The Role of the Transfer Agent in the IPO

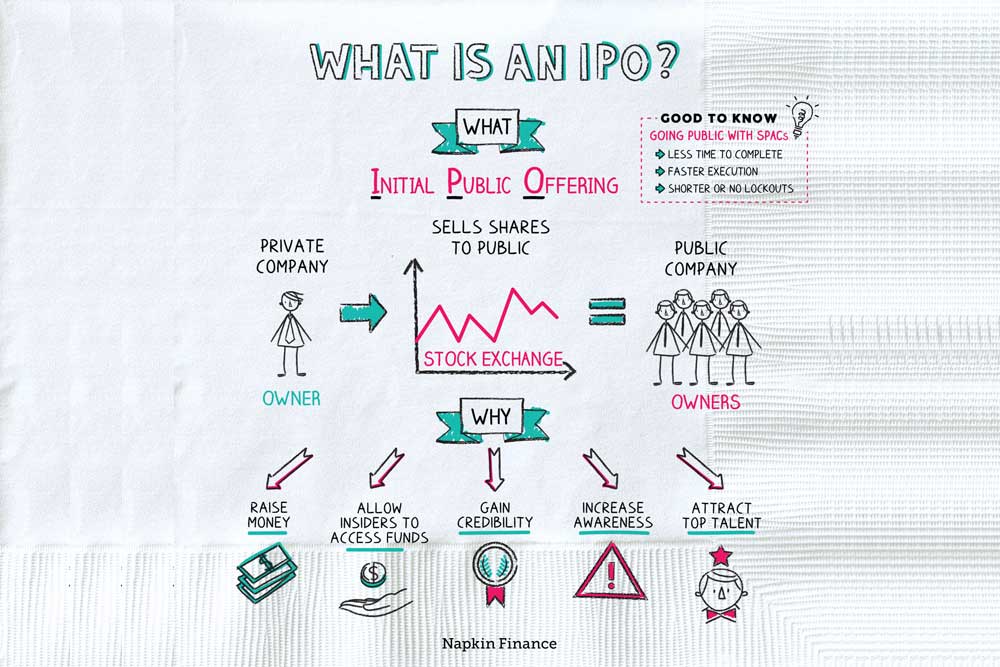

Initial Public Offerings (IPOs) are complex financial events that mark a significant milestone for companies seeking to raise capital by transitioning from private to public

Initial Public Offerings (IPOs) are complex financial events that mark a significant milestone for companies seeking to raise capital by transitioning from private to public

The Initial Public Offering (IPO) represents a significant milestone in a company’s growth, symbolizing its transition from a private entity to a publicly traded corporation.

The Initial Public Offering (IPO) is a transformative milestone for private companies looking to raise capital by offering shares to the public for the first

Initial Public Offerings (IPOs) mark a significant milestone for a company transitioning from private to public ownership. For investors, IPOs represent an opportunity to invest

Introduction The “quiet period” is a fundamental concept under U.S. securities law that governs communications by companies, underwriters, and insiders during the process of an

This article was written for Investopedia By TROY SEGAL updated May 29, 2020 and reviewed by GORDON SCOTT. I reproduce it here because it is

The development of a movie typically follows several key stages, each of which is crucial to the successful creation and release of the film. Below

The IPO Institute, a globally recognized authority in financial certifications, has recently introduced the “True PreIPO™” certification. This certification aims to distinguish legitimate pre-initial public

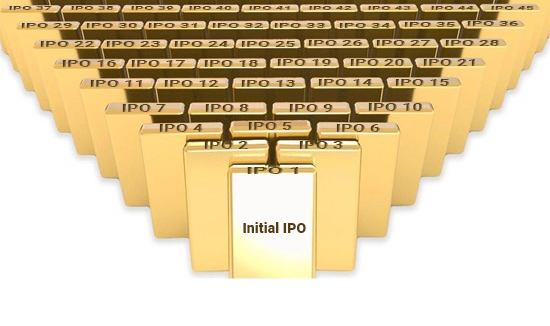

The IPO Cascade is a patented process conceived by Marc Deschenaux and licensed exclusively to Market Street Capital Inc. A Company willing to issue equity

