Page 101 - Initial Public Offering - An Introduction to IPO on Wall Street

P. 101

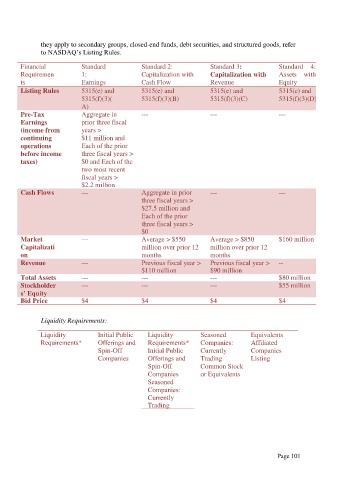

they apply to secondary groups, closed-end funds, debt securities, and structured goods, refer

to NASDAQ’s Listing Rules.

Financial Standard Standard 2: Standard 3: Standard 4:

Requiremen 1: Capitalization with Capitalization with Assets with

ts Earnings Cash Flow Revenue Equity

Listing Rules 5315(e) and 5315(e) and 5315(e) and 5315(e) and

5315(f)(3)( 5315(f)(3)(B) 5315(f)(3)(C) 5315(f)(3)(D)

A)

Pre-Tax Aggregate in --- --- ---

Earnings prior three fiscal

(income from years >

continuing $11 million and

operations Each of the prior

before income three fiscal years >

taxes) $0 and Each of the

two most recent

fiscal years >

$2.2 million

Cash Flows --- Aggregate in prior --- ---

three fiscal years >

$27.5 million and

Each of the prior

three fiscal years >

$0

Market --- Average > $550 Average > $850 $160 million

Capitalizati million over prior 12 million over prior 12

on months months

Revenue --- Previous fiscal year > Previous fiscal year > --

$110 million $90 million

Total Assets --- --- --- $80 million

Stockholder --- --- --- $55 million

s’ Equity

Bid Price $4 $4 $4 $4

Liquidity Requirements:

Liquidity Initial Public Liquidity Seasoned Equivalents

Requirements* Offerings and Requirements* Companies: Affiliated

Spin-Off Initial Public Currently Companies

Companies Offerings and Trading Listing

Spin-Off Common Stock

Companies or Equivalents

Seasoned

Companies:

Currently

Trading

Page 101