Problemático:

It is often difficult to raise the budget of an IPO (Initial Public Offering). Moreover, there is a widely held wrong belief that an IPO is only possible after a company has validated its business model, has “traction”, has an order book.

Solução

As discussed in my previous article“Is your company ready for an I.P.O. Initial Public Offering ?”, the main barriers preventing an IPO to happen for a company which is ready, willing and able to pursue it are the following:

- The preparation cost of an IPO is prohibitive.

- There is no guarantee that the IPO will succeed.

- Bankers and other professionals putting their career at stake will not authorize the IPO without:

- Proper due diligence ensuring financial securities markets’ safety;

- Validation of the business model;

- Sufficient revenue making the company at least cash-flow positive and if not profitable;

- Strong and stable growth.

Em outras palavras, não deve haver dúvidas de que a empresa está no caminho certo para o sucesso.

I saw a number of companies with a high profitability potential that deserved investment banking services but could not afford them due to costs prior to the distribution of the securities, especially pertaining to the preparation and drafting of disclosure.

The Theory of Wagons

According to my mentor, as I have not found any source of information about that, Howard Hughes invented the Theory of Wagons. Following the legend, he had installed a giant train in his garden and had to put more than one wagon to give a ride through his property to groups of his guests. Seeing the wagons attached to each other inspired him to create a corporate growth theory.

He thought that the locomotive which is the heaviest element of the train was symbolizing its core company that was a very well-established institution. The more a company is well-established, the closer it is to the locomotive and the less a company is well-established, the further it is from the locomotive. Start-ups are at the rear end of the train.

Using this model, Howard Hughes was using the cash flow of his best-performing companies to finance his new ventures. Making basic financial mathematics analysis, it seems obvious that such system can only work if the locomotive and first wagons companies are highly profitable and that the investment in new ventures are far less than this profitability. According to my mentor, a ratio of 3 between the sum of profitable companies and the total investment required by the start-ups should be considered as a minimum for safety but I could never figure out how he came up with said ratio.

This theory made a big impression on me because I saw in it a corporate chain financing and I thought it could be the solution to overcome the first barrier for an IPO to happen. For a long time, I wondered how I could make IPOs cascading, the previous pulling the next one.

When I got to learn about the JOBS Act (Jumpstart Our Business Startups Act), I realized that the cost of small IPOs had been drastically reduced and thus that financing IPOs through a domino cascading process was now possible.

