Page 105 - Initial Public Offering - An Introduction to IPO on Wall Street

P. 105

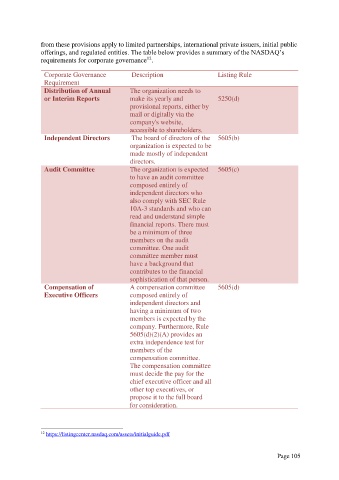

from these provisions apply to limited partnerships, international private issuers, initial public

offerings, and regulated entities. The table below provides a summary of the NASDAQ’s

12

requirements for corporate governance .

Corporate Governance Description Listing Rule

Requirement

Distribution of Annual The organization needs to

or Interim Reports make its yearly and 5250(d)

provisional reports, either by

mail or digitally via the

company's website,

accessible to shareholders.

Independent Directors The board of directors of the 5605(b)

organization is expected to be

made mostly of independent

directors.

Audit Committee The organization is expected 5605(c)

to have an audit committee

composed entirely of

independent directors who

also comply with SEC Rule

10A-3 standards and who can

read and understand simple

financial reports. There must

be a minimum of three

members on the audit

committee. One audit

committee member must

have a background that

contributes to the financial

sophistication of that person.

Compensation of A compensation committee 5605(d)

Executive Officers composed entirely of

independent directors and

having a minimum of two

members is expected by the

company. Furthermore, Rule

5605(d)(2)(A) provides an

extra independence test for

members of the

compensation committee.

The compensation committee

must decide the pay for the

chief executive officer and all

other top executives, or

propose it to the full board

for consideration.

12 https://listingcenter.nasdaq.com/assets/initialguide.pdf

Page 105