Can anyone invest in an IPO?

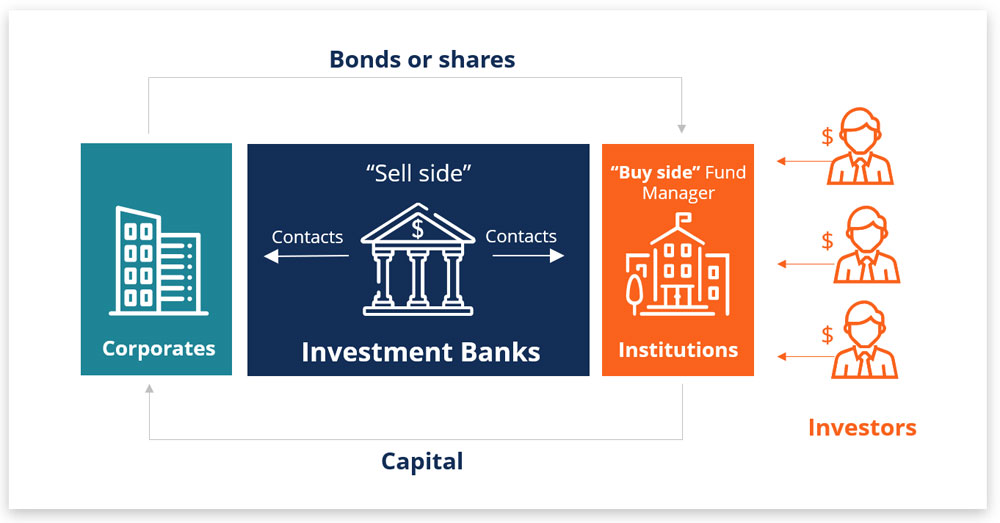

Technically, anyone can invest in an IPO, as long as they meet the requirements set by the underwriters and the stock exchange where the IPO is listed. However, in practice, most IPOs are available only to institutional investors and high net worth individuals, due to the high demand and limited supply of shares. The underwriters … Read more