I. A Strategic Masterstroke in Equity Financing In the ever-evolving sphere of financial markets, every so often, there emerges a pioneering concept that disrupts traditional

Fundraising is a critical activity in the life cycle of a business. It not only provides the necessary capital to initiate operations but also supports

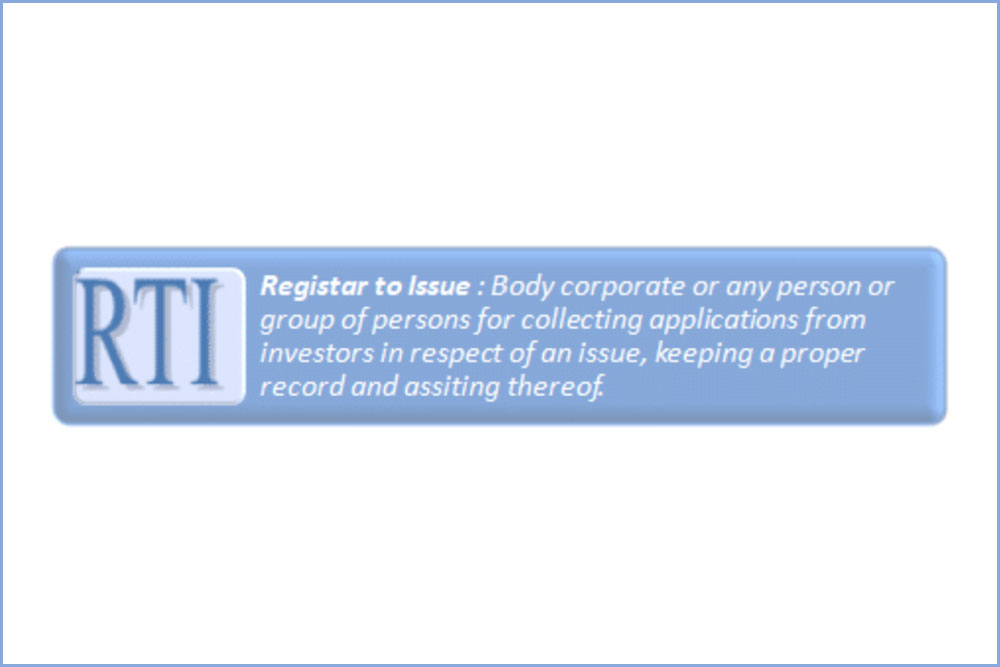

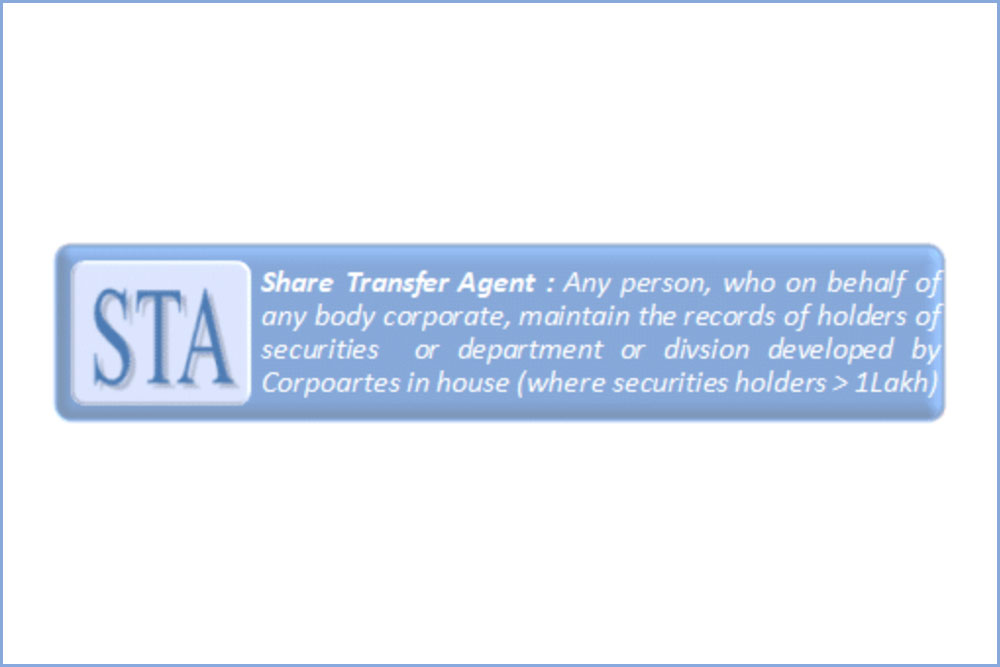

In an IPO, the Registrar plays an important role as a key intermediary between the company going public and its investors. Here are some of

