- 全部

- 上市

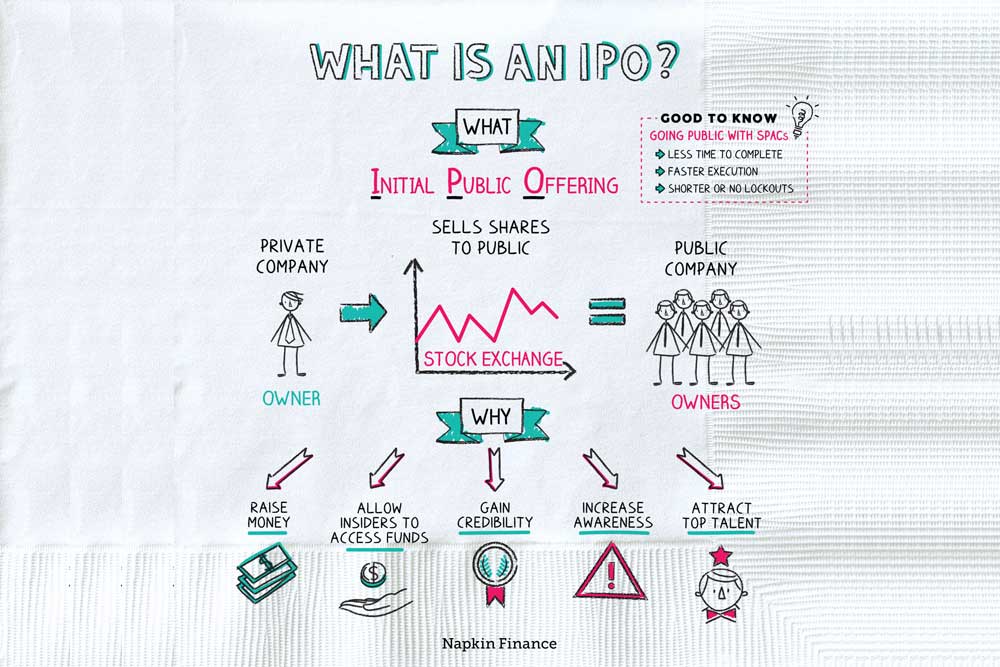

- IPO基础

- 上市成本

- IPO临

- 语言

- SPAC

- SPAC变体

- IP Securities

220 Total posts:

Intellectual Property Direct Securitization:

A New Paradigm in IP Finance

Introduction Intellectual Property (IP) Direct Securitization is an innovative financing method that turns intangible IP assets – like patents, copyrights, trademarks, or creative works –

Intellectual Property Securitization:

