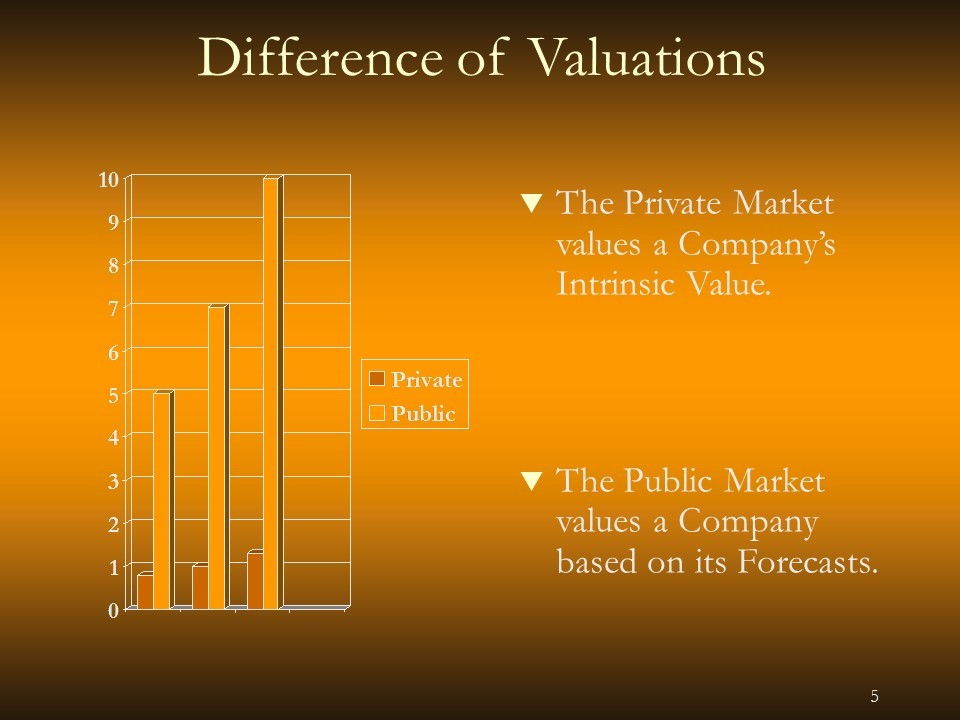

The value creation of an IPO arises mainly from the difference of valuations between the private and public markets.

The Private Market values the Assets. Thus, a bakery that has a turnover of $ 1 million will be sold at approximately $ 1 million. About $ 800,000 during recession and perhaps $ 1,3 million if the market is booming.

In this valuation model, there is no anticipation, everything is based on the past, on the intrinsic value.

The Public Market values the Anticipation. It is based on the equivalent interest rate. In a simplistic form, excluding risk factors for explanation purposes, if the capital market interest rate is 2% and the bakery generates 10%, it will be valued by the public market at least five times its price.

Thus, our bakery with a $ 1 million turnover would be sold at about $ 7 million, i.e. taking into account an Anticipation on 15 years of turnover. About $ 5 million during recession, with a 10 years anticipation, and perhaps $ 10 million if the market is booming with a 20 years anticipation.

In this valuation model, the anticipation is predominant and the intrinsic value is negligible.