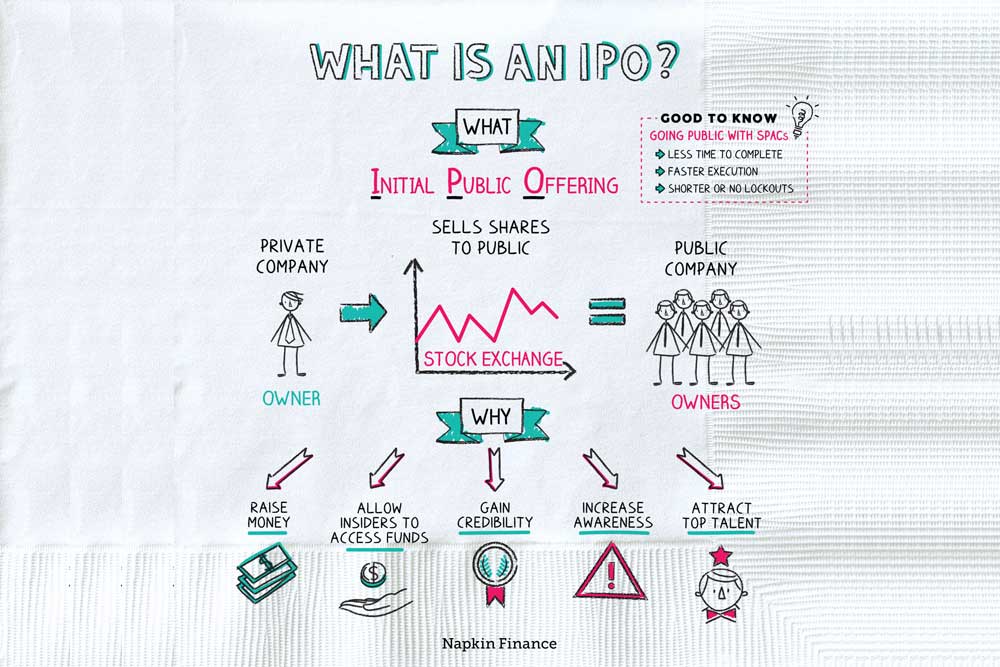

Who sets the price of an IPO?

In an IPO, the price of the shares is determined by the underwriters, who are investment banks hired by the company to help facilitate the offering. The underwriters work with the company to determine the appropriate offering price, based on a number of factors including the company’s financial performance, growth prospects, and market conditions. The … Read more