An Initial Public Offering (IPO) is a significant event in the life of a company, marking its transition from a privately held organization to a publicly traded entity.

The process involves numerous steps, from engaging in due diligence to marketing and selling the company’s shares to public investors.

Each of these steps comes with various expenses, which are crucial to factor in when planning an IPO. In this article, we will explore the different types of expenses incurred by the issuer during an IPO in detail

-

Deal Makers Fees

One of the primary expenses associated with an IPO is the deal maker fees. Deal makers are crucial players in the business world, specializing in facilitating transactions such as initial public offerings, mergers, acquisitions, and other business deals.

One of the primary expenses associated with an IPO is the deal maker fees. Deal makers are crucial players in the business world, specializing in facilitating transactions such as initial public offerings, mergers, acquisitions, and other business deals.

They are responsible for identifying potential deals, guiding negotiations, structuring transactions, conducting due diligence, recruiting and convincing the lead underwriter which is an investment bank, organizing the syndication among investment banks and closing transactions.

Deal maker fees can vary widely and may include retainer fees, success fees based on a percentage of the transaction value, or hourly or fixed fees for specific services.

For an IPO, the fees can range from 9% to 12% of the gross proceeds raised in the IPO, depending on the size of the offering and the complexity of the transaction.

Understanding the role and associated costs of deal makers is essential for businesses considering potential transactions.

-

Underwriting Fees

Another of the primary expenses associated with an IPO is the underwriting fees.

These fees are paid to the investment banks or underwriters who assist in the preparation, marketing, and sale of the company’s shares.

The fees can range from 6% to 9% of the gross proceeds raised in the IPO, depending on the size of the offering and the complexity of the transaction.

-

Legal Fees

The IPO process requires the involvement of legal counsel for both the issuer and the underwriters. Legal fees can vary significantly, depending on factors such as the complexity of the offering, the size of the company, and the jurisdiction in which it operates. Legal fees typically range from several hundred thousand dollars to over a million dollars for a standard IPO.

-

Accounting and Auditing Fees

Accounting and auditing fees are another significant expense associated with an IPO. These fees are paid to the accounting firm responsible for preparing and auditing the issuer’s financial statements, which must be filed with regulatory authorities and included in the IPO prospectus. The cost of these services can range from tens of thousands of dollars to several million dollars, depending on the size and complexity of the company and the audit work required.

-

Registration and Filing Fees

The issuer is required to pay registration and filing fees to the relevant securities regulators, such as the Securities and Exchange Commission (SEC) in the United States. These fees are based on the size of the offering and vary according to the specific regulations of each jurisdiction.

-

Printing and Distribution Costs

The preparation and distribution of the IPO prospectus and other marketing materials can be a significant expense.

This includes the cost of printing and mailing the prospectus to potential investors, as well as the creation and distribution of any supplementary marketing materials, such as presentations, roadshow materials, and press releases.

-

Roadshow Expenses

The roadshow is an essential component of the IPO marketing process, during which the issuer’s management team and the underwriters travel to meet with potential investors and present the company’s story. Expenses related to the roadshow can include travel, accommodations, meals, and venue rentals for the various meetings and presentations.

-

Listing Fees

To list their shares on a stock exchange, issuers are required to pay listing fees. These fees vary depending on the exchange and the size of the company. In addition, issuers may be required to pay annual listing fees to maintain their listing on the exchange.

-

Investor Relations Expenses

An IPO often requires the issuer to ramp up its investor relations efforts to attract and communicate with potential investors. This can include the creation of a dedicated investor relations website, the production of investor materials, and the hiring of investor relations personnel or consultants.

-

Insurance Costs

Directors and Officers (D&O) liability insurance is a critical expense for issuers during an IPO. This insurance protects the company’s directors and officers from personal liability in the event of legal action or claims related to their roles in the company. The cost of D&O insurance can vary significantly based on factors such as the company’s size, industry, and risk profile.

-

Internal Resources

While not a direct expense, it’s important to consider the cost of the internal resources dedicated to the IPO process. This includes the time and effort of the company’s management team, as well as other employees who may be involved in the preparation and execution of the IPO. The cost of these internal resources can be substantial, as it often means diverting attention from regular business operations during the IPO process.

-

Financial Advisor Fees

Some issuers choose to hire financial advisors to provide guidance and support throughout the IPO process. These advisors can assist with valuation, structuring, and negotiation of the offering, as well as provide advice on the selection of underwriters and other service providers. The fees for financial advisors can vary based on the scope of their services and the size of the transaction.

-

Miscellaneous Expenses

In addition to the costs outlined above, issuers may also incur a variety of miscellaneous expenses during the IPO process. These can include expenses related to due diligence investigations, background checks, intellectual property filings, and any other required professional services. Additionally, there may be costs associated with compliance and regulatory requirements, such as Sarbanes-Oxley Act (SOX) compliance in the United States.

-

Post-IPO Expenses

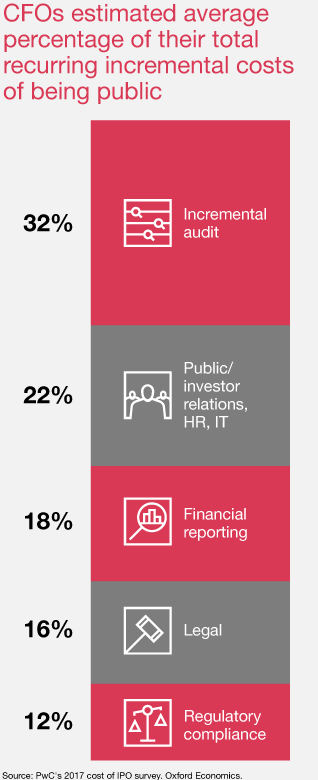

After the IPO is completed, issuers will continue to incur ongoing expenses related to being a publicly traded company. These costs can include ongoing financial reporting and auditing, maintaining investor relations programs, and complying with ongoing regulatory requirements, such as annual filings and disclosures.

-

Factors Impacting the Costs of an IPO

Several factors can impact the cost of an initial public offering (IPO). Here are some of the most significant ones:

Company size and complexity: The larger and more complex a company is, the more expensive its IPO is likely to be. This is because larger companies typically require more legal and accounting work to comply with securities regulations and prepare financial statements.

Industry: The industry that a company operates in can also impact the cost of an IPO. Certain industries, such as biotechnology and technology, require more extensive due diligence and may have higher legal and accounting fees associated with their IPOs.

Market conditions: The state of the stock market can also impact the cost of an IPO. In a strong market, demand for new issuances may be high, leading to lower underwriting fees. In a weaker market, underwriters may charge higher fees to compensate for the additional risk.

Timing: The timing of an IPO can also affect its cost. If a company rushes to go public without proper preparation, it may face higher expenses due to the need for additional legal and accounting work. On the other hand, if a company waits too long to go public, it may miss out on favorable market conditions.

Marketing and promotion: The cost of marketing and promoting an IPO can also impact its overall cost. Companies may need to spend significant amounts of money on advertising, investor relations, and roadshows to generate interest from potential investors.

Underwriter fees: Underwriters typically charge a percentage of the total amount raised in the IPO. The higher the percentage, the more expensive the IPO will be.

-

Conclusion

The expenses associated with an IPO are numerous and can add up quickly.

It is crucial for the issuer to have a clear understanding of these costs and to budget appropriately when planning for an IPO.

By carefully considering each expense category and working with experienced professionals, the issuer can navigate the IPO process more effectively and ensure a successful transition to a publicly traded company.

We cordially invite the skeptical reader to read this great article of price waterhouse cooper

“Considering an IPO? First, understand the costs“