Page 107 - Initial Public Offering - An Introduction to IPO on Wall Street

P. 107

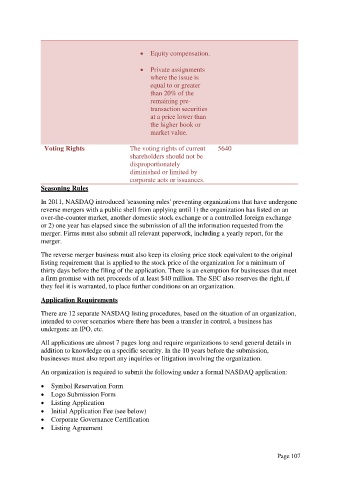

Equity compensation.

Private assignments

where the issue is

equal to or greater

than 20% of the

remaining pre-

transaction securities

at a price lower than

the higher book or

market value.

Voting Rights The voting rights of current 5640

shareholders should not be

disproportionately

diminished or limited by

corporate acts or issuances.

Seasoning Rules

In 2011, NASDAQ introduced 'seasoning rules' preventing organizations that have undergone

reverse mergers with a public shell from applying until 1) the organization has listed on an

over-the-counter market, another domestic stock exchange or a controlled foreign exchange

or 2) one year has elapsed since the submission of all the information requested from the

merger. Firms must also submit all relevant paperwork, including a yearly report, for the

merger.

The reverse merger business must also keep its closing price stock equivalent to the original

listing requirement that is applied to the stock price of the organization for a minimum of

thirty days before the filing of the application. There is an exemption for businesses that meet

a firm promise with net proceeds of at least $40 million. The SEC also reserves the right, if

they feel it is warranted, to place further conditions on an organization.

Application Requirements

There are 12 separate NASDAQ listing procedures, based on the situation of an organization,

intended to cover scenarios where there has been a transfer in control, a business has

undergone an IPO, etc.

All applications are almost 7 pages long and require organizations to send general details in

addition to knowledge on a specific security. In the 10 years before the submission,

businesses must also report any inquiries or litigation involving the organization.

An organization is required to submit the following under a formal NASDAQ application:

Symbol Reservation Form

Logo Submission Form

Listing Application

Initial Application Fee (see below)

Corporate Governance Certification

Listing Agreement

Page 107