Is your company ready for an I.P.O. Initial Public Offering?

This question is always a topic of discussion among the various actors of and around the company, from the entrepreneur to the investment bankers, going

What are the regulatory requirements for a company to go public through an IPO?

In order to go public through an IPO, a company must meet certain regulatory requirements. These requirements are designed to protect investors and ensure that

How important is the timing of an IPO, and what factors should a company consider when deciding when to go public?

The timing of an IPO can be critical for a company’s success. There are several factors a company should consider when deciding when to go

Selecting, Pitching and Convincing an Investment Bank to underwrite Your IPO

Selecting investment banks to underwrite an IPO is an important decision for a company, and there are several key considerations to keep in mind. Here

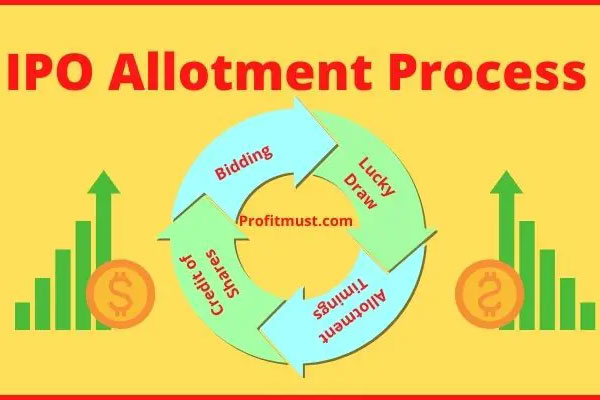

IPO Allotment Process

The allocation of shares in an IPO is typically handled by the underwriting investment banks. The banks will typically conduct a roadshow in which they

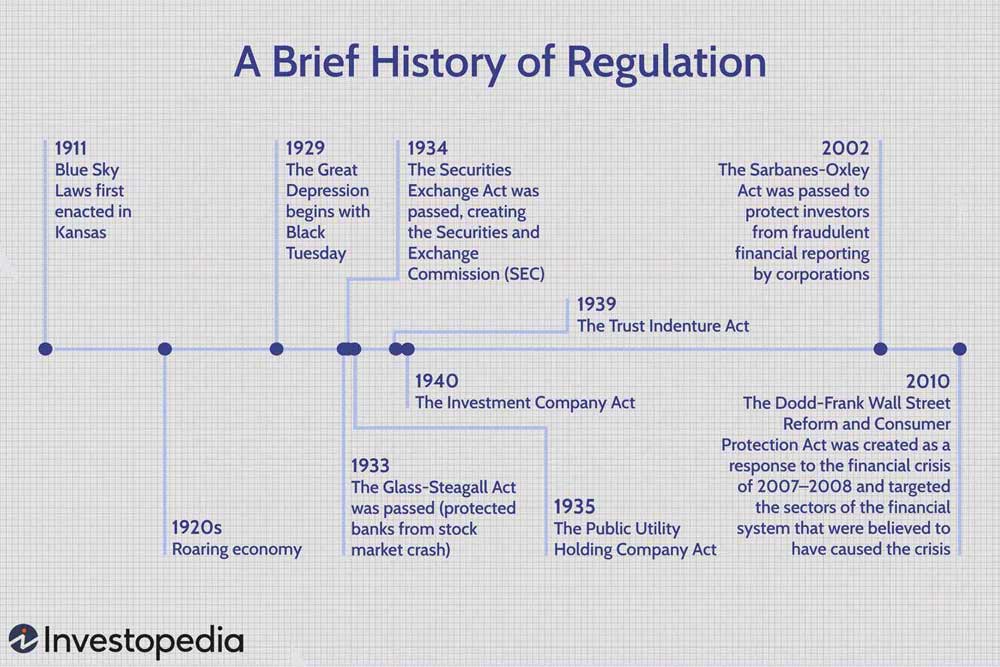

How are the securities laws and regulations relevant to an IPO, and what is the process of obtaining regulatory approvals?

The securities laws and regulations are highly relevant to an IPO. The primary law that governs IPOs in the United States is the Securities Act

What is the role of the Securities and Exchange Commission (SEC) in the IPO process?

Overview The Securities and Exchange Commission (SEC) plays a crucial role in the IPO process. It is the primary regulator of the securities markets in

Filing and IPO Registration Statement & Prospectus

Filing an IPO registration statement is a complex process that involves several steps. Here are the key components: Selection of underwriters: The company selects one

Bookbuilding process, and how is it used to determine pricing and allotment in an IPO?

The bookbuilding process is a mechanism used by investment banks to determine the demand for shares in an initial public offering (IPO) and set an

What is the difference between a firm commitment underwriting and a best efforts underwriting, and what are the advantages and disadvantages of each approach?