The IPO process can be complex and challenging for companies, and there are several pitfalls that can arise along the way. Here are some common

The risks associated with an IPO can be different from those associated with other forms of financing, such as private equity or debt financing. One

Companies can prepare for ongoing reporting and disclosure requirements after an initial public offering (IPO) by implementing effective corporate governance practices, developing strong internal controls,

A transfer agent plays an important role in an initial public offering (IPO) by serving as an intermediary between a company going public and its

The lock-up period is determined by the underwriters of the Initial Public Offering (IPO) and is agreed upon between the underwriters and the company. The

Stabilizing the price of shares in an initial public offering (IPO) is the process of supporting the share price in the secondary market during the

The market reaction to an Initial Public Offering (IPO) is typically assessed by measuring the performance of the shares in the aftermarket. The aftermarket refers

What is the role of the syndicate in an IPO, and how are the roles and responsibilities of the lead underwriter and other underwriters determined?

The fees for underwriting an Initial Public Offering (IPO) are typically structured as a percentage of the total amount raised through the IPO. This fee

Firm commitment underwriting is when the underwriter agrees to purchase all the securities being issued by the issuer and then resell them to investors. In

The bookbuilding process is a mechanism used by investment banks to determine the demand for shares in an initial public offering (IPO) and set an

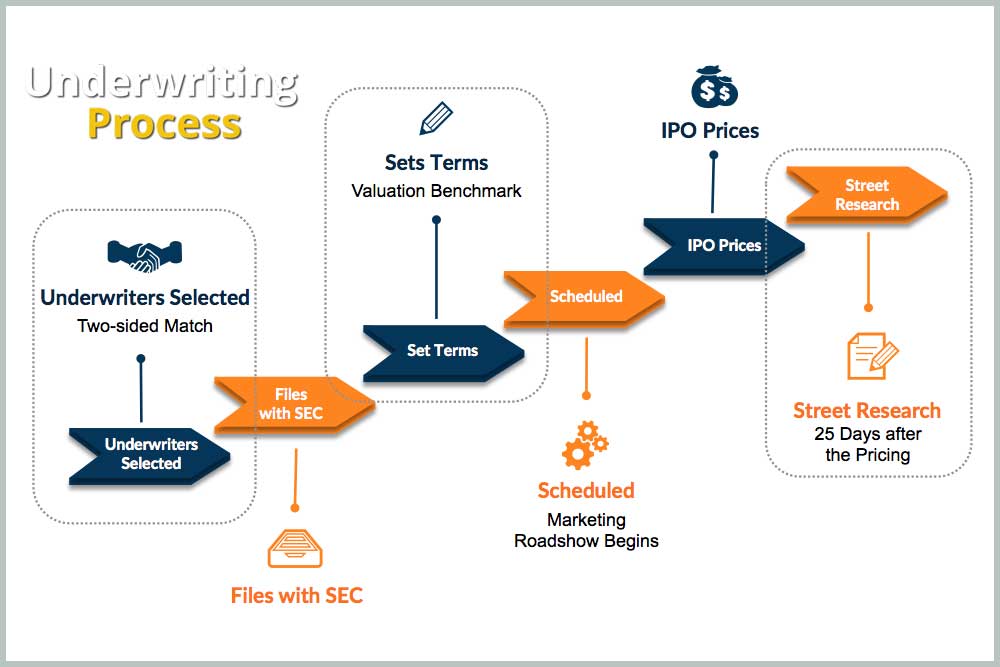

Filing an IPO registration statement is a complex process that involves several steps. Here are the key components: Selection of underwriters: The company selects one

