Estrutura e taxas de subscrição

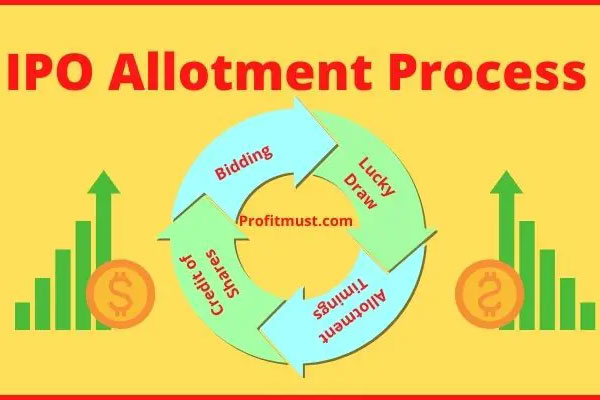

The fees for underwriting an Initial Public Offering (IPO) are typically structured as a percentage of the total amount raised through the IPO. This fee is called the underwriting spread and typically ranges from 6% to 13% of the total offering amount. The underwriting spread is divided between the lead underwriter (also known as the … Ler mais