A comparison between direct and indirect securitization

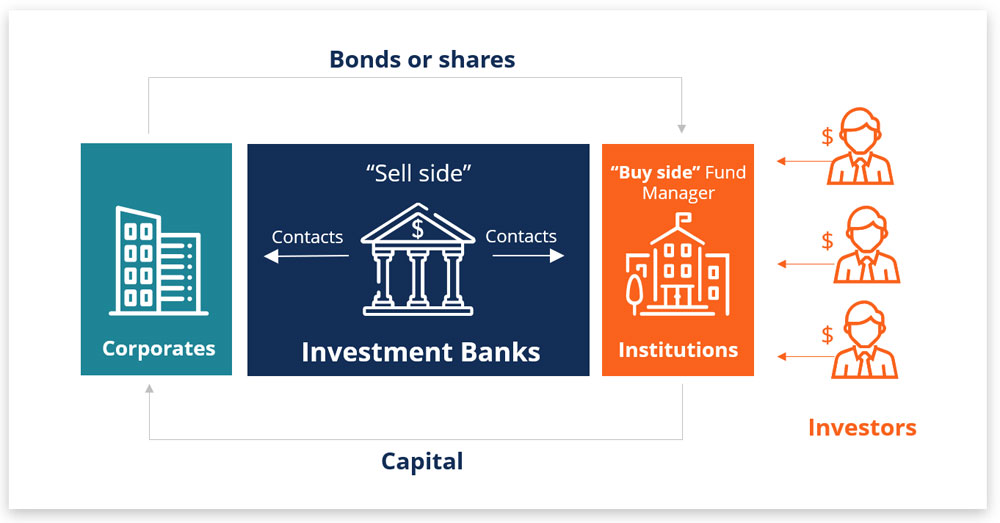

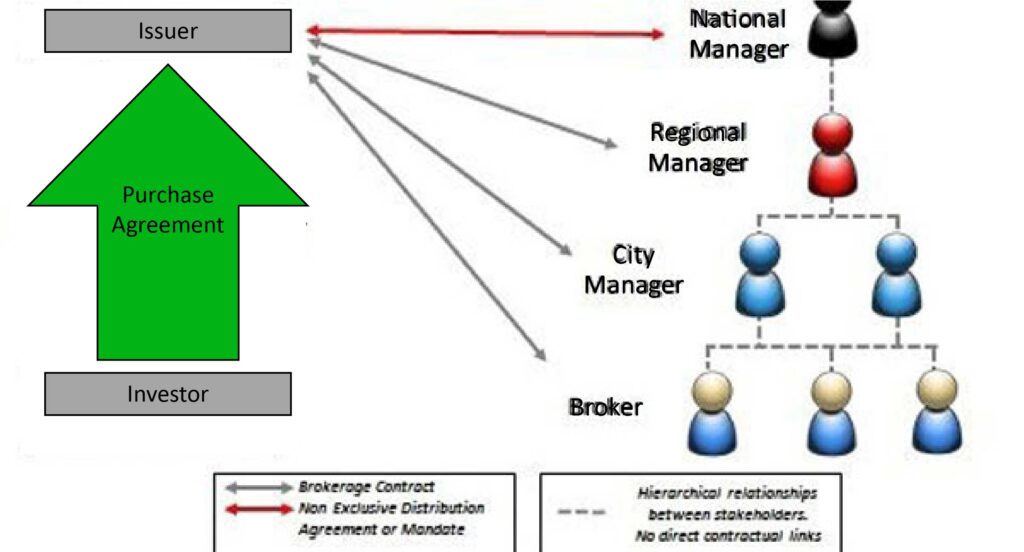

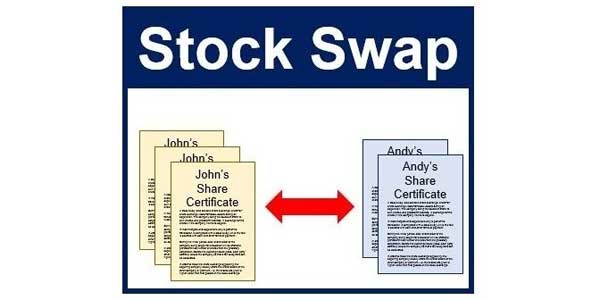

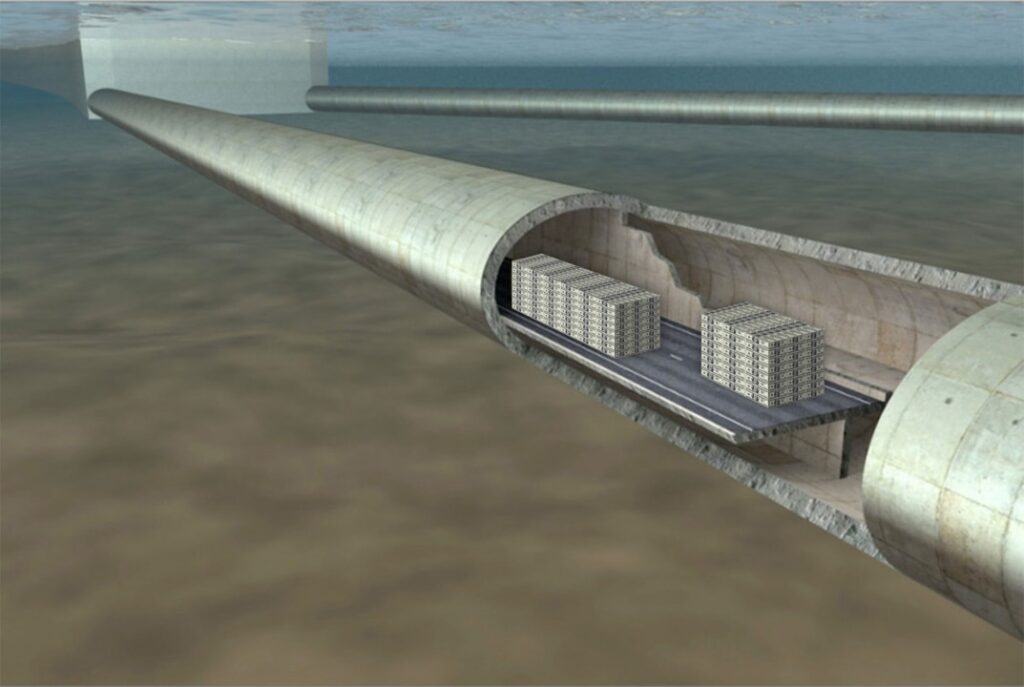

Historically, monetizing IP through securitization meant using IP assets as collateral for bonds or loans. Typically, a company or an SPV would hold the IP and issue asset-backed securities (ABS) to investors

Intellectual Property Direct Securitization:

Technical White Paper

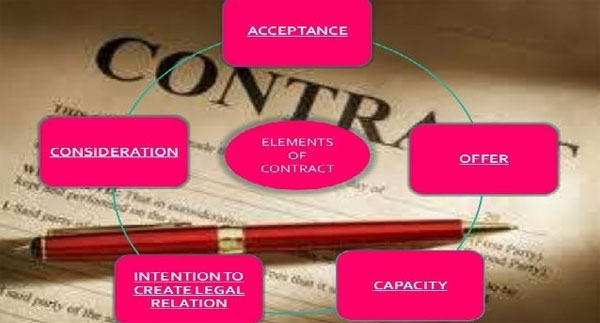

IP Direct Securitization involves the issuance of securities directly associated with intellectual property rights (patents, copyrights, trademarks, etc.). Investors acquire fractional ownership

Process Patents vs. Business Method Patents with the help of ChatGPT

Introduction In U.S. patent law, an invention can take different forms – it might be a product, a machine, a composition of matter, or a

Difference between a Pending or Issued Patent

The world of intellectual property can be complex, with various terms and processes that may seem daunting to those who are not familiar with them.