Overview The Securities and Exchange Commission (SEC) plays a crucial role in the IPO process. It is the primary regulator of the securities markets in

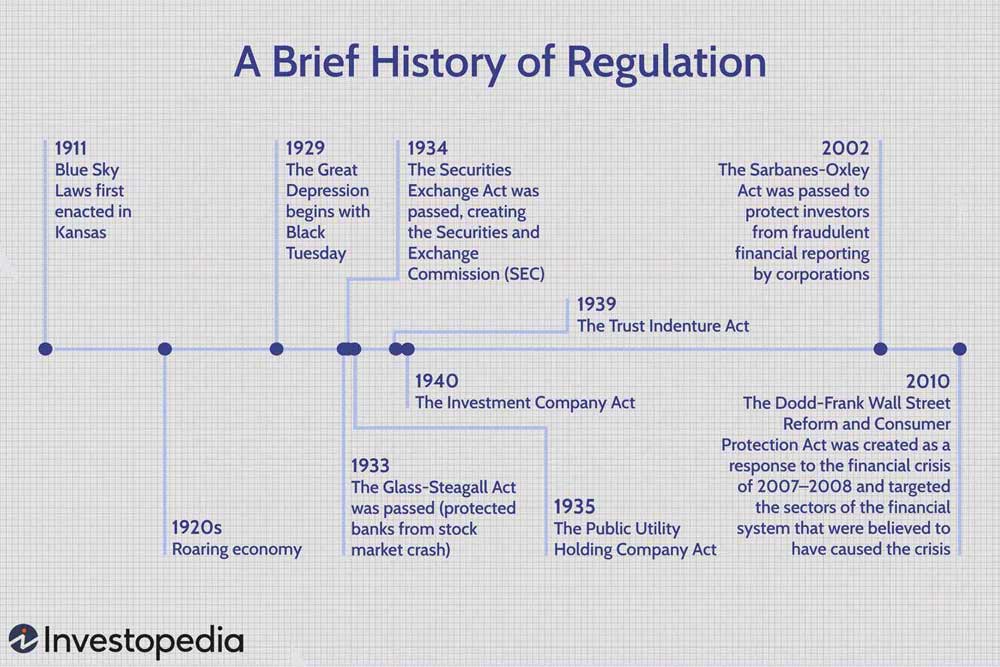

The securities laws and regulations are highly relevant to an IPO. The primary law that governs IPOs in the United States is the Securities Act

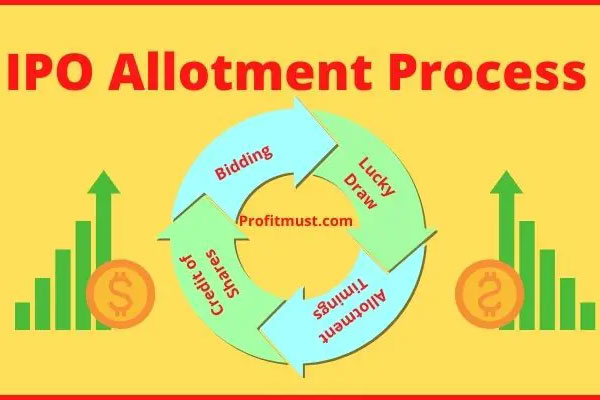

The allocation of shares in an IPO is typically handled by the underwriting investment banks. The banks will typically conduct a roadshow in which they

Selecting investment banks to underwrite an IPO is an important decision for a company, and there are several key considerations to keep in mind. Here

The timing of an IPO can be critical for a company’s success. There are several factors a company should consider when deciding when to go

In order to go public through an IPO, a company must meet certain regulatory requirements. These requirements are designed to protect investors and ensure that

Investing in an IPO can be a high-risk, high-reward proposition, and there are several common mistakes that investors should try to avoid. Here are a

An IPO can have both positive and negative effects on the existing shareholders of a company. On the positive side, an IPO can provide existing

Technically, anyone can invest in an IPO, as long as they meet the requirements set by the underwriters and the stock exchange where the IPO

A direct listing and an IPO are both ways for a company to become publicly traded, but they differ in several important ways. In an

