The underwriting process in an IPO involves the investment bank, or group of investment banks, acting as intermediaries between the company issuing the shares and the investors who are buying them.

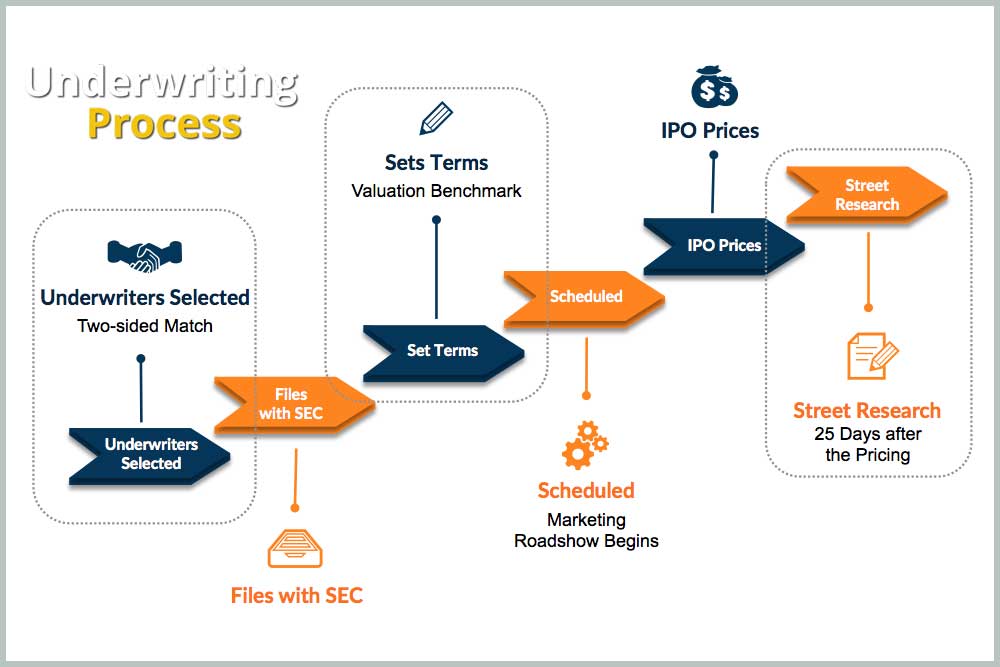

The underwriting process typically follows these steps:

Due diligence: The investment bank performs due diligence on the company, reviewing its financial statements, management team, operations, and other relevant information to determine its viability and attractiveness to investors.

Underwriting agreement: The investment bank enters into an underwriting agreement with the company, in which it agrees to purchase a certain number of shares from the company at a predetermined price, and then resell those shares to investors at a markup.

Pricing and marketing: The investment bank works with the company to determine the offering price of the shares, based on various factors such as the company’s financial performance, growth prospects, and market conditions. The investment bank also markets the shares to potential investors, using its extensive network of contacts to reach a broad range of investors.

Allocation of shares: Once the offering price has been determined and the shares have been marketed to investors, the investment bank allocates the shares to investors based on their orders and the amount of shares available.

Underwriting syndicate: In some cases, a group of investment banks may form an underwriting syndicate to share the risk and cost of the underwriting process. The lead underwriter is responsible for coordinating the syndicate and ensuring that each member is fulfilling its obligations.

Stabilization: After the shares begin trading on the secondary market, the investment bank may engage in stabilization activities to support the share price and prevent it from falling below the offering price. This may involve buying shares in the secondary market to increase demand and support the share price.

In summary, the underwriting process in an IPO involves the investment bank performing due diligence, entering into an underwriting agreement with the company, pricing and marketing the shares, allocating the shares to investors, forming an underwriting syndicate if necessary, and engaging in stabilization activities after the shares begin trading.