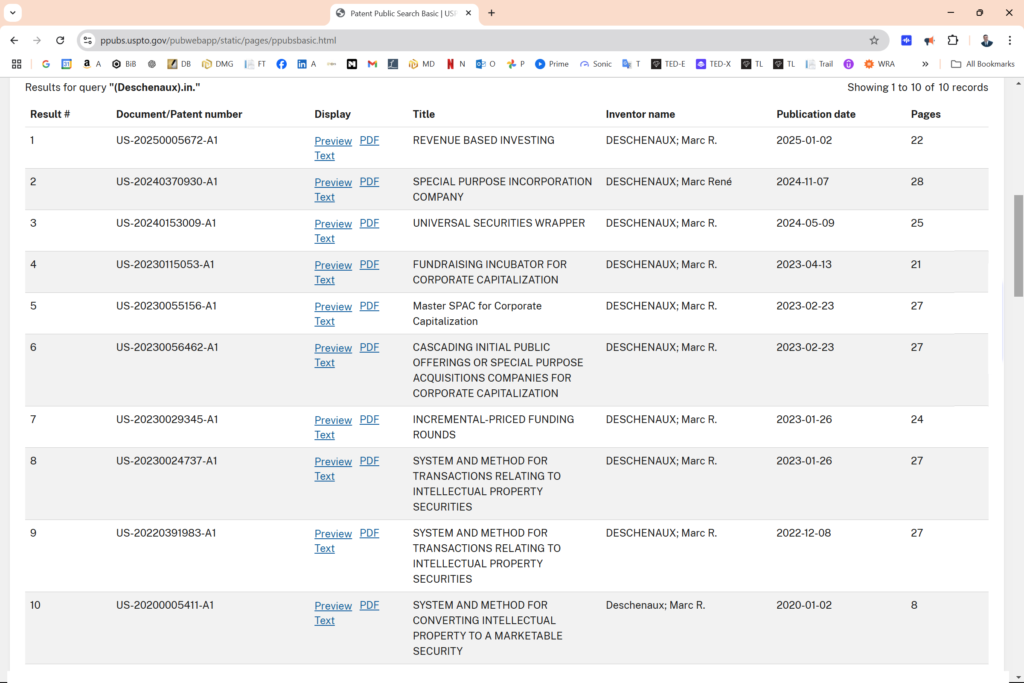

Universal Securities Wrapper – Patent published

United States Patent

Application No. 18/504,287

Patent No. US 12,505,486 B2

Applicant & Inventor: Marc R Deschenaux

Receipt of Acknowledge – Revenue Based Investing

Electronic acknowledgement receipt of US Patent Application

Utility – Non-provisional

Attorney Docket # P25194US01

Leila Alia iReceipt Patent

This application claims the benefit of US Provisional Application Serial No. 63/333,712,

filed April 22, 2022, the contents of which are incorporated herein in their entirety.

Receipt of Acknowledge – Special Purpose Incorporation Company

Electronic acknowledgement receipt of Special Purpose Incorporation Company (SPIC) Invention

Receipt of Acknowledge – United States Patent and Trademark Office 2022

Receipt is acknowledged of this non-provisional utility patent application. The application will be taken up for examination in due course. Applicant will be notified as to the results of the examination.

A Fundraising Incubator for Venture Capitalization

It is often difficult to raise the budget of a large venture such as a merger, an acquisition, a securities private placement or an initial public offering (IPO). In addition to significant cost, it monopolizes a significant portion of the company’s resources and the management’s attention. That is why it is not uncommon that during the venture capitalization (e.g. IPO) process, the performance of the company is heavily impacted. Hence, there may be an additional need for funding, if only to offset the poor sales performance due to the effort of the venture capitalization or IPO process.

Cascading Initial Public Offerings for Venture Capitalization

The main barriers preventing an initial public offering (IPO) to happen for a company which is ready, willing and able to pursue it include the following: the preparation cost of an IPO is prohibitive; there is no guarantee that the IPO will succeed; and bankers and other professionals putting their career at stake will not authorize the IPO without proper due diligence ensuring financial securities markets’ safety, validation of the business model; sufficient revenue making the company at least cash-flow positive and if not profitable; strong and stable growth.

Incremental-Priced Funding Rounds

Previously, methods of raising investment capital included the funding rounds method. Each time a securities issue was needed, a fixed price for each share of the security was determined according to the current state and valuation of the company for which the security was issued and was offered to investors. With a single fixed price, if the company was mismanaged or could not achieve its initial objectives or was simply running out of money, the fixed price would need to be lowered to attract new investors. New investors could buy shares of stock at a lower price than the earlier investors, while new investors still have less risk than the earlier investors.

Intellectual Property Securities

Traditionally, investors have been able to invest capital in collective ventures such as corporations by buying shares of the entire company. For example, someone interested in investing in the movie industry was able to buy shares in large corporations that produced movies, such as Sony or Disney. However, these large corporations have other ventures outside of movies that may not be of interest to individual investors. In some instances, an investor may wish to invest in a more targeted manner.

Master SPAC for Venture Capitalization

The main barriers preventing an initial public offering (IPO) to happen for a company which is ready, willing and able to pursue it include the following: the preparation cost of an IPO is prohibitive; there is no guarantee that the IPO will succeed; and bankers and other professionals putting their career at stake will not authorize the IPO without proper due diligence ensuring financial securities markets’ safety, validation of the business model; sufficient revenue making the company at least cash-flow positive and if not profitable; strong and stable growth.