The quiet period in an IPO is a period of time during which the company and its underwriters are prohibited from making public statements or

The lock-up period is a period of time following an IPO during which certain shareholders are prohibited from selling their shares in the company imposed

After an IPO, a company’s stock begins trading on a public stock market or exchange, and its price can rise or fall depending on a

The amount of money a company can raise through an IPO depends on several factors, such as the number of shares being offered, the offering

The duration of an IPO process can vary depending on a number of factors, such as the size of the offering, the complexity of the

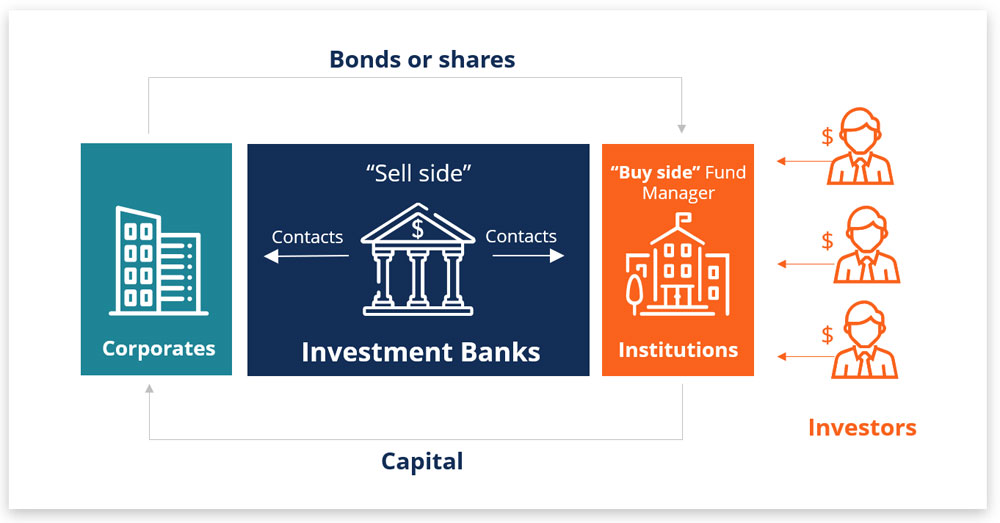

The underwriting process in an IPO involves the investment bank, or group of investment banks, acting as intermediaries between the company issuing the shares and

Investment banks play a crucial role in an IPO. They are hired by the company to help facilitate the offering and act as intermediaries between

In an IPO, the price of the shares is determined by the underwriters, who are investment banks hired by the company to help facilitate the