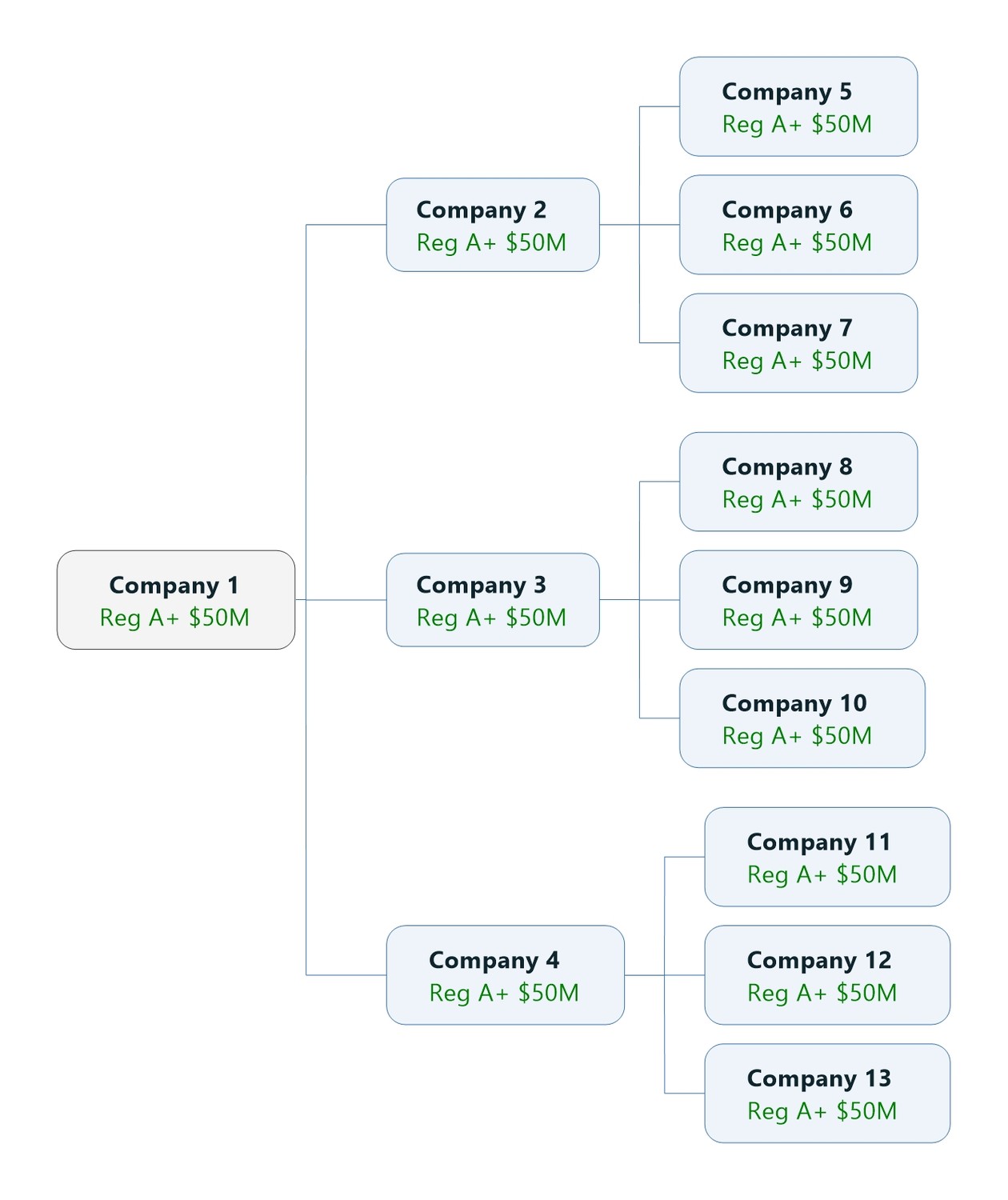

My first idea was to take a part of the proceeds of the first IPO to finance three other IPOs and to apply the same principle to said three other IPOs as on the scheme hereunder.

However, there were a number of problems from a securities markets regulation and from a disclosure standpoints.

How to avoid these IPOs to be considered a group of companies acting in concert by the regulator ?

Simply by concluding an IPO Development Agreement between an IPO Incubator and the future Issuer for the financing of its IPO.

How to avoid the birth of a tree of shareholding relationships among all these companies ?

Simply by concluding excluding from this IPO Development Agreement between the IPO Incubator and the future Issuer any purchase of shares of stock.

Preliminary Financing of the Incubator

- USD 2 million are raised in the Incubator through either a loan or an equity investment.

- The Incubator goes public and raises USD 50 million through a Regulation A+ Tier 2 registered offering of shares of common stock.

- If the Incubator was financed through a loan, the Incubator will reimburse this loan with interest and pay a Premium Bonus to its creditor/s.

Procedure & Sequence of Events for an IPO Candidate

- The Incubator enters into a Development Agreement with an IPO candidate company, in other words a potential securities issuer willing to distribute its securities to the general public to raise money.

- This Development Agreement provides that against the financing of the IPO candidate’s Regulation A+ registered offering for a maximum of USD 2 million, the IPO candidate shall immediately remit 20% of its issued and outstanding shares of stock, and that upon successful IPO, shall pay Incubator 12% of the proceeds.

- The IPO candidate proceeds with its IPO and thus becomes a public securities Issuer and public company listed on the NASDAQ or the New York Stock Exchange. Moreover it is funded with USD 50 million.

- From the IPO proceeds the Issuer (ex-IPO Candidate) pays Incubator 12% of the proceeds.

- So, in case of a typical Regulation A+ Tier 2 registered offering of shares of common stock raising USD 50 million, the Issuer will effectively pay to the Incubator USD 6 million.

Structure of Cascade depends on the Type of IPO

- The Incubator can finance between 1 and 24 Reg A+. We will call this number n the number of parallel processes. On the left figure, n = 3.

- If the Incubator has USD 50 million and wants to finance small S-1 IPOs, n will be reduced to 10.

- If the Incubator has USD 50 million and wants to finance large S-1 IPOs, n will be reduced to 5.

Sequence of Events for the Cascade of IPOs

- The Incubator enters into a Total of T Development Agreements (described under §4 and §5 hereabove) with n IPO candidate companies, in other words n potential securities issuers willing to distribute its securities to the general public to raise money.

- The IPO candidates proceed with their IPOs and thus become public securities Issuers and public companies listed on the NASDAQ or the New York Stock Exchange. Moreover they are funded with USD 50 million at least, depending on the type of IPOs.

- The Incubator receives:

- ts commission on the funds raised in the IPOs according to the the formula: 12% . IPOraise(T). On a cluster identical to the left figure with n = 3 there are 13 companies. Assuming they all do USD 50 million raises with USD 6 million commission for the Incubator, the Incubator shall receive USD 78 million in cash.

- 20% of the issued and outstanding shares of stock of each candidate. The amount represented cannot be quantified as it depends on each corporate valuation.