Page 103 - Initial Public Offering - An Introduction to IPO on Wall Street

P. 103

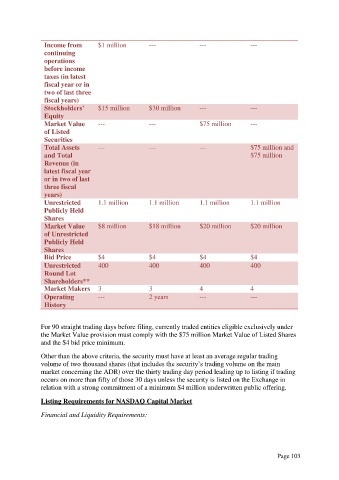

Income from $1 million --- --- ---

continuing

operations

before income

taxes (in latest

fiscal year or in

two of last three

fiscal years)

Stockholders’ $15 million $30 million --- ---

Equity

Market Value --- --- $75 million ---

of Listed

Securities

Total Assets --- --- --- $75 million and

and Total $75 million

Revenue (in

latest fiscal year

or in two of last

three fiscal

years)

Unrestricted 1.1 million 1.1 million 1.1 million 1.1 million

Publicly Held

Shares

Market Value $8 million $18 million $20 million $20 million

of Unrestricted

Publicly Held

Shares

Bid Price $4 $4 $4 $4

Unrestricted 400 400 400 400

Round Lot

Shareholders**

Market Makers 3 3 4 4

Operating --- 2 years --- ---

History

For 90 straight trading days before filing, currently traded entities eligible exclusively under

the Market Value provision must comply with the $75 million Market Value of Listed Shares

and the $4 bid price minimum.

Other than the above criteria, the security must have at least an average regular trading

volume of two thousand shares (that includes the security’s trading volume on the main

market concerning the ADR) over the thirty trading day period leading up to listing if trading

occurs on more than fifty of those 30 days unless the security is listed on the Exchange in

relation with a strong commitment of a minimum $4 million underwritten public offering.

Listing Requirements for NASDAQ Capital Market

Financial and Liquidity Requirements:

Page 103