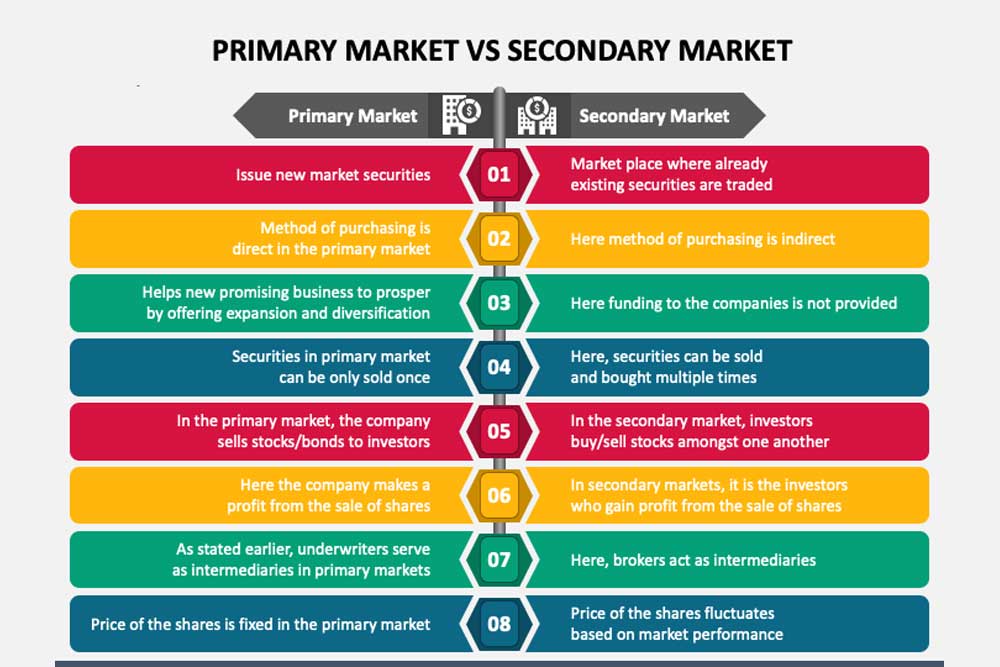

In an IPO, the primary market and the secondary market play different roles. The primary market is where the shares of the newly listed company

Investing in an IPO typically involves the following steps: Research the company in the websites offering Pre-IPOs: Before investing in an IPO, it is important

There are several risks involved in investing in an IPO: Uncertain valuations: The price at which an IPO is offered can be based on various

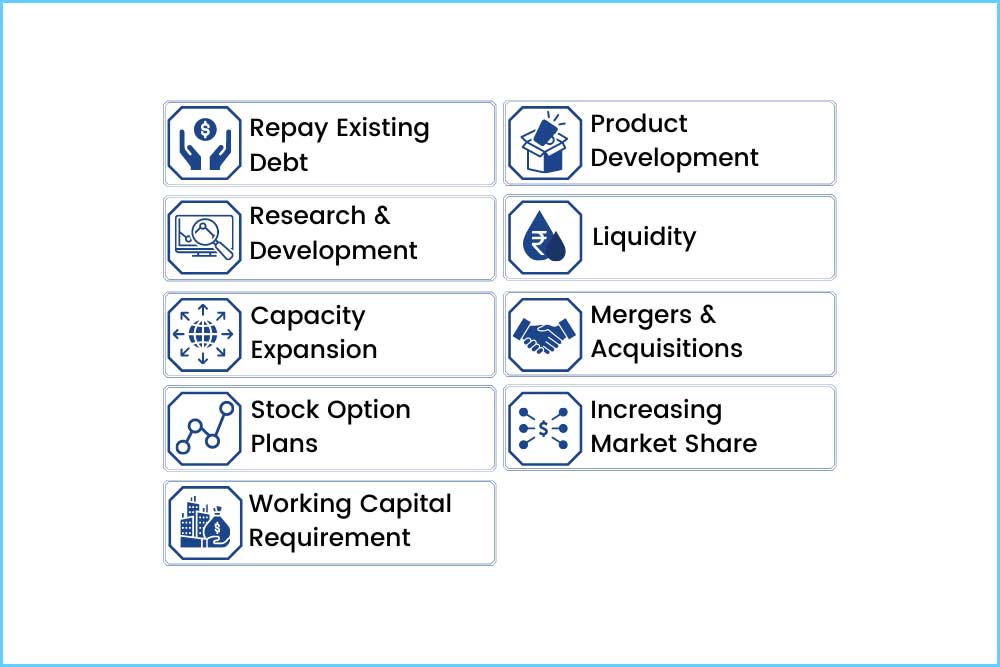

There are several benefits of going public through an IPO: Access to capital: Going public provides companies with access to a large pool of capital

Companies go public through an IPO for several reasons: Capital raising: One of the main reasons for going public is to raise capital for the

An IPO, or initial public offering, is a process by which a privately held company offers shares of its stock to the public for the

Once your company has convinced the managing underwriters for the offering and wants to begin the IPO process in earnest, an organizational meeting with management,

Swiss Financiers has developed solutions to support businesses that are seeking a listing. Candidate companies are appraised to assess eligibility. We take on mandates that

Taking a company public demands a certain amount of disposable cash that often is considered a high barrier to entry. By using Swiss Financiers proprietary

This question is always a topic of discussion among the various actors of and around the company, from the entrepreneur to the investment bankers, going

Many entrepreneurs do not understand the reasons why the Initial Public Offering of a share of common stock (also known as “IPO “) makes money?

An Initial Public Offering (IPO) is a significant event in the life of a company, marking its transition from a privately held organization to a