Firm commitment underwriting is when the underwriter agrees to purchase all the securities being issued by the issuer and then resell them to investors. In

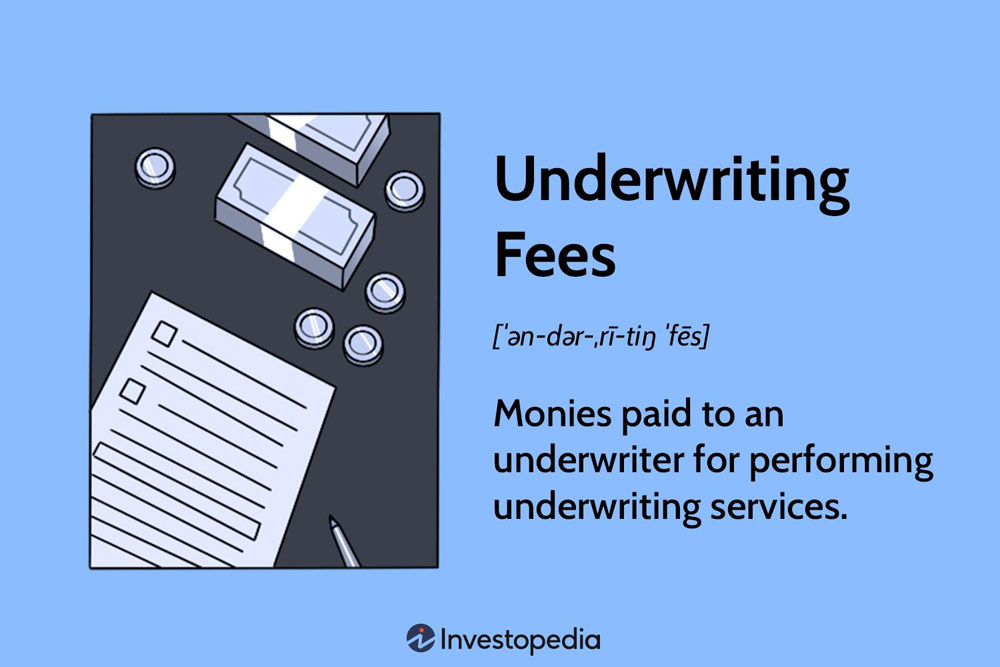

Underwriting Structure & Fees

The fees for underwriting an Initial Public Offering (IPO) are typically structured as a percentage of the total amount raised through the IPO. This fee

Underwriting

What is the role of the syndicate in an IPO, and how are the roles and responsibilities of the lead underwriter and other underwriters determined?

IPO Pricing and Shares Offered Dynamics

The market reaction to an Initial Public Offering (IPO) is typically assessed by measuring the performance of the shares in the aftermarket. The aftermarket refers

What is the process of stabilizing the price of shares in an IPO, and what are the rules and restrictions on stabilization activities?

Stabilizing the price of shares in an initial public offering (IPO) is the process of supporting the share price in the secondary market during the

How is the lock-up period determined, and what are the implications of the lock-up period for investors and the company?

The lock-up period is determined by the underwriters of the Initial Public Offering (IPO) and is agreed upon between the underwriters and the company. The

Stock / Share Transfer Agent

A transfer agent plays an important role in an initial public offering (IPO) by serving as an intermediary between a company going public and its

How can companies prepare for the ongoing reporting and disclosure requirements after an IPO, and what are the key requirements for maintaining compliance with securities laws?

Companies can prepare for ongoing reporting and disclosure requirements after an initial public offering (IPO) by implementing effective corporate governance practices, developing strong internal controls,

How do the risks associated with an IPO compare to those associated with other forms of financing, such as private equity or debt financing?

The risks associated with an IPO can be different from those associated with other forms of financing, such as private equity or debt financing. One

IPO Challenges, Pitfalls & Mitigation

The IPO process can be complex and challenging for companies, and there are several pitfalls that can arise along the way. Here are some common

What is the role of the REGISTRAR in an IPO, and what services do they provide?

In an IPO, the Registrar plays an important role as a key intermediary between the company going public and its investors. Here are some of

Controlled Failure

I. A Strategic Masterstroke in Equity Financing In the ever-evolving sphere of financial markets, every so often, there emerges a pioneering concept that disrupts traditional

Revenue-Based Investing (RBI), Revenue-Sharing Financing (RSF) or Revenue Discount

The innovative business model is called “Revenue-Based Investing” (RBI), “Revenue-Sharing Financing” (RSF) or “Revenue Discount” (RD) and was invented by Marc René Deschenaux. In this