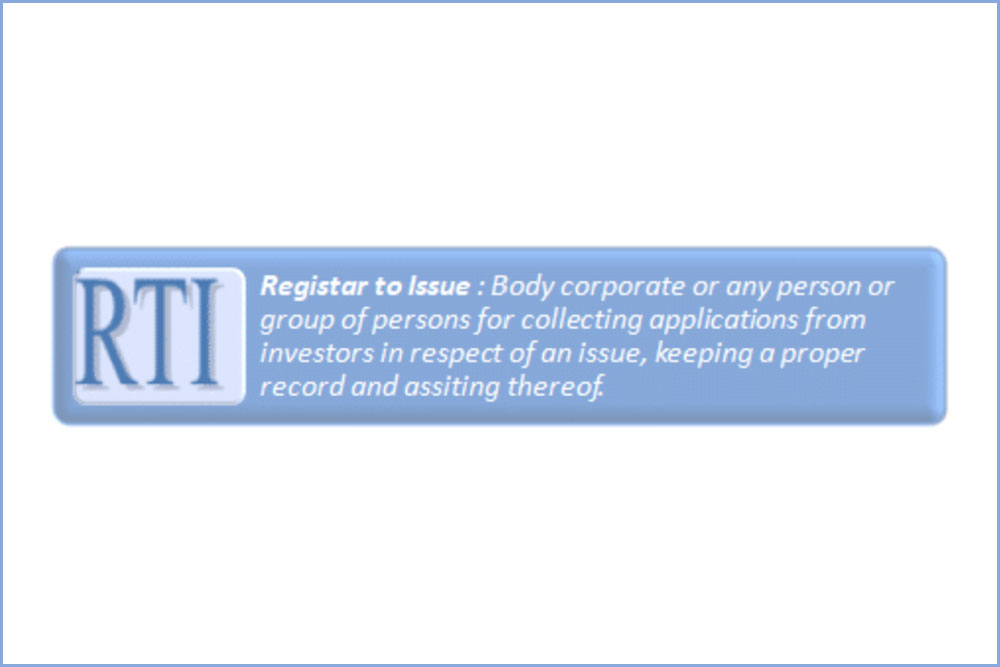

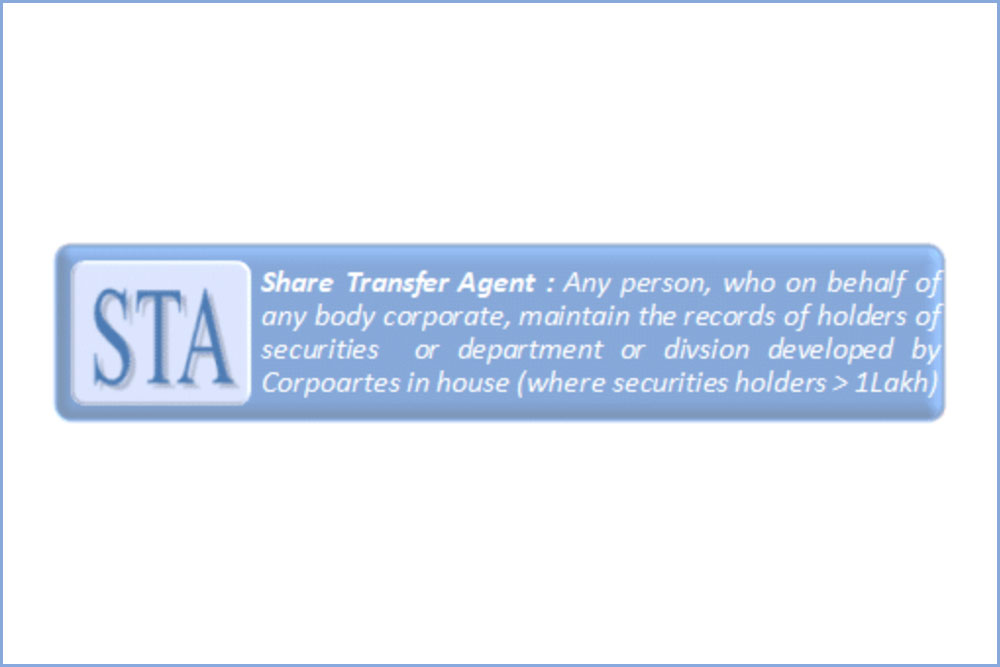

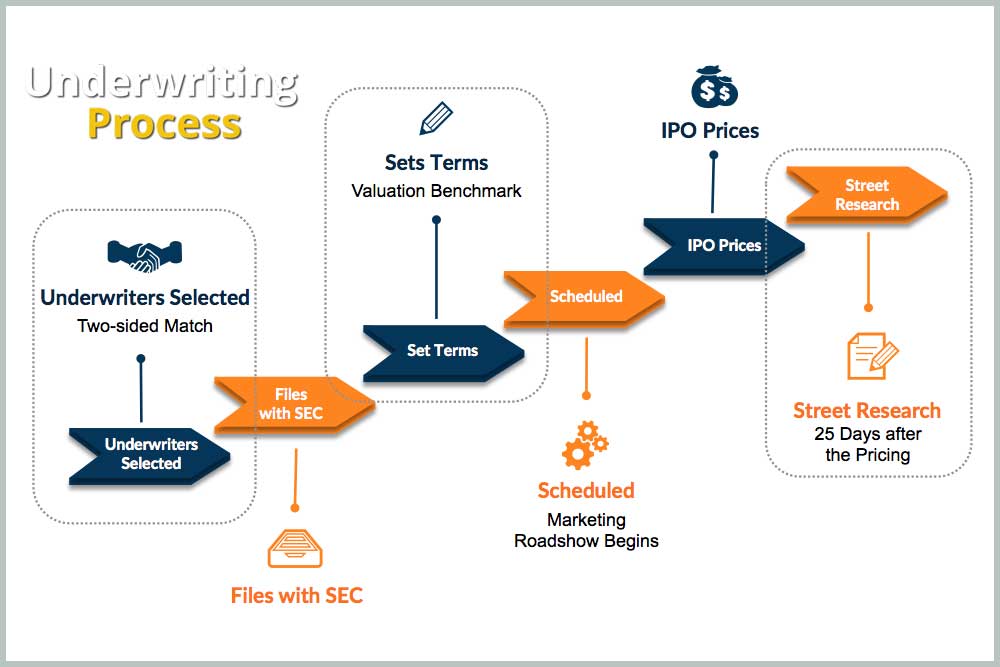

The Role of the Transfer Agent in the IPO

Initial Public Offerings (IPOs) are complex financial events that mark a significant milestone for companies seeking to raise capital by transitioning from private to public

The Role of the FINRA in the IPO Process

The Initial Public Offering (IPO) represents a significant milestone in a company’s growth, symbolizing its transition from a private entity to a publicly traded corporation.

The Role of the U.S. Securities & Exchange Commission in the IPO Process

The Initial Public Offering (IPO) is a transformative milestone for private companies looking to raise capital by offering shares to the public for the first

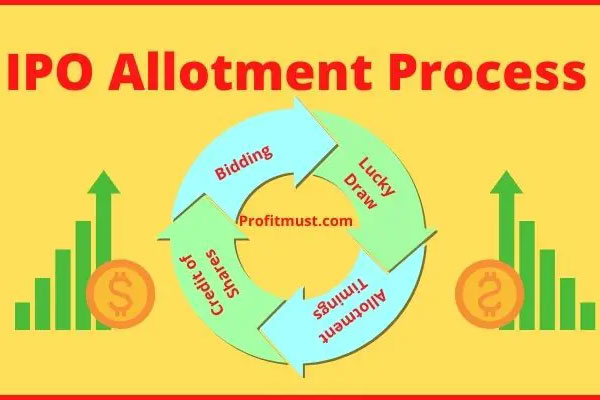

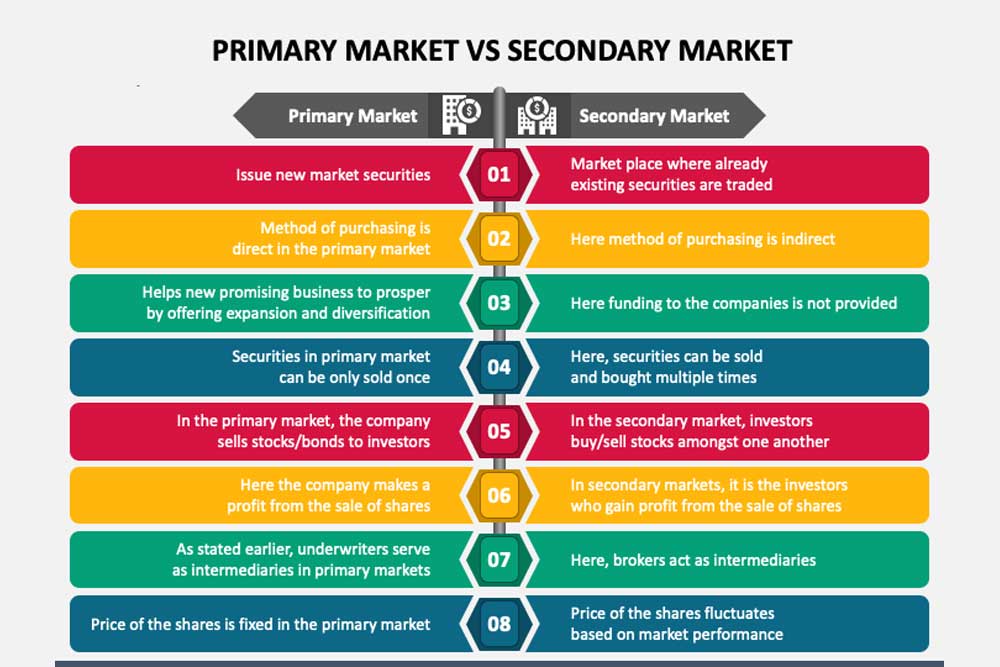

The Allocation of Shares in the IPO

Initial Public Offerings (IPOs) mark a significant milestone for a company transitioning from private to public ownership. For investors, IPOs represent an opportunity to invest

The IPO “Quiet Period” under U.S. Securities Law

Introduction The “quiet period” is a fundamental concept under U.S. securities law that governs communications by companies, underwriters, and insiders during the process of an

Definition of a Passthrough Security

This article was written for Investopedia By TROY SEGAL updated May 29, 2020 and reviewed by GORDON SCOTT. I reproduce it here because it is

The Consolidated Tape

In any financial market, the concept of the consolidated tape represents more than just a utility; it serves as the backbone of market transparency and

Plea for a Love Relationship Rooted in Passion

In the vast expanse of human connection, there exists a path that begins not with the gentle warmth of friendship but with the electric spark

Development Stages of a Film

The development of a movie typically follows several key stages, each of which is crucial to the successful creation and release of the film. Below

Factuality

The Factuality: The Compromise Between Reality and Perception The Factuality, at its core, is the bridge between objective reality and subjective perception. The term itself

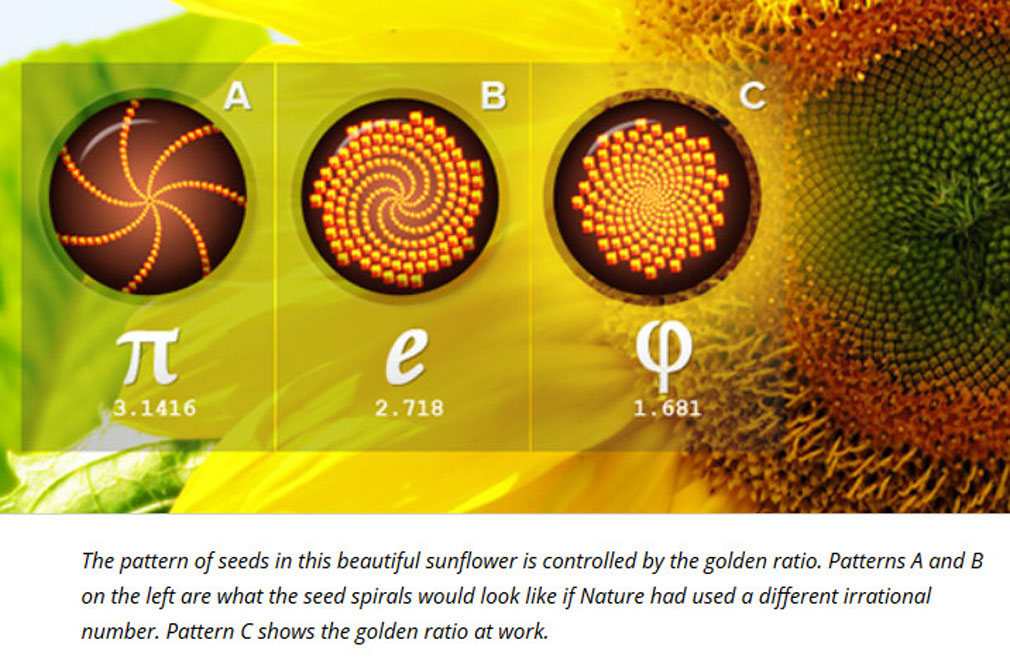

Relationships between PI, PHI the GOLDEN RATIO, e and FIBONACCI

Mathematics is often described as the language of the universe, filled with patterns and constants that govern everything from the growth of plants to the

TruePreIPO™ Certification

The IPO Institute, a globally recognized authority in financial certifications, has recently introduced the “True PreIPO™” certification. This certification aims to distinguish legitimate pre-initial public

Cross-Collateralization in the Music Industry

Cross-collateralization in the music business is a crucial yet complex topic that can significantly impact an artist’s financial future. This practice, widely used in record

Mechanical Rights in the Music Industry

Mechanical rights are a fundamental concept in the music industry, governing how songwriters, composers, and music publishers earn income from the reproduction of their compositions.

Publishing Rights of a Music Work

In the music industry, publishing rights are one of the most critical and valuable aspects of a song’s copyright. Often less visible to the public,

Compulsory Licensing for Music Works

In the music industry, copyright law protects the rights of creators, but it also provides mechanisms to balance these rights with the public’s need to

The Moral Right to a Music Work

The concept of “moral rights” in intellectual property law, especially in relation to songs, provides an essential layer of protection for creators, focusing not on

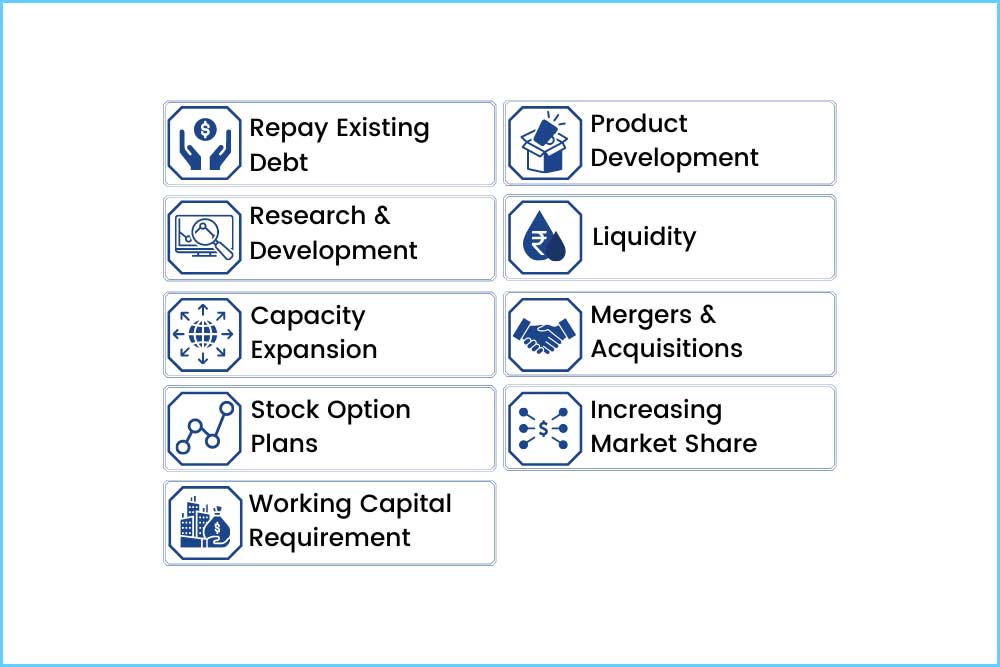

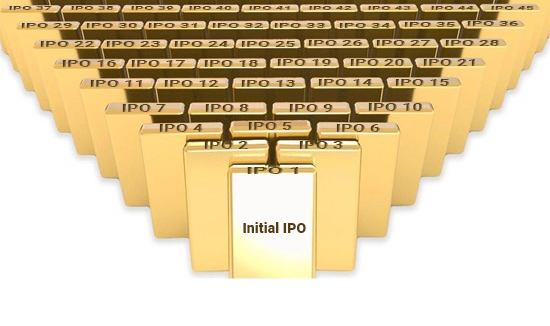

IPO Cascade – Cascade of Initial Public Offerings

The IPO Cascade is a patented process conceived by Marc Deschenaux and licensed exclusively to Market Street Capital Inc. A Company willing to issue equity

The Minority Shareholder’s Rights

Minority shareholders, while owning a smaller stake in a company, are still entitled to specific rights that protect their interests and allow them to participate

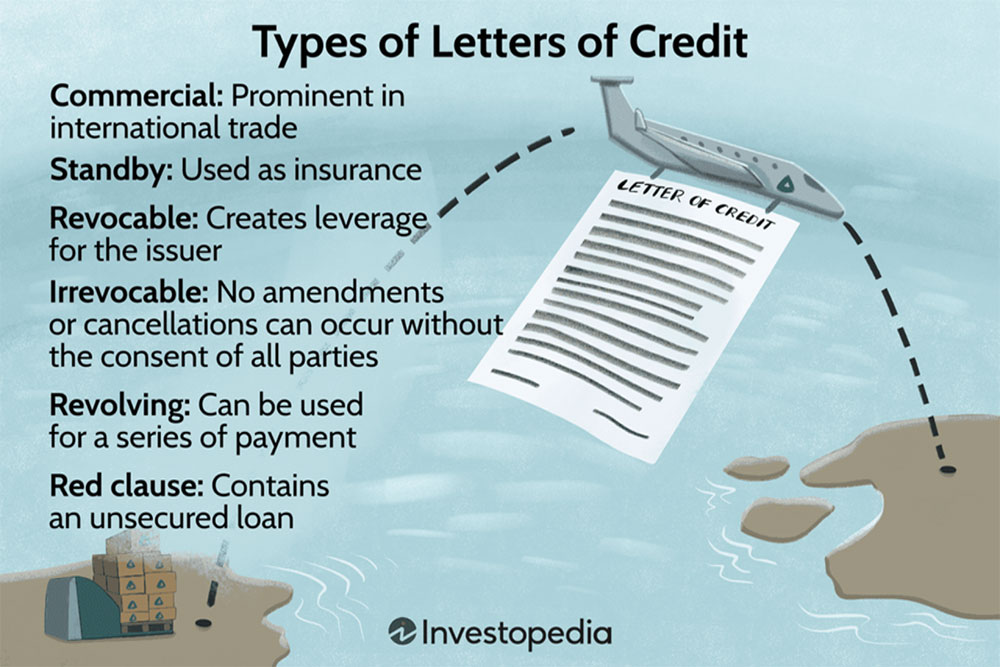

Commercial and Standby Letter of Credit

A Letter of Credit (LC) is a fundamental instrument used in international trade and commerce to ensure payment for goods and services between parties in

Insurance Dedicated or Directed Fund (IDF)

An Insurance Dedicated Fund (IDF) is a fund that is typically established as a segregated account within a life insurance company’s general account or a

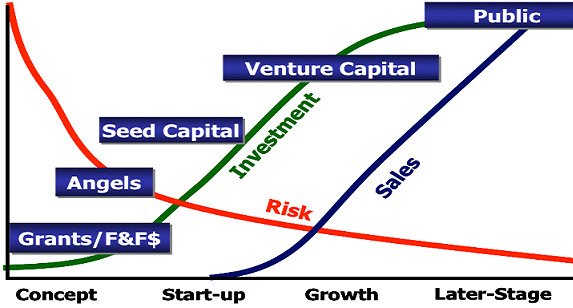

Valuation of a Startup Company

Valuing a startup, thus a company without any revenue, can be one of the most challenging tasks in the business world. Traditional valuation methods, such

Buying a Bank

Purchasing a bank represents a monumental undertaking that requires a confluence of strategic planning, regulatory insight, and financial acumen. This article aims to serve as

How to Detect an Exit Opportunity

In the fast-paced world of finance and investments, timing is everything. Whether you’re a startup founder, a venture capitalist, or a stock market investor, knowing

Revenue-Based Investing (RBI), Revenue-Sharing Financing (RSF) or Revenue Discount

The innovative business model is called “Revenue-Based Investing” (RBI), “Revenue-Sharing Financing” (RSF) or “Revenue Discount” (RD) and was invented by Marc René Deschenaux. In this

Intellectual Property Rights Offering

Title: Unleashing Value through : A Comprehensive Legal Analysis Introduction: In today’s innovation-driven economy, intellectual property (IP) has emerged as a critical asset for businesses

瑞士学校计划的紧急改革

NOBODY IS SUPPOSED TO IGNORE THE LAW! BUT IT IS NOT TEACHED OR AT LEAST BEFORE THE SECONDARY CYCLE… Then we are surprised that the

From the old Funding Rounds to the new Progressive or Incremental Price Method

In the early days of business funding, before 1995, the predominant method for raising capital was through “funding rounds.” This approach, although straightforward, had several

美国证券交易委员会 (SEC) 在 IPO 过程中扮演什么角色?

Overview The Securities and Exchange Commission (SEC) plays a crucial role in the IPO process. It is the primary regulator of the securities markets in

股东或合伙人的赔偿权

Shareholder meetings are a cornerstone of corporate governance. These meetings enable shareholders to exercise their voting rights on significant matters concerning the company, such as

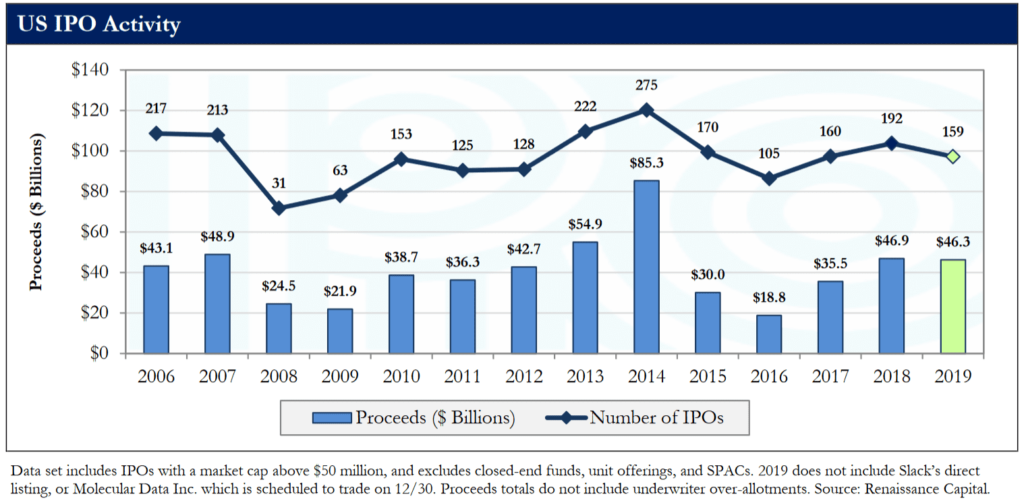

2019 年 IPO 市场:好于头条新闻

期待已久的大型独角兽 Uber 和 Lyft 的首次亮相都以失败告终,WeWork 在 9 月份的神风敢死队首次公开募股尝试就此画上了句号。但除了这些引人注目的头条新闻

Financial Liquidity & Market Liquidity

The term “Liquidity” may seem straightforward at a glance, often mistakenly equated to the term cash in popular understanding. However, within the financial realm, its

Little Story to Understand Authoring Rights

First, let’s understand authoring rights: Mr. Composer Author married Ms. Lyricist Author, and thus they became the Co-Author couple. Together, they embarked on the creative

私募股权二级市场(Private Equity Secondary or Secondary)

在金融领域,私募股权二级市场(通常也称为私募股权二级市场)是指买卖预先存在的投资者对私募基金的承诺。

Deschenaux Hornblower & Partners LLP 拍卖迈克尔杰克逊的黑钻石骰子

Deschenaux Hornblower & Partners LLP 自豪地宣布,他们受 Premier Entertainment Inc. 委托出售 The Black Diamond Dice,它是

54 Total posts in “IPO”:

The Role of the Transfer Agent in the IPO

Initial Public Offerings (IPOs) are complex financial events that mark a significant milestone for companies seeking to raise capital by transitioning from private to public

The Role of the FINRA in the IPO Process

The Initial Public Offering (IPO) represents a significant milestone in a company’s growth, symbolizing its transition from a private entity to a publicly traded corporation.

The Role of the U.S. Securities & Exchange Commission in the IPO Process

The Initial Public Offering (IPO) is a transformative milestone for private companies looking to raise capital by offering shares to the public for the first

The Allocation of Shares in the IPO

Initial Public Offerings (IPOs) mark a significant milestone for a company transitioning from private to public ownership. For investors, IPOs represent an opportunity to invest

The IPO “Quiet Period” under U.S. Securities Law

Introduction The “quiet period” is a fundamental concept under U.S. securities law that governs communications by companies, underwriters, and insiders during the process of an

Definition of a Passthrough Security

This article was written for Investopedia By TROY SEGAL updated May 29, 2020 and reviewed by GORDON SCOTT. I reproduce it here because it is

Development Stages of a Film

The development of a movie typically follows several key stages, each of which is crucial to the successful creation and release of the film. Below

TruePreIPO™ Certification

The IPO Institute, a globally recognized authority in financial certifications, has recently introduced the “True PreIPO™” certification. This certification aims to distinguish legitimate pre-initial public

IPO Cascade – Cascade of Initial Public Offerings

The IPO Cascade is a patented process conceived by Marc Deschenaux and licensed exclusively to Market Street Capital Inc. A Company willing to issue equity

美国证券交易委员会 (SEC) 在 IPO 过程中扮演什么角色?

Overview The Securities and Exchange Commission (SEC) plays a crucial role in the IPO process. It is the primary regulator of the securities markets in

22 Total posts in “IPO Basic”:

TruePreIPO™ Certification

The IPO Institute, a globally recognized authority in financial certifications, has recently introduced the “True PreIPO™” certification. This certification aims to distinguish legitimate pre-initial public

3 Total posts in “IPO Cost”:

21 Total posts in “IPO Pro”:

美国证券交易委员会 (SEC) 在 IPO 过程中扮演什么角色?

Overview The Securities and Exchange Commission (SEC) plays a crucial role in the IPO process. It is the primary regulator of the securities markets in

64 Total posts in “SPAC”:

4 Total posts in “SPAC Variants”:

4 Total posts in “IP Securities”:

Intellectual Property Rights Offering

Title: Unleashing Value through : A Comprehensive Legal Analysis Introduction: In today’s innovation-driven economy, intellectual property (IP) has emerged as a critical asset for businesses

Intellectual Property Direct Securitization:

Technical White Paper

IP Direct Securitization involves the issuance of securities directly associated with intellectual property rights (patents, copyrights, trademarks, etc.). Investors acquire fractional ownership

Intellectual Property Securitization:

A comparison between direct and indirect securitization

Historically, monetizing IP through securitization meant using IP assets as collateral for bonds or loans. Typically, a company or an SPV would hold the IP and issue asset-backed securities (ABS) to investors

Intellectual Property Direct Securitization:

A New Paradigm in IP Finance

Introduction Intellectual Property (IP) Direct Securitization is an innovative financing method that turns intangible IP assets – like patents, copyrights, trademarks